2021 Consumer Debt Statistics Lexington Law

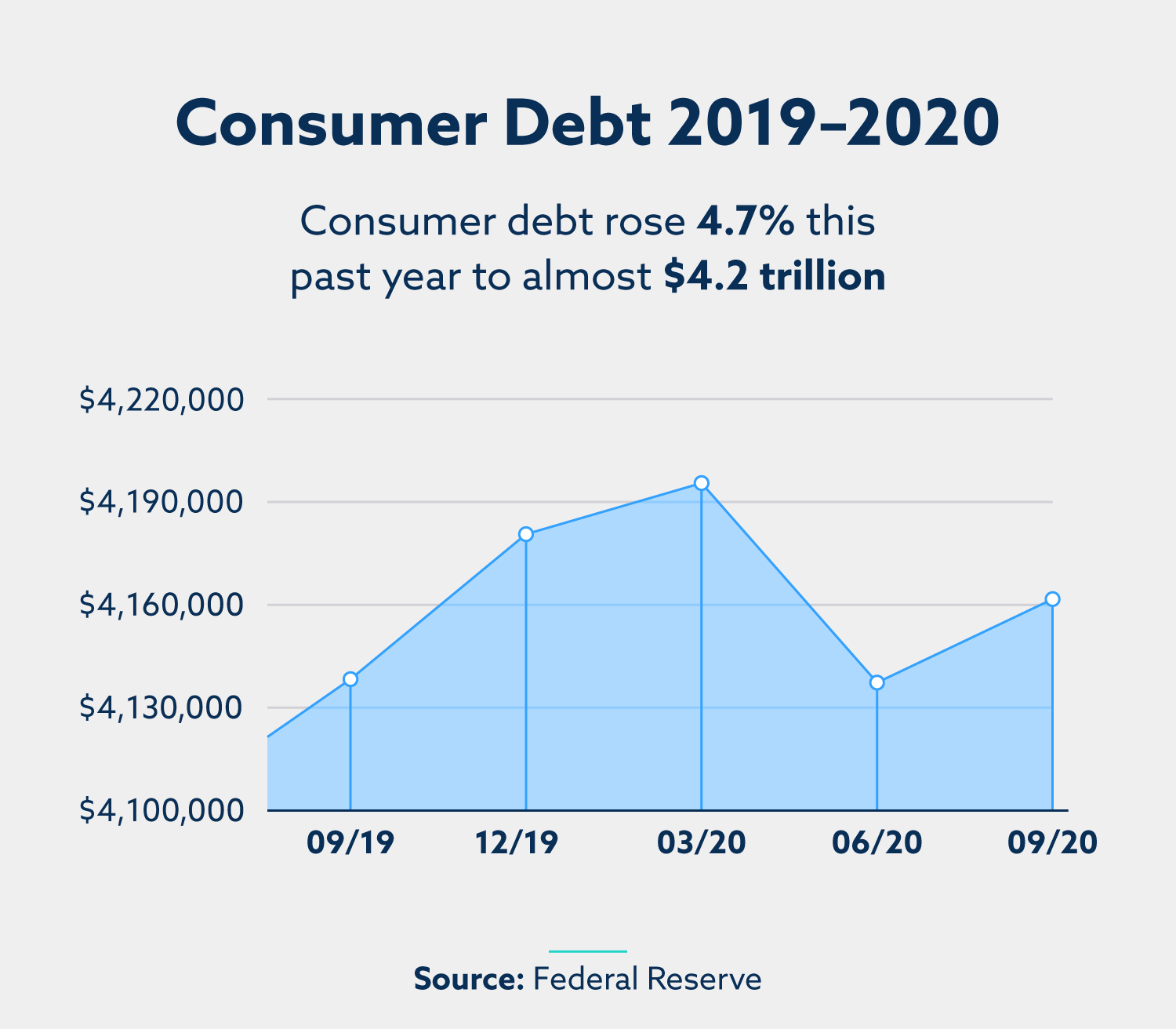

2021 Consumer Debt Statistics Lexington Law Total household debt increased $1.32 trillion from q4 of 2021 to q4 of 2022. (source: federal reserve bank of new york) total revolving consumer debt was nearly $1.22 trillion in january 2023. (source: federal reserve) total nonrevolving consumer debt was $3.589 trillion in january 2023. (source: federal reserve). The average u.s. credit card debt is a balance of $5,910 per person. ( experian) between q1 2019 and q1 2022, the total number of credit cards in america has risen by almost 8 percent to 492.5 million. ( transunion) the average fico ® credit score for all generations rose by three points to 714 between 2020 and 2021.

2021 Consumer Debt Statistics Lexington Law Since 2006, vantagescore has encompassed 2,500 users between 2,200 financial institutions. average vantagescore statistics of 2021 show generational disparities and contrasts. the average vantagescore credit score in january and february of 2022 was 696. (source: vantagescore) generation z had a median vantagescore of 661 in 2021. The ratio between male and female debtors in 2019 was 53% to 47%. in 2021 it changed to 51% to 49%, closer to the ratio in the general population of approximately 50 50. 1 the marital status of debtors was divided into four categories: married common law 34%. single 42%. divorced separated 21%. widowed 3%. Average consumer debt balance in the united states from 2010 to 2023 (in 1,000 u.s. dollars) premium statistic amount of personal debt held in the u.s. 2018 2023. It helped boost non revolving debt from about 62% of all consumer debt in may 2008 to about 74% in february 2020. in december 2021, non revolving debt ($3.40 trillion) stood at about 77% of all consumer debt ($4.43 trillion).

Student Loan Debt Statistics For 2021 Lexington Law Average consumer debt balance in the united states from 2010 to 2023 (in 1,000 u.s. dollars) premium statistic amount of personal debt held in the u.s. 2018 2023. It helped boost non revolving debt from about 62% of all consumer debt in may 2008 to about 74% in february 2020. in december 2021, non revolving debt ($3.40 trillion) stood at about 77% of all consumer debt ($4.43 trillion). Social media statistics & facts looking at total consumer debt, 97 percent of the total balance was current or non delinquent (i.e. all payments made on time or less than 30 days late) at. Research. experian study: average u.s. consumer debt and statistics. february 14, 2024 • 9 min read. by chris horymski. quick answer. the total u.s. consumer debt balance increased to $17.1 trillion in 2023, up 4.4% from $16.38 trillion in 2022. growth in 2023 was slower than the 7% increase from 2021 to 2022.

Student Loan Debt Statistics For 2021 Lexington Law Social media statistics & facts looking at total consumer debt, 97 percent of the total balance was current or non delinquent (i.e. all payments made on time or less than 30 days late) at. Research. experian study: average u.s. consumer debt and statistics. february 14, 2024 • 9 min read. by chris horymski. quick answer. the total u.s. consumer debt balance increased to $17.1 trillion in 2023, up 4.4% from $16.38 trillion in 2022. growth in 2023 was slower than the 7% increase from 2021 to 2022.

2022 Consumer Debt Statistics Lexington Law

Comments are closed.