2020 Average Credit Card Debt Statistics In The U S Lexington Law

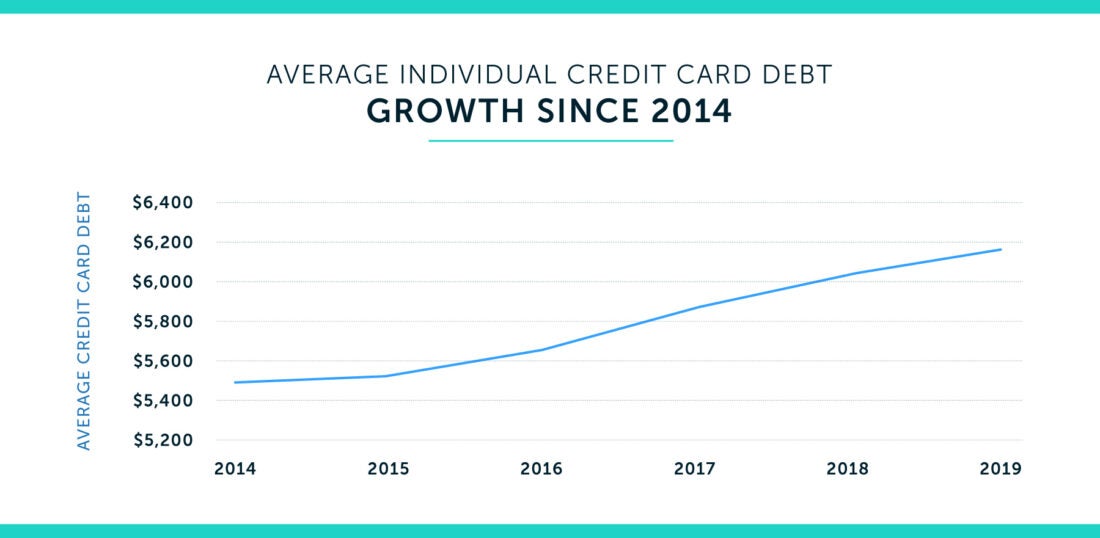

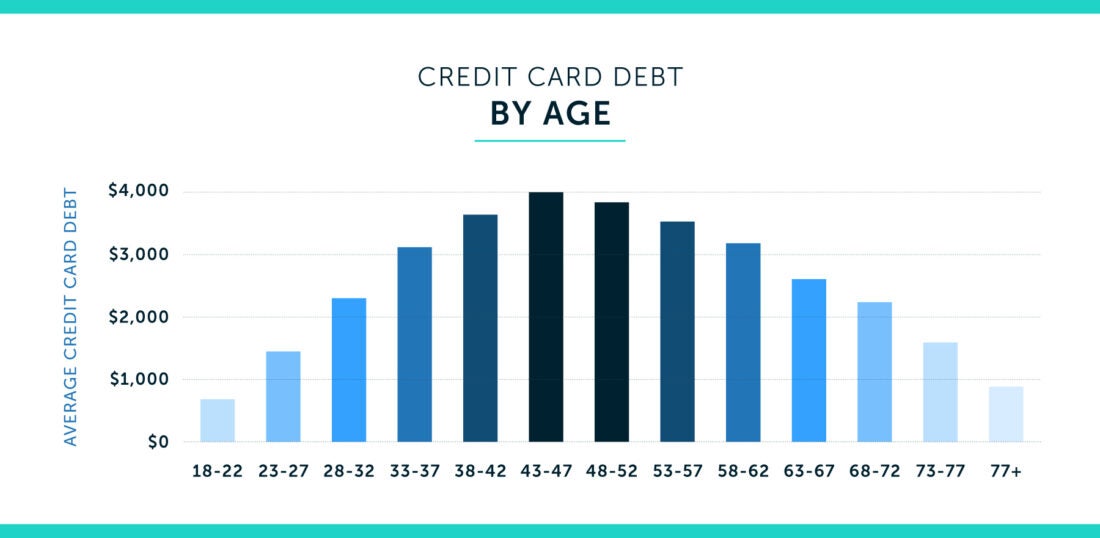

2020 Average Credit Card Debt Statistics In The U S Lexington Law The average u.s. credit card debt is a balance of $5,910 per person. ( experian) between q1 2019 and q1 2022, the total number of credit cards in america has risen by almost 8 percent to 492.5 million. ( transunion) the average fico ® credit score for all generations rose by three points to 714 between 2020 and 2021. The total credit card balance in the u.s. rose to $986 billion at the end of q4 in 2022. (source: federal reserve bank of new york ) americans aged 30 – 39 have the highest amount of non mortgage debt, with an average non mortgage debt per capita of $26,532.

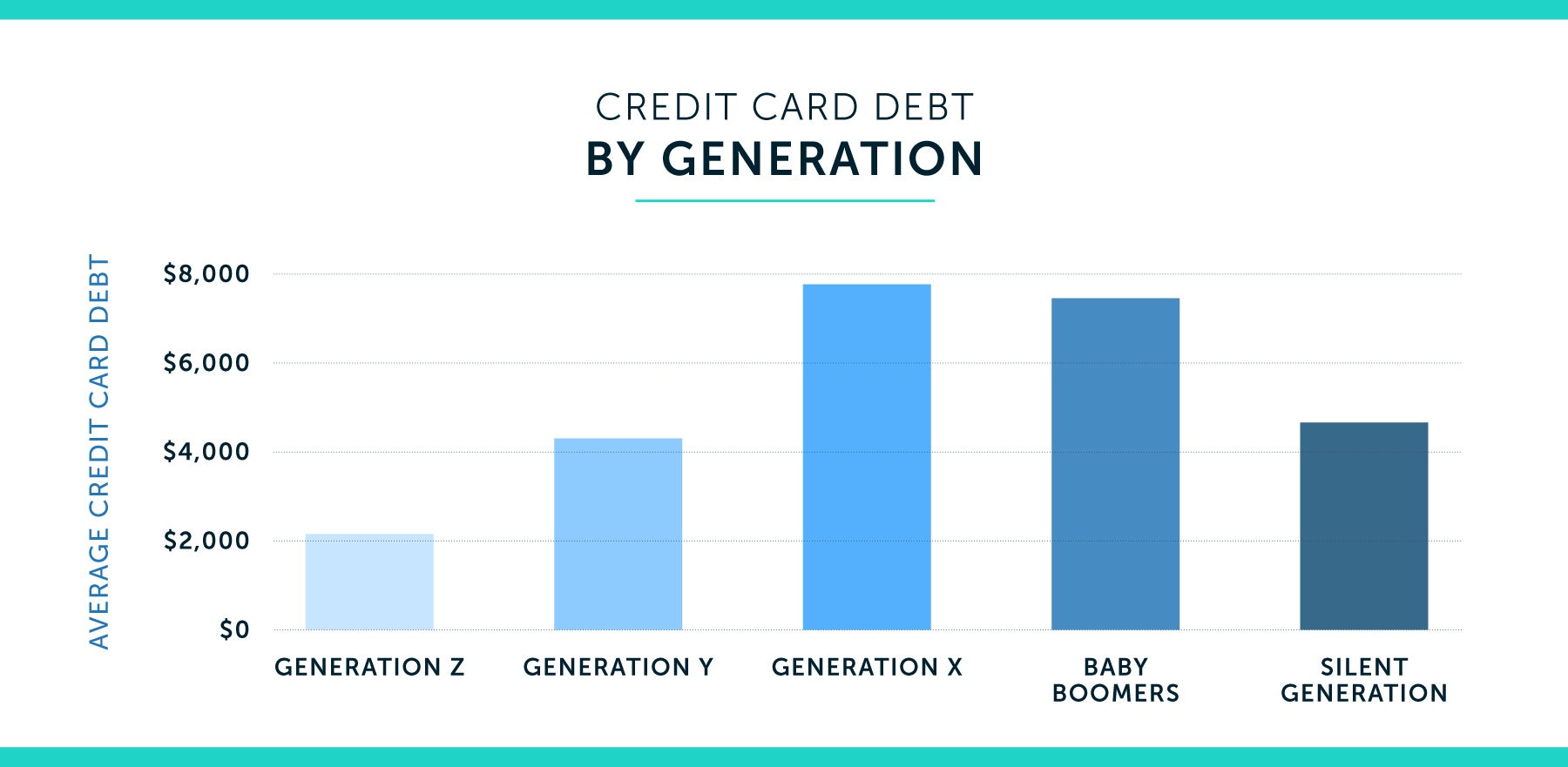

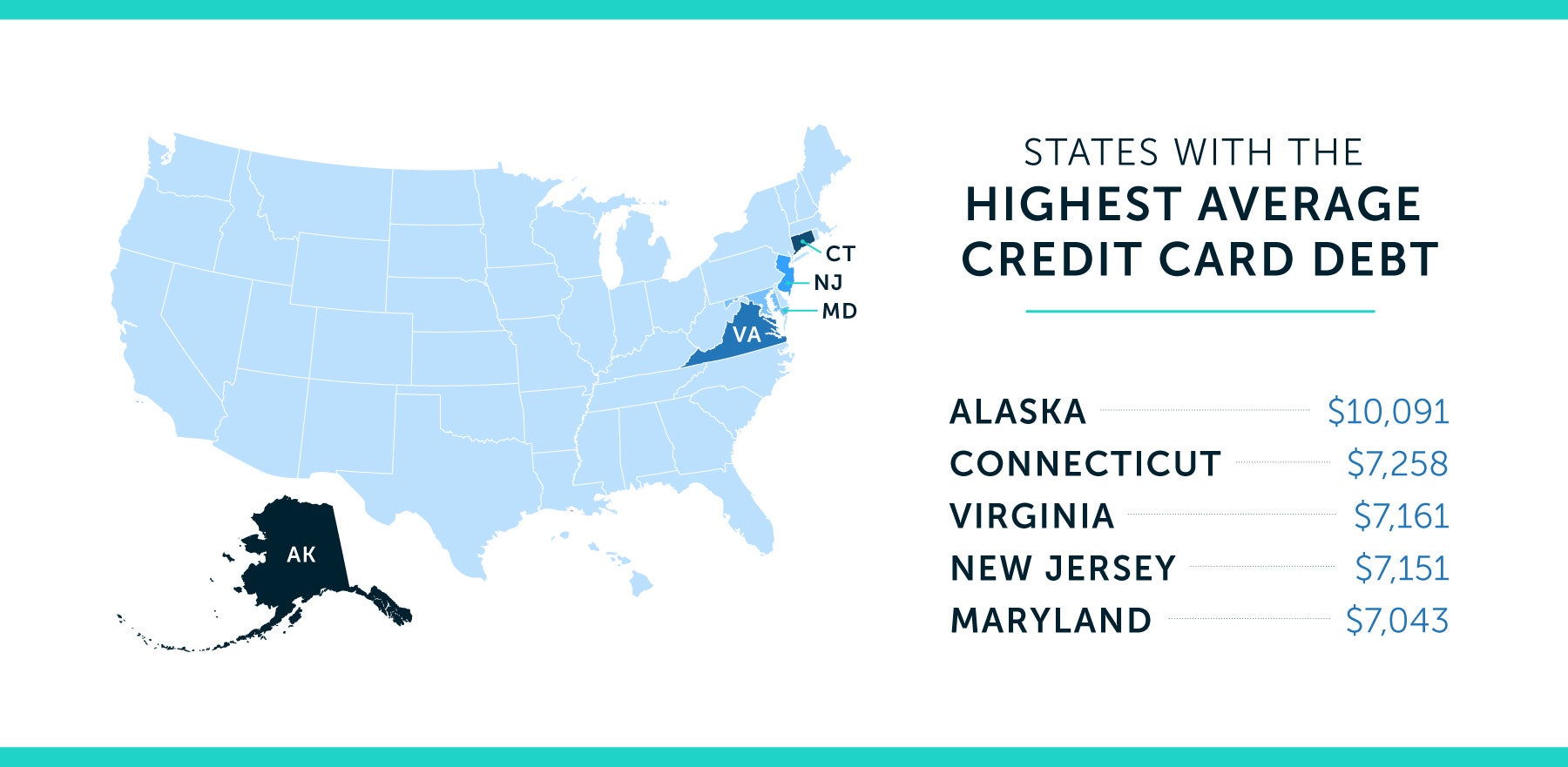

2020 Average Credit Card Debt Statistics In The U S Lexington Law Their average credit card debt is close to eight thousand dollars, according to recent reports. asians have an average of $7,660, latinos average $6,469, and african americans have the lowest average at $6,172. education and debt. the highest average credit card debt was among individuals with a college degree. Average credit card debt in the u.s. 2017, by income purchase volume per credit card in u.s. in 2000 and 2010, with a forecast for 2018 ownership rate credit cards indonesia 2011 2021 by gender. In fact, during the pandemic, the share of cardholders who paid off their credit card debt reached the highest in recent years. specifically, the share of all active accounts that carried a balance declined from 50% to 45% from april 2020 to december 2021. percentage of active credit card accounts that carried a balance, 2019 2021. Credit card debt reached a record $1 trillion: the cfpb’s data showed credit card debt at the end of 2022 surpassed $1 trillion for the first time, and annual spending on credit cards increased to $3.2 trillion. the report also found that total average credit card balances per cardholder returned to about $5,300, about the same as before the.

2020 Average Credit Card Debt Statistics In The U S Lexington Law In fact, during the pandemic, the share of cardholders who paid off their credit card debt reached the highest in recent years. specifically, the share of all active accounts that carried a balance declined from 50% to 45% from april 2020 to december 2021. percentage of active credit card accounts that carried a balance, 2019 2021. Credit card debt reached a record $1 trillion: the cfpb’s data showed credit card debt at the end of 2022 surpassed $1 trillion for the first time, and annual spending on credit cards increased to $3.2 trillion. the report also found that total average credit card balances per cardholder returned to about $5,300, about the same as before the. Average per household: $10,479. total credit card debt: $1.26 trillion. year over year: 14% down. the average credit card balance is $10,479 per household, as of q1 2024. adjusted for inflation, the average household’s balance is actually well below the record high of more than $12,000 at the end of 2008. below, you can find additional data. Total u.s. credit card outstanding debt stands at $915 billion as of september 2020, which includes both revolving and transacting balances. to get a better look at the pandemic’s impact on.

2020 Average Credit Card Debt Statistics In The U S Lexington Law Average per household: $10,479. total credit card debt: $1.26 trillion. year over year: 14% down. the average credit card balance is $10,479 per household, as of q1 2024. adjusted for inflation, the average household’s balance is actually well below the record high of more than $12,000 at the end of 2008. below, you can find additional data. Total u.s. credit card outstanding debt stands at $915 billion as of september 2020, which includes both revolving and transacting balances. to get a better look at the pandemic’s impact on.

Comments are closed.