1099 Nec Vs 1099 Misc Who Should Get One And How To File

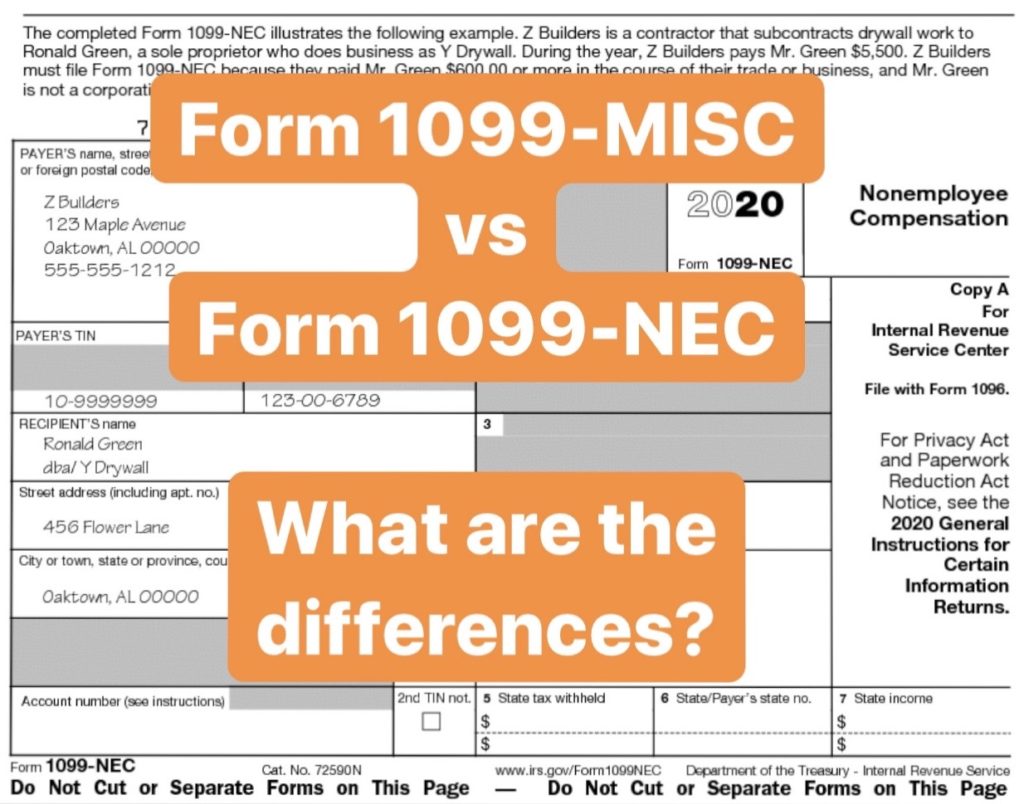

Form 1099 Misc Vs 1099 Nec Differences Deadlines More Here’s how to make sure you don’t get penalized for a missing 1099 nec. step #1. ask your contractor to fill out a w 9. have your contractors fill out a form w 9 before you issue them any payments. the w 9 will give you lists out all the relevant information you’ll need in order to file a 1099 nec: tax id number. Form 1099 misc differs from form 1099 nec in one distinct way. a business will only use a form 1099 nec if it is reporting nonemployee compensation. if a business needs to report other income.

Form 1099 Misc Vs Form 1099 Nec How Are They Different A key difference between 1099 misc and 1099 nec forms is the filing deadline. the filing deadline for these two forms is: form 1099 misc: march 31 if filing electronically (feb 28 if filing paper copies) form 1099 nec: jan 31. as for the rest of the process, let’s look at where each copy goes: 1. filing with the irs. Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc). 1099 nec vs 1099 misc. the 1099 nec is now used to report independent contractor income. but the 1099 misc form is still around, it’s just used to report miscellaneous income such as rent or payments to an attorney. although the 1099 misc is still in use, contractor payments made in 2020 and beyond will be reported on the form 1099 nec. However, with the re introduction of the form 1099 nec and the updates made to speed up the filing process, all businesses are required to file their 1099 forms (which includes form 1099 nec) on or by the 31 st of january 2021. fortunately, the 31 st of january falls on a weekend, which means that businesses have until the 1 st of february 2021.

1099 Nec Vs 1099 Misc Who Should Get One And How To File 1099 nec vs 1099 misc. the 1099 nec is now used to report independent contractor income. but the 1099 misc form is still around, it’s just used to report miscellaneous income such as rent or payments to an attorney. although the 1099 misc is still in use, contractor payments made in 2020 and beyond will be reported on the form 1099 nec. However, with the re introduction of the form 1099 nec and the updates made to speed up the filing process, all businesses are required to file their 1099 forms (which includes form 1099 nec) on or by the 31 st of january 2021. fortunately, the 31 st of january falls on a weekend, which means that businesses have until the 1 st of february 2021. Form 1099 nec is part of the 1099 series of information returns. starting in 2020, the irs requires business owners to report payments to non employees on form 1099 nec. in previous years, businesses reported those payments in box 7 on form 1099 misc. the 1099 nec form is not a replacement for form 1099 misc. Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc).

1099 Nec Vs 1099 Misc Who Should Get One And How To File Form 1099 nec is part of the 1099 series of information returns. starting in 2020, the irs requires business owners to report payments to non employees on form 1099 nec. in previous years, businesses reported those payments in box 7 on form 1099 misc. the 1099 nec form is not a replacement for form 1099 misc. Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc).

Comments are closed.