1099 R Software To Create Print E File Irs Form 1099 R

Irs Form 1099 R How To Fill It Right And Easily You can e file information returns for tax year 2022 and later with the information returns intake system (iris). the system also lets you file corrections and request automatic extensions. 10 or more returns: e filing is required. for system availability, check iris status. get solutions to known issues. there are 2 ways to e file with iris:. Easy 1099 software to simplify tax reporting processes. checkmark 1099 software helps you prepare, print or e file your 1099 forms with the irs quickly and easily. diy 1099 tax software for paper and electronic filings. supports 1099 nec, misc, int, div, r, and –s forms. unlimited recipients, companies, and filings.

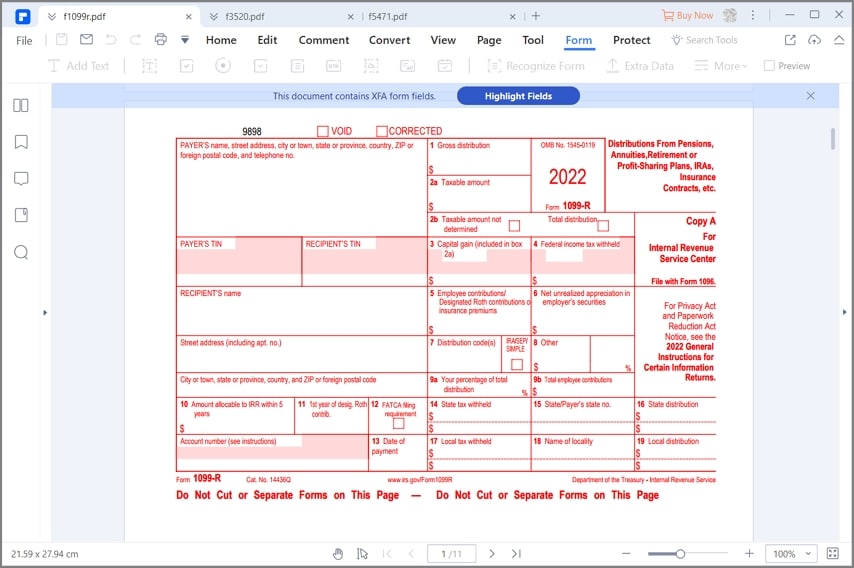

1099 R Software To Create Print E File Irs Form 1099 R Washington — the internal revenue service announced today that businesses can now file form 1099 series information returns using a new online portal, available free from the irs. known as the information returns intake system (iris), this free electronic filing service is secure, accurate and requires no special software. The distribution may also be subject to the 10% additional tax under section 72 (t). it is not eligible to be rolled over to an eligible retirement plan nor is it eligible for the 10 year tax option. on form 1099 r, complete the appropriate boxes, including boxes 1 and 2a, and enter code l in box 7. With account ability tax form preparation software, irs 1099 r compliance couldn't be easier! 1099 r tax forms can be keyed or imported from text files, spreadsheets and irs pub 1220 compliant transmittals. electronic filing (e file) of tax form 1099 r via irs fire is included for free. 1099 r forms are easily maintained on user friendly. Supported forms. our software supports 1099 misc, 1099 nec, 1099 div, 1099 int, 1099 r, and 1099 s forms. add unlimited companies and recipients. effortlessly manage any number of companies and recipients without any limitations. unlimited 1099 filings. submit as many 1099 filings as necessary with the irs, whether through paper or electronically.

Comments are closed.