1099 Employee Form 2023 Printable Forms Free Online

2023 1099 Form Printable Forms Free Online Irs 1099 form. irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. there are 20 active types of 1099 forms used for various income types. 1099s fall into a group of tax documents called. Recipient’s taxpayer identification number (tin). for your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). however, the payer has reported your complete tin.

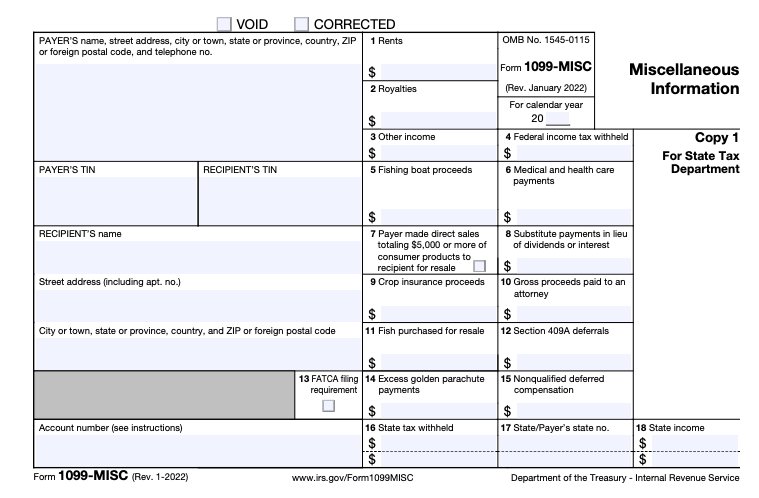

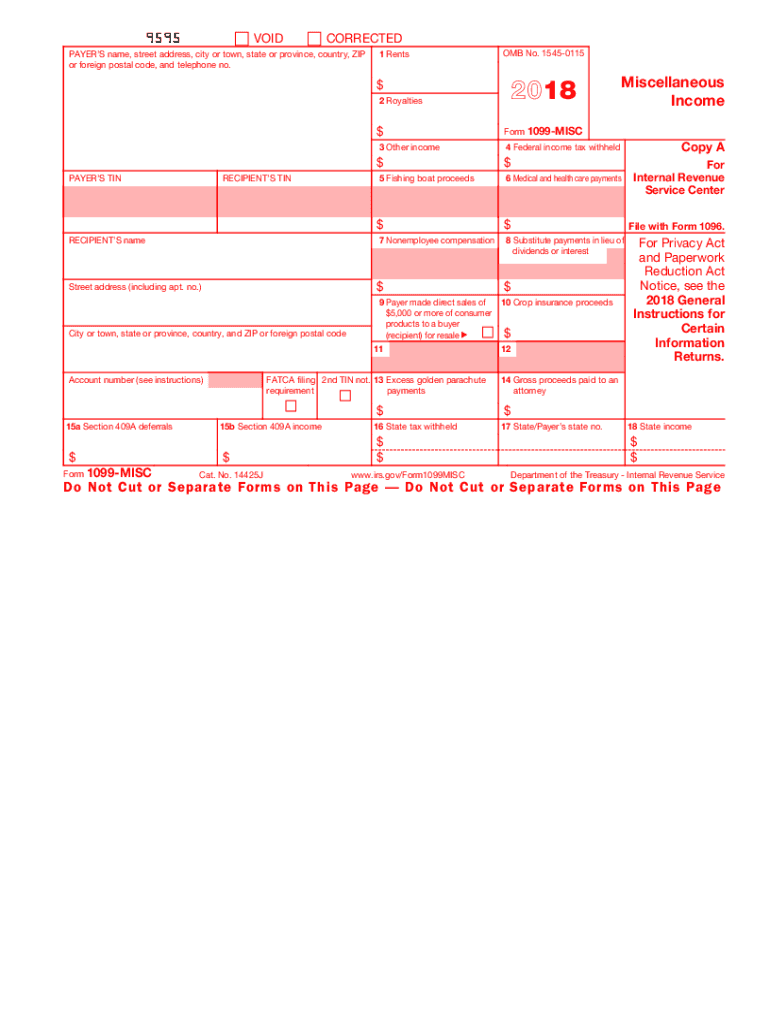

Free Blank 1099 Form 2023 Printable Blank Printable Irs form 1099 misc. updated march 20, 2024. a 1099 misc is a tax form used to report certain payments made by a business or organization. payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Ir 2023 14, january 25, 2023 — the internal revenue service announced today that businesses can now file form 1099 series information returns using a new online portal, available free from the irs. ir 2023 14, january 25, 2023 washington — the internal revenue service announced today that businesses can now file form 1099 series information returns using a new online portal, available free. 1099 misc forms for all purposes are due to the irs by february 28, 2024, or march 31, 2024, if you’re filing electronically. you must issue the form to the recipient by february 15, 2024, for gross proceeds paid to attorneys, substitute dividends, or tax exempt interest payments. you should issue all other payments to the recipient by. Filing due dates for 1099 misc forms have also been updated for the 2023 tax year. the 1099 misc must be sent: to recipients by january 31, 2024. to the irs by february 28, 2024 if filing by mail. to the irs by april 1, 2024 if e filing. the deadline for the 1099 misc is different from the deadline for the 1099 nec.

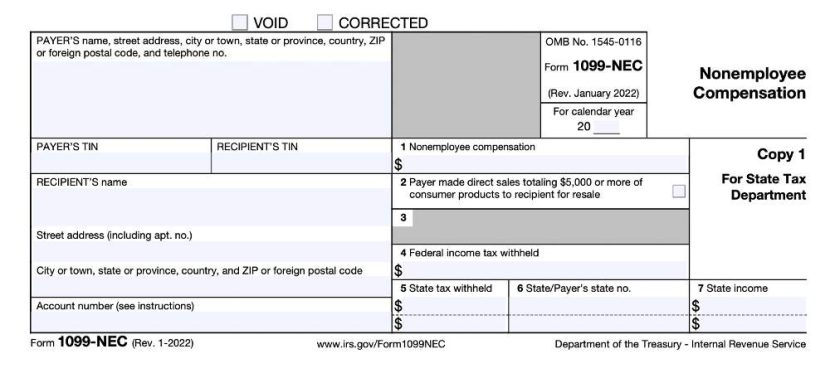

2023 Form 1099 R Printable Forms Free Online 1099 misc forms for all purposes are due to the irs by february 28, 2024, or march 31, 2024, if you’re filing electronically. you must issue the form to the recipient by february 15, 2024, for gross proceeds paid to attorneys, substitute dividends, or tax exempt interest payments. you should issue all other payments to the recipient by. Filing due dates for 1099 misc forms have also been updated for the 2023 tax year. the 1099 misc must be sent: to recipients by january 31, 2024. to the irs by february 28, 2024 if filing by mail. to the irs by april 1, 2024 if e filing. the deadline for the 1099 misc is different from the deadline for the 1099 nec. Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc). You must issue a free printable 1099 tax form if you have paid an independent contractor who is not an employee at least $600 for services during the fiscal period. it's a key tax compliance component for freelancers and those who utilize freelance services. not issuing a 1099 when necessary can result in penalties from the irs.

Printable 1099 Form 2023 Printable Forms Free Online Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc). You must issue a free printable 1099 tax form if you have paid an independent contractor who is not an employee at least $600 for services during the fiscal period. it's a key tax compliance component for freelancers and those who utilize freelance services. not issuing a 1099 when necessary can result in penalties from the irs.

Comments are closed.