2024 Income Tax Brackets Chart Mela Stormi

New York State Tax Brackets 2024 Inna Renata 2024 federal income tax rates. these rates apply to your taxable income. your taxable income is your income after various deductions, credits, and exemptions have been applied. there are also various tax credits, deductions and benefits available to you to reduce your total tax payable. see how amounts are adjusted for inflation. For 2024, the marginal rate for $173,205 to $246,752 is 29.32% because of the above noted personal amount reduction through this tax bracket. the additional 0.32% is calculated as 15% x ($15,705 $14,156) ($246,752 $173,205). for 2023, the marginal rate for $165,430 to $235,675 is 29.32% because of the above noted personal amount reduction.

Income Tax Brackets 2024 India Tova Ainsley In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). the federal income tax has seven tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with. Request an extension until oct. 15, 2024, for businesses whose tax return deadline is april 15, 2024. 1 st installment deadline to pay 2024 estimated taxes due. last day to file federal income tax returns for individuals (unless the individual lives in maine or massachusetts, in which case the deadline is april 17, 2024). The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. your bracket depends on your taxable income and filing status. The amt exemption rate is also subject to inflation. the amt exemption amount for tax year 2024 for single filers is $85,700 and begins to phase out at $609,350 (in 2023, the exemption amount for.

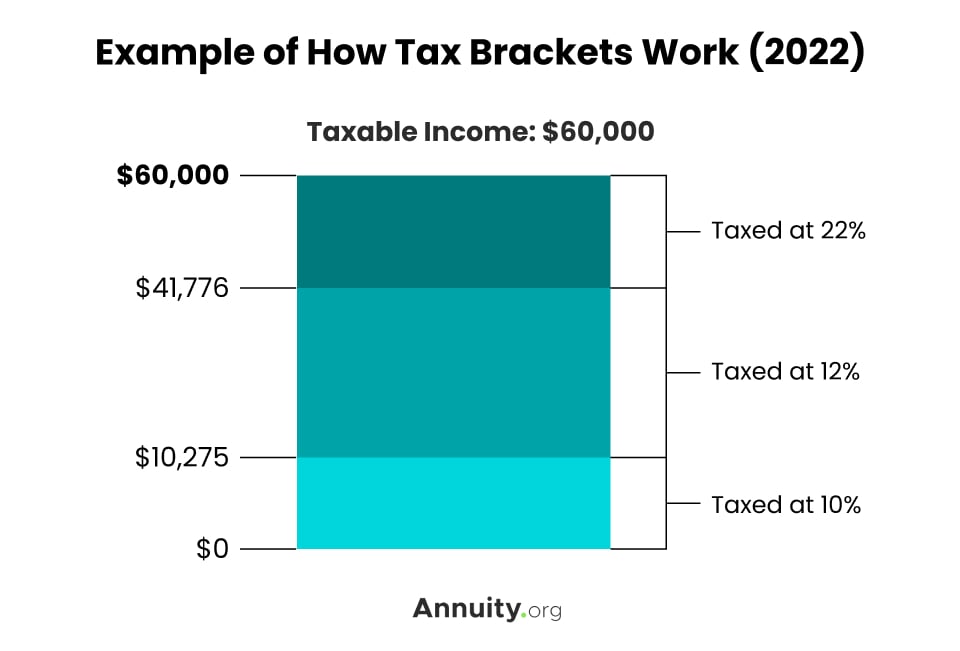

Compare 2024 Tax Brackets With Previous Years Mela Stormi The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. your bracket depends on your taxable income and filing status. The amt exemption rate is also subject to inflation. the amt exemption amount for tax year 2024 for single filers is $85,700 and begins to phase out at $609,350 (in 2023, the exemption amount for. You pay tax as a percentage of your income in layers called tax brackets. as your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a. Tax brackets for 2021 and 2022 publications national, the irs has adjusted federal income tax bracket ranges for the 2024 tax year to account for inflation. source: eduvark irs ez tax table 2023 2024 eduvark , 12% for incomes between $11,001 to $44,725.

2024 Income Tax Brackets And Deductions Pdf Download Arlyne Leeanne You pay tax as a percentage of your income in layers called tax brackets. as your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a. Tax brackets for 2021 and 2022 publications national, the irs has adjusted federal income tax bracket ranges for the 2024 tax year to account for inflation. source: eduvark irs ez tax table 2023 2024 eduvark , 12% for incomes between $11,001 to $44,725.

2024 Income Tax Brackets Chart Mela Stormi

Comments are closed.