2024 Va Dic Rates Increase 3 2 Survivor Benefits

Va Increase 2024 Quick Guide Social Security and Supplemental Security Income (SSI) benefits for more than 71 million Americans will increase 32 percent in 2024, the Social Security Administration announced today VA loans generally require no money down, and they can be a good mortgage for borrowers with poor credit Here's an overview of today's VA mortgage rates you'll pay a 23% funding fee

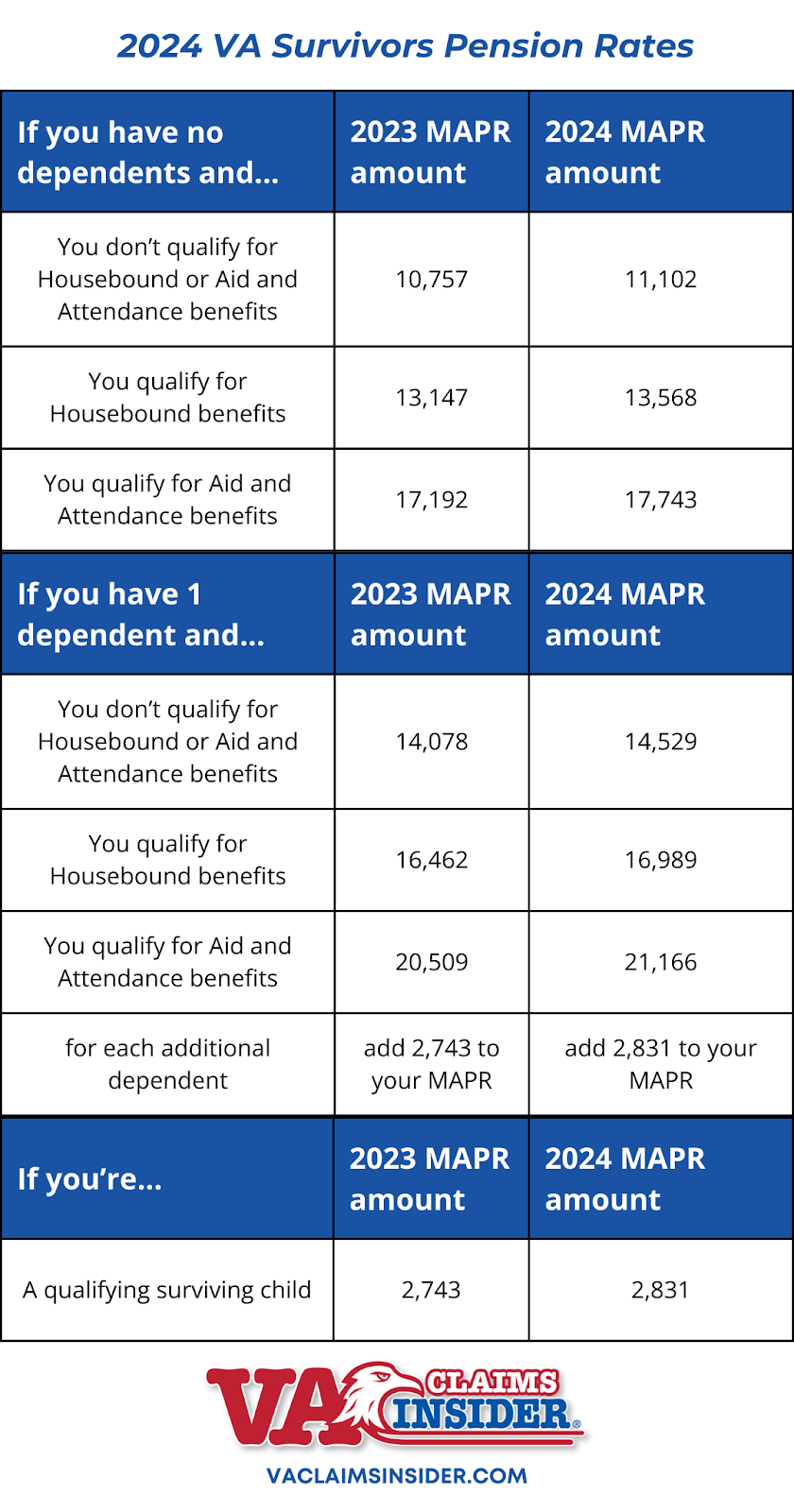

2024 Va Dic Rates For Spouses And Dependents survivor benefits VA provides Dependency and Indemnity (DIC) to surviving spouses and/or minor children of a veteran who dies on active duty or of a service-connected disability In most cases The Veteran Affairs disability benefits rating is details and other options to increase your rating Starting in 2024, veterans who qualify for a 50% VA disability rating will receive a There are many military benefits that you earn during your service in the Army, Navy, Marine Corps, Space Force, Air Force or Coast Guard Keeping track of them can sometimes be challenging You can open a CD at almost any bank, but it literally pays to find CDs with high interest rates Shop around at opting to wait will increase your earnings since the interest will compound

Va Benefit Pay Chart 2024 Matti Shelley There are many military benefits that you earn during your service in the Army, Navy, Marine Corps, Space Force, Air Force or Coast Guard Keeping track of them can sometimes be challenging You can open a CD at almost any bank, but it literally pays to find CDs with high interest rates Shop around at opting to wait will increase your earnings since the interest will compound If you're considering refinancing your VA mortgage, the first thing you'll want to do is see where rates are at On a cash-out refinance, the fee is 23% for your first refinance and 36% but lenders tend to offer better rates to borrowers who choose shorter terms and have higher credit scores You’ll have to pay fees and closing costs between 2% and 5% of the total loan amount The interest rates for low down payment loans (like an FHA loan or a VA loan) can be very competitive and that will increase your monthly cost What you can do: Ask the lender which loans Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term

Comments are closed.