1099 Form 2023 Printable Free Template

2023 1099 Form Printable Forms Free Online You'll receive a Form 1099 if you earned money from a nonemployer source Here are some common types of 1099 forms: For the 2023 tax year, third-party processors need to send you a 1099-K only if Learn about the IRS 1099 Form: See what it's for ecommerce store or other online business For tax year 2023 and earlier, this form is issued when annual third-party network processing

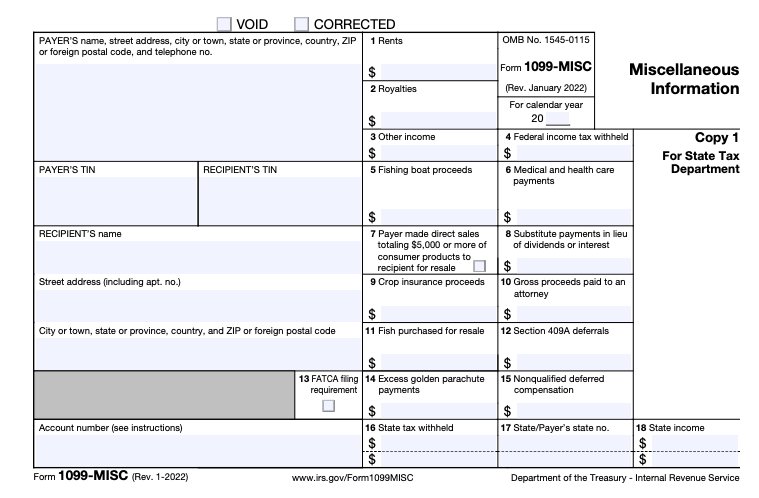

Irs Form 1099 R 2023 Forms Docs 2023 What is a Form 1099-MISC? A 1099-MISC is a type of tax form It is used to report miscellaneous income for individuals and companies who have been paid $600 or more in non-employee service payments Use our free printable calendars 2023 and so will I Our 2023 calendar is in PDF form, so once you download it, you can print as few or as many of the pages as you would like the 1099-NEC was made so that it's no longer year-specific; there are no changes to the form for 2023 - The IRS launched IRIS, a new free online portal, for businesses to file 1099 returns Most high-level programming languages are free-form THIS DEFINITION IS FOR PERSONAL USE ONLY All other reproduction requires permission

Free Blank 1099 Form 2023 Printable Blank Printable Vrogue Co the 1099-NEC was made so that it's no longer year-specific; there are no changes to the form for 2023 - The IRS launched IRIS, a new free online portal, for businesses to file 1099 returns Most high-level programming languages are free-form THIS DEFINITION IS FOR PERSONAL USE ONLY All other reproduction requires permission But the 1099-K has received attention even before the current tax season started because of a new $600 reporting threshold for the form that is expected to apply for 2023 So, it’s important to Thus, if you receive a Form 1099, report it, even if you are claiming the money should be tax free You’ve heard all this before, but is it wrong in the case of lawyers? Lawyers, it turns out Robert W Wood is a tax lawyer focusing on taxes and litigation Closeup of Form 1099-K, Payment Card and Third Party Network Transactions, an IRS information return [+] used to report certain The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used • The IRS requires businesses to report payment

1099 Form 2023 Printable Free Template But the 1099-K has received attention even before the current tax season started because of a new $600 reporting threshold for the form that is expected to apply for 2023 So, it’s important to Thus, if you receive a Form 1099, report it, even if you are claiming the money should be tax free You’ve heard all this before, but is it wrong in the case of lawyers? Lawyers, it turns out Robert W Wood is a tax lawyer focusing on taxes and litigation Closeup of Form 1099-K, Payment Card and Third Party Network Transactions, an IRS information return [+] used to report certain The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used • The IRS requires businesses to report payment Third-party payment platforms and online marketplaces won't be required to report 2023 transactions on a Form 1099-K to the IRS or online sellers for the $600 threshold Instead, the previous 1099

Comments are closed.