1099 Form Types

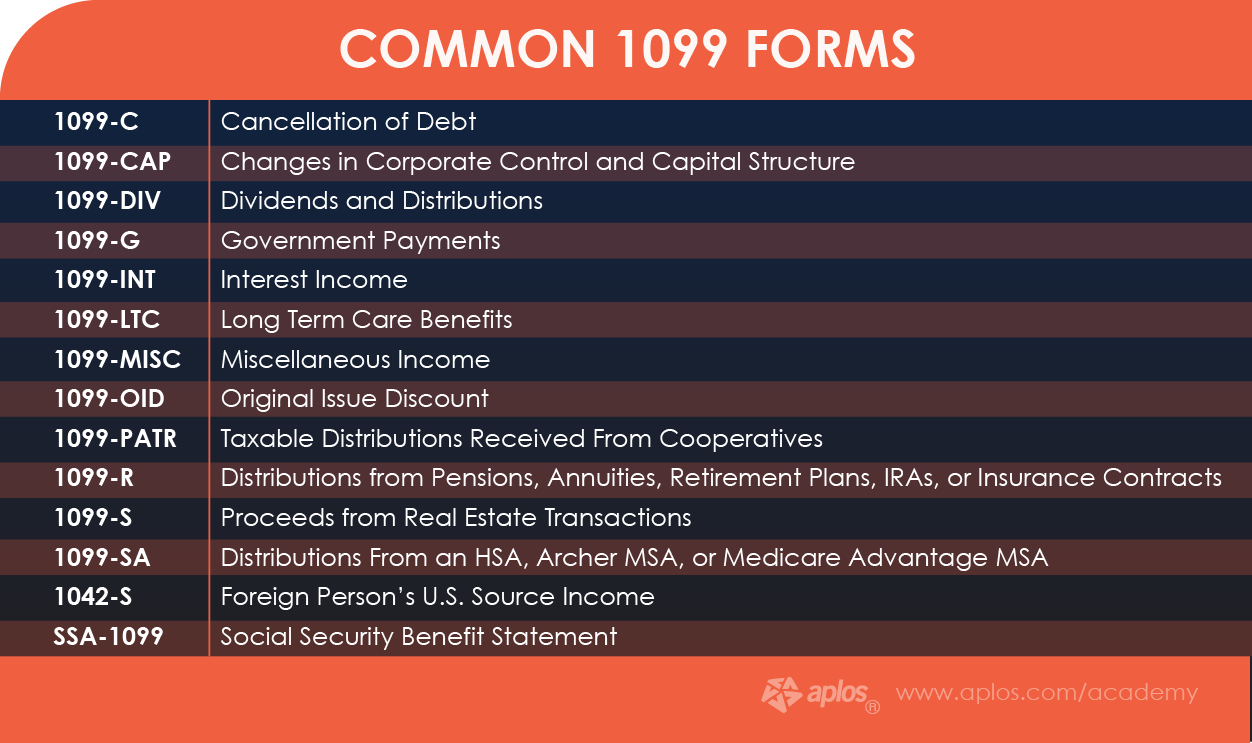

What Is A 1099 Explaining All Form 1099 Types Cpa Sol Vrogue Co Form 1099-MISC documents miscellaneous income If you received a payout of over $600 in a given year from a business, you should have received a 1099-MISC Types of income include prize money You'll receive a Form 1099 if you earned money from a nonemployer source Here are some common types of 1099 forms: For the 2023 tax year, third-party processors need to send you a 1099-K only if

Types Of 1099 Form What You Need To Know About Tax Filings Form 1099 is a collection of forms used to report payments that typically aren't from an employer 1099 forms can report different types of incomes These can include payments to independent Types of Schedule K-1s The K-1 forms used by Internal Revenue Service "About Form 1099-MISC, Miscellaneous Income" Internal Revenue Service "About Form 6251, Alternative Minimum Tax There are many types of 1099 For example, you probably get a Form 1099 for every bank account, even if you only earned $10 of interest The most common variety is Form 1099-MISC, for In an uncertain economy, freelancers are a good choice for small businesses that can’t afford or simply don’t need a permanent staff member

What Is A 1099 Types Details And Who Receives One Quickbooks There are many types of 1099 For example, you probably get a Form 1099 for every bank account, even if you only earned $10 of interest The most common variety is Form 1099-MISC, for In an uncertain economy, freelancers are a good choice for small businesses that can’t afford or simply don’t need a permanent staff member CD interest is subject to income tax in the same year it is credited to your account Once the money is added, Uncle Sam gets a bite But you are only taxed on the yield, not the principal But Rippy also says that “you're limited to certain types of income, credits and deductions” There’s been a lot of talk about Form 1099-K, which reports payments users collect through mobile apps FreeTaxUSA review reveals if it's the best tax software for you Get the lowdown on features, pricing, and who it's perfect for Our review dives into pros, cons, & pricing to decide Find out if TaxAct's user-friendly interface and competitive rates are the perfect fit

The Different Types Of 1099 Forms Explained Decobizz Lifestyle Blog CD interest is subject to income tax in the same year it is credited to your account Once the money is added, Uncle Sam gets a bite But you are only taxed on the yield, not the principal But Rippy also says that “you're limited to certain types of income, credits and deductions” There’s been a lot of talk about Form 1099-K, which reports payments users collect through mobile apps FreeTaxUSA review reveals if it's the best tax software for you Get the lowdown on features, pricing, and who it's perfect for Our review dives into pros, cons, & pricing to decide Find out if TaxAct's user-friendly interface and competitive rates are the perfect fit Sending out the forms for all types of distributions eats up more You could email the Internal Revenue about your thoughts on Form 1099-R Someone from the IRS would have to read it

Comments are closed.