How To Start An Llc 8 Easy Steps To Form An Llc Nolo

Form An Ohio Llc How To Start An Llc In Ohio Nolo Nolo Appoint a registered agent. file your articles of organization. decide whether your llc should be member managed or manager managed. create an llc operating agreement. comply with tax and regulatory requirements. file your annual reports. register to do business in other states. 1. choose a name for your llc. If you want to form a limited liability company (llc) in california, you need to legally register your business with the state. in addition, you'll need to decide how you want to manage your llc, create organizational documents, register for taxes, and file initial reports. we'll take you through the eight steps to start your california llc.

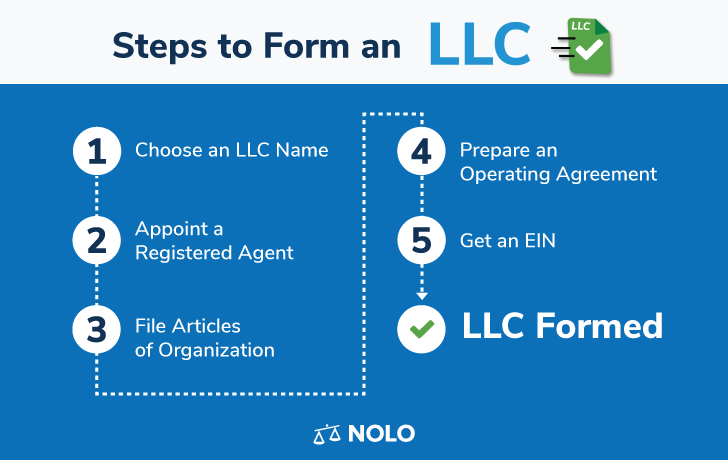

How To Start An Llc Form A Limited Liability Company Step By Step Step 4: obtain an ein. an employer identification number (ein) is a unique tax identification number for your business. the application is free and simple to complete. you can submit your application online on the irs website. if your llc has more than one owner, or if you have employees, you need an ein. Once you’re ready to get the ball rolling, you can create an llc in eight simple steps: decide on a business name. determine your management structure. designate a registered agent for your llc. file articles of organization. create an operating agreement. 6. create an operating agreement. an operating agreement contains the details of the financial, legal and management rights of all members of the llc. more specifically, it can include how profits. Form an llc in only seven steps: select a unique name, appoint your registered agent, determine your llc’s management structure, create an operating agreement, and file articles of organization. set your new llc up for success : stay compliant with federal and state law, think about taxes early, and build a strong financial structure.

Comments are closed.