3 Golden Rules Of Accounting Types Benefits Examples

3 Golden Rules Of Accounting Explained Concepts Behind It The golden rules of accounting provide fundamental principles, with three key technical rules ensuring accuracy in the process. 1. credit the provider and debit the recipient: in personal accounts associated with specific individuals or entities, the guideline is to record a debit for the receiver and a credit for the giver. Here is an explanation of the three types of accounts: 1. real account. also known as permanent accounts. real accounts record assets, liabilities, and capital. the balances in real accounts are carried forward to the next accounting period. examples include accounts for land, buildings, equipment, loans, capital, etc.

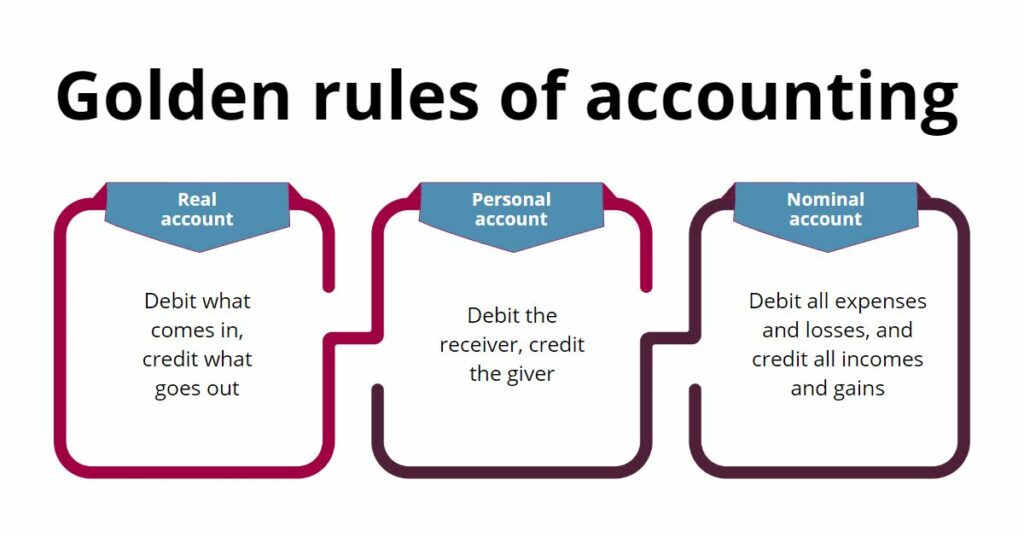

Top 3 Golden Rules Of Accounting Sage Software The 5 basic accounting principles are: revenue recognition principle: recognize revenue when it’s earned, regardless of when payment is received. matching principle: match expenses with revenues in the period in which the revenue was earned. historical cost principle: record assets at their original purchase price. The three golden rules of accounting. these three golden rules of accounting: debit the receiver and credit the giver; debit what comes in and credit what goes out; and debit expenses and losses credit income and gains, form the bedrock of double entry bookkeeping. they regulate the entry of financial transactions with precision and consistency. Example of the three golden rules of accounting. let’s see an example where we apply all three rules together. suppose your friend’s company (company y) owes your company $20,000. you’ve decided to acquire used furniture from company y to settle the account. the furniture’s current market value is $19,750. company y offers marketing. Take a look at the three main rules of accounting: debit the receiver and credit the giver. debit what comes in and credit what goes out. debit expenses and losses, credit income and gains. 1. debit the receiver and credit the giver. the rule of debiting the receiver and crediting the giver comes into play with personal accounts.

3 Golden Rules Of Accounting Types Benefits Examples Example of the three golden rules of accounting. let’s see an example where we apply all three rules together. suppose your friend’s company (company y) owes your company $20,000. you’ve decided to acquire used furniture from company y to settle the account. the furniture’s current market value is $19,750. company y offers marketing. Take a look at the three main rules of accounting: debit the receiver and credit the giver. debit what comes in and credit what goes out. debit expenses and losses, credit income and gains. 1. debit the receiver and credit the giver. the rule of debiting the receiver and crediting the giver comes into play with personal accounts. The golden rules of accounting are a set of three rules that simplify the process of bookkeeping and accounting. they help you classify the accounts into three types: personal, real, and nominal. they also help you determine the debit and credit entries for each transaction involving these accounts. in this blog post, we will explain the golden. Three golden rules of accounting. 1. debit the one that has received and credit the one that has given. 2. what comes in must be debited, and what goes out must be credited. 3. every loss or expense is debited, and every gain or income is credited. some examples to help understand the 3 accountancy rules.

3 Golden Rules Of Accounting Examples Fundamentals Advantages The golden rules of accounting are a set of three rules that simplify the process of bookkeeping and accounting. they help you classify the accounts into three types: personal, real, and nominal. they also help you determine the debit and credit entries for each transaction involving these accounts. in this blog post, we will explain the golden. Three golden rules of accounting. 1. debit the one that has received and credit the one that has given. 2. what comes in must be debited, and what goes out must be credited. 3. every loss or expense is debited, and every gain or income is credited. some examples to help understand the 3 accountancy rules.

3 Golden Rules Of Accounting Types Benefits Examples

Comments are closed.