1099 Filing Changes For 2024 Josy Riannon

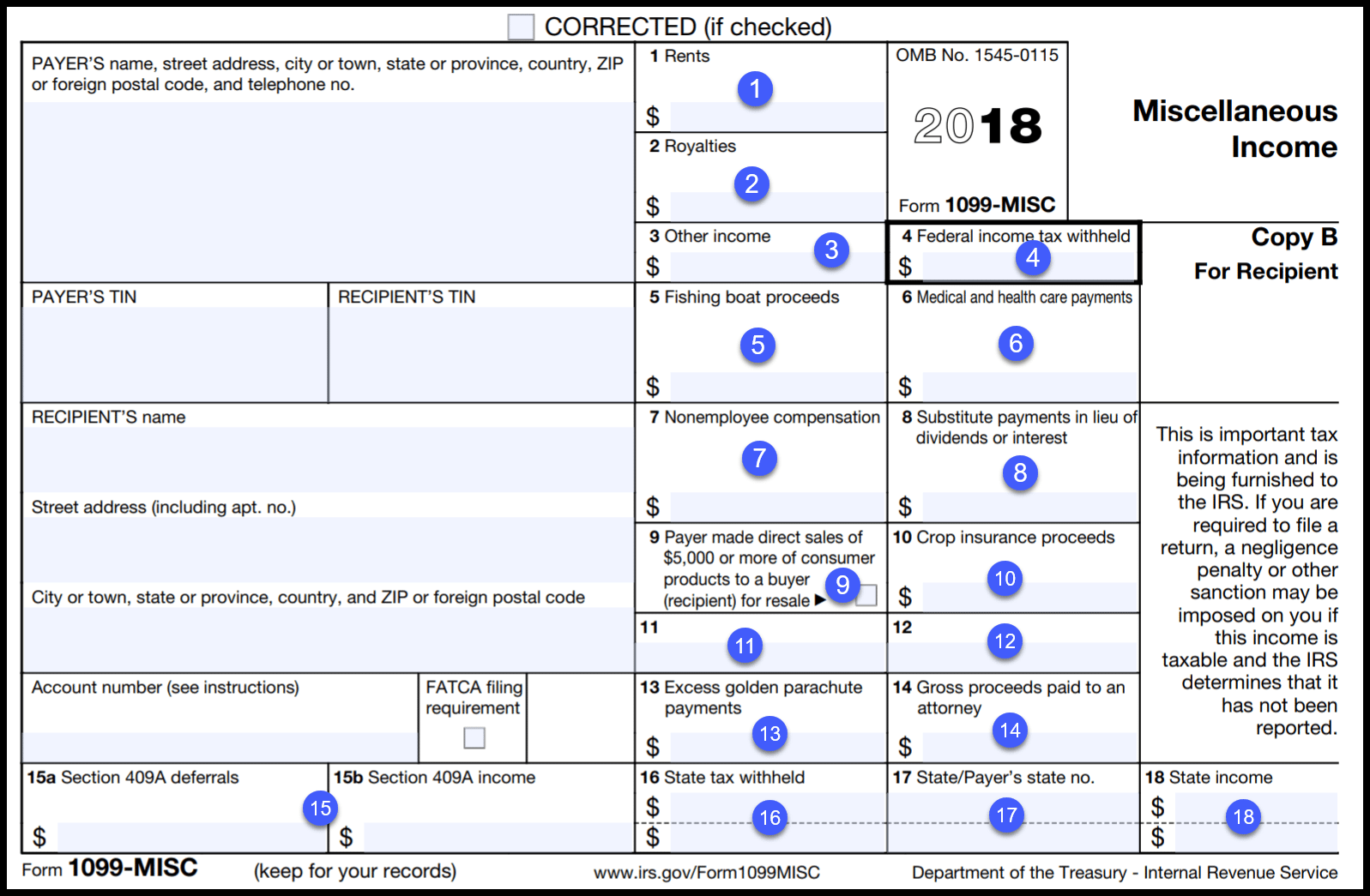

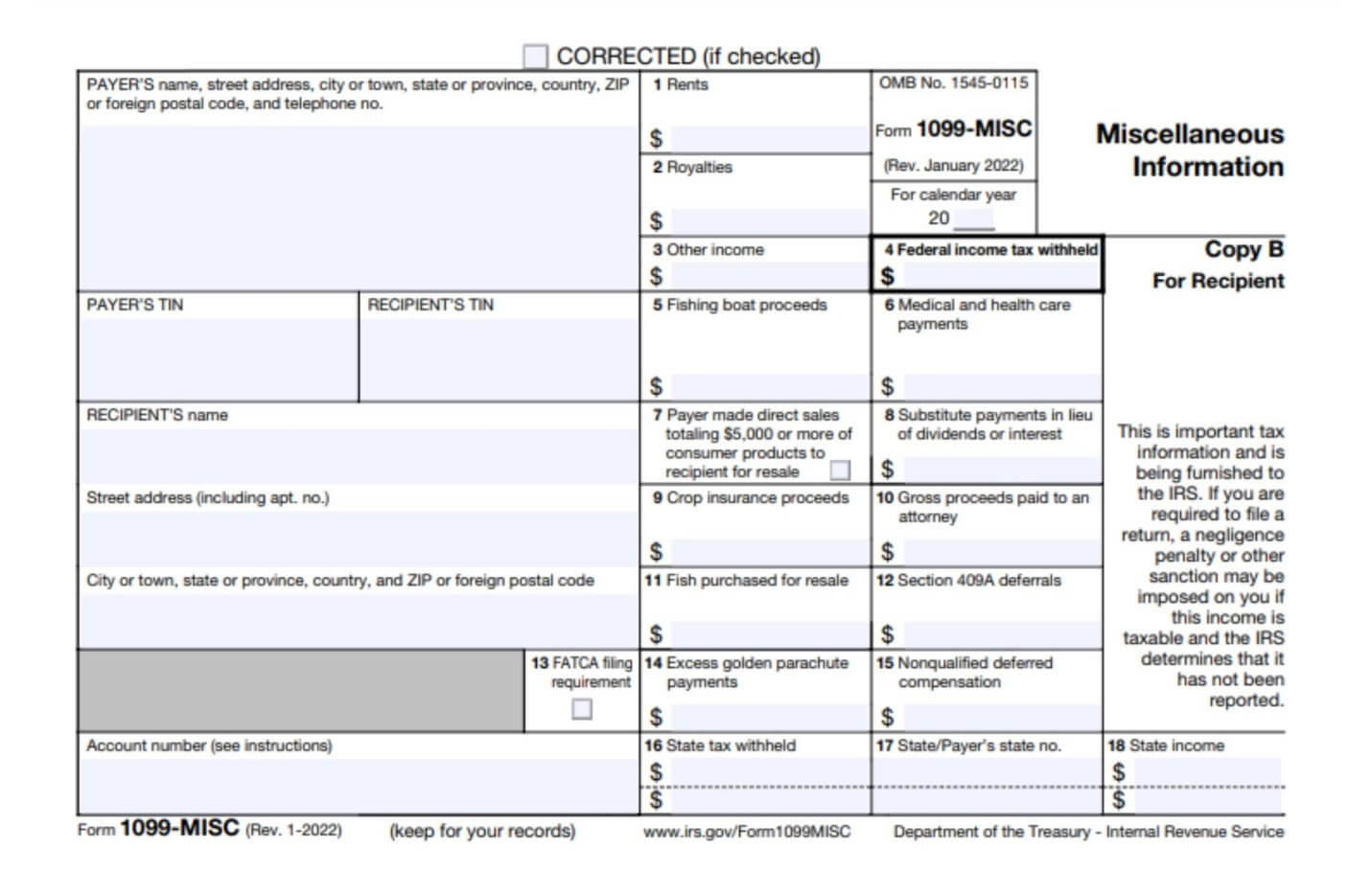

1099 Filing Changes For 2024 Josy Riannon In order to submit 1099 forms electronically, filers must request a new ir tcc code from the irs, which can take up to 45 days. extensions may be granted. starting in 2025 (for tax year 2024), the. 2024 filing season changes for 1099 reporting. as the january 31st deadline looms before us, explore all the information reported on the "granddaddy of all 1099s," form 1099 misc. this form is now joined with the 1099 nec, a form revived from 1982. this webinar will instruct attendees on how to be familiar with the purpose of every box of these.

1099 Filing Changes For 2024 Josy Riannon H.r. 7024 would increase the reporting threshold for the 1099 misc and 1099 nec from $600 to $1,000 for payments made on or after january 1, 2024. for future years, this threshold would be tied to inflation. the bill would also decrease the reporting threshold for payments of direct sales from $5,000 to $1,000. Treasury released final regulations in 2023, making 2024 (i.e., 2023 related filings due in 2024) and later filings of ten or more information returns now subject to electronic filing. with the. Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc). The irs has announced an important change to form 1099 reporting this year. if your business possesses ten or more information returns, your organization is now required to file electronically. this change encompasses both 1099 forms and w 2s. businesses have the option to electronically file any form 1099 using the information returns intake.

1099 Changes For 2024 Megan Felecia Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc). The irs has announced an important change to form 1099 reporting this year. if your business possesses ten or more information returns, your organization is now required to file electronically. this change encompasses both 1099 forms and w 2s. businesses have the option to electronically file any form 1099 using the information returns intake. 1099 k reporting changes. beginning in 2023, the form 1099 k reporting threshold for businesses that use third party payment services, such as venmo, etsy, stubhub and airbnb, was set to decrease. Irs makes major changes to form 1099 filing, reporting rules. filing and reporting rules for forms 1099 misc, miscellanous income, and 1099 nec, nonemployee compensation, are changing in the coming year, and employers should be aware of the new requirements, a payroll practitioner said may 17. jim medlock, payroll compliance educator at medlock.

Comments are closed.