401 K Vs Simple Ira What S The Difference The Motley Fool

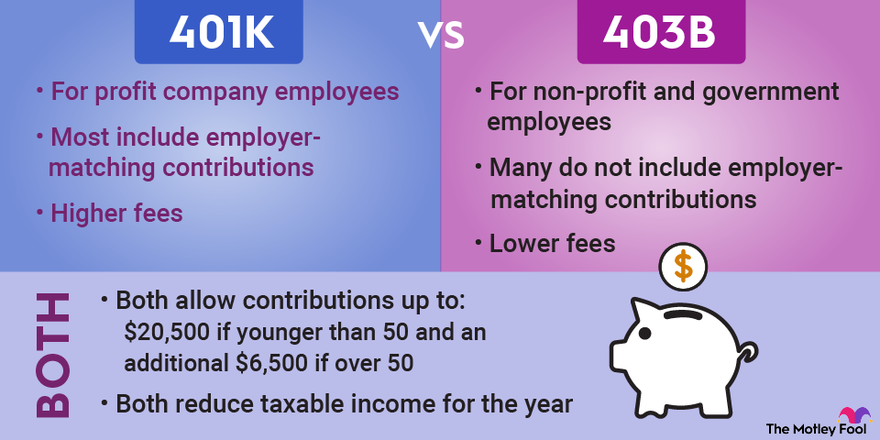

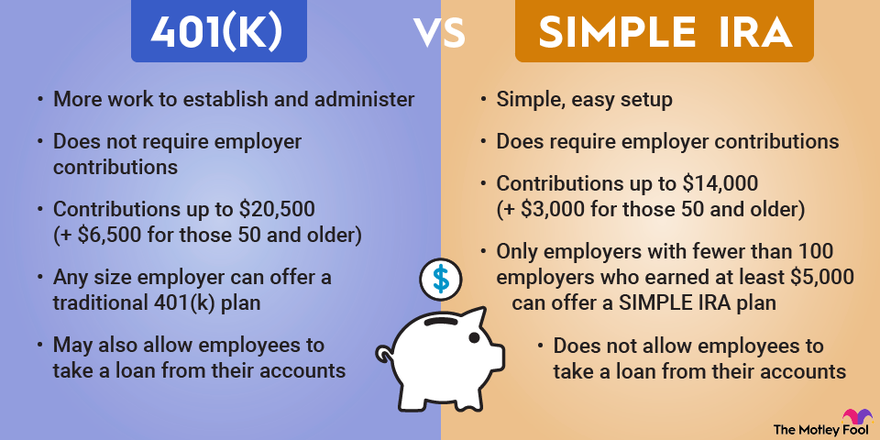

403 B Vs 401 K What S The Difference The Motley Fool The contribution limit into 401 (k)s for employee salary deferrals is $23,000 in 2024 (up from $22,500 in 2023) $7,000 more than a simple ira. those older than 50 are able to contribute up to. Key points. 401 (k)s are employer sponsored retirement plans, while iras are individual retirement accounts that aren't linked to a job. the annual contribution limits for 401 (k)s are higher than.

401 K Vs Simple Ira What S The Difference The Motley Fool The simple ira vs. 401 (k) decision is, at its core, a choice between simplicity and flexibility for employers. the aptly named simple ira, which stands for savings incentive match plan for. High contribution limit. just as with a regular 401(k), an individual can contribute up to $23,000 as the employee to a solo 401(k) account in 2024 ($22,500 in 2023).those 50 and older make an. Simple ira funds are immediately fully vested, including your employer's contributions. on the downside, there is no such thing as a simple ira loan, unlike with a 401 (k). however, you are allowed to take a penalty free early distribution from a simple ira to pay for qualified college expenses, or withdraw up to $10,000 for a first time home. The simple 401 (k) plan is a cross between a simple ira and a traditional 401 (k) plan and offers some features of both plans. for both the simple ira and the simple 401 (k), eligible employers.

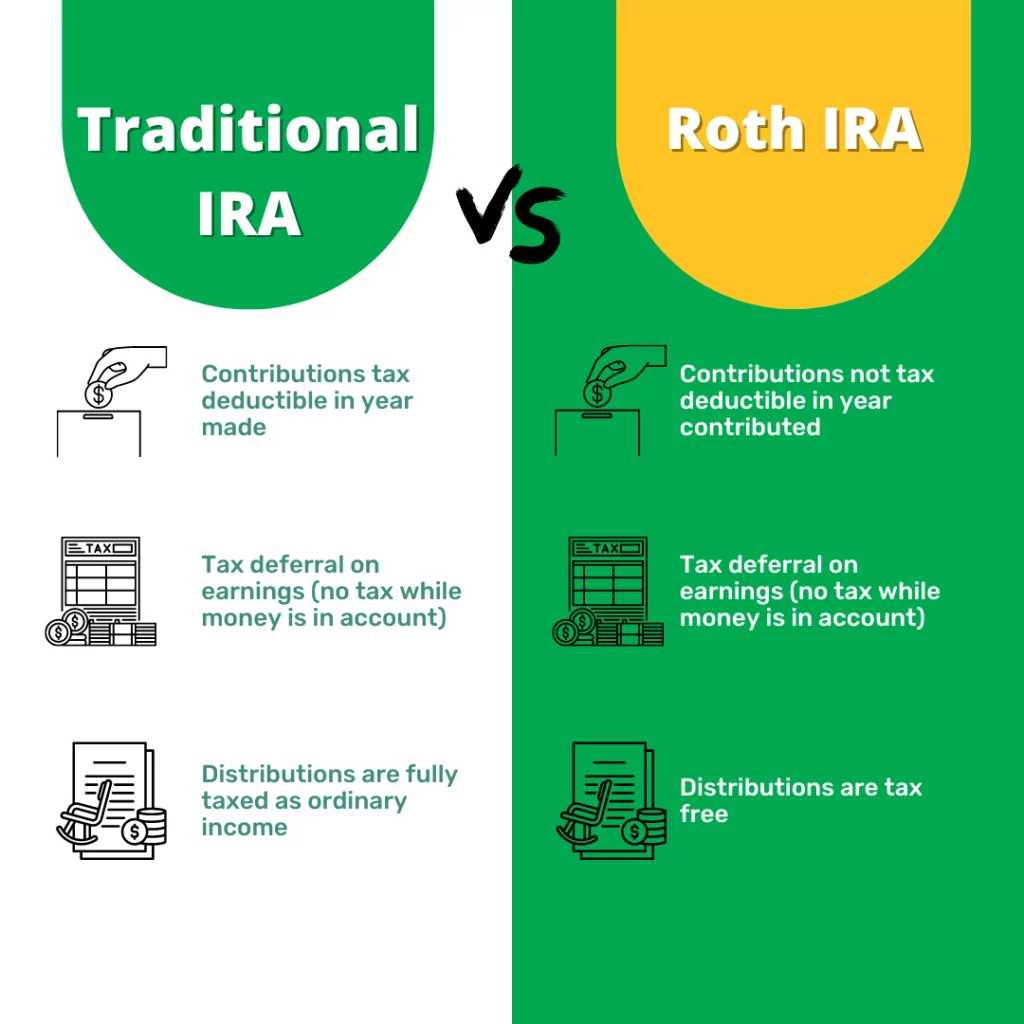

What Is The Difference Between An Ira A 401k Iwa Blog Simple ira funds are immediately fully vested, including your employer's contributions. on the downside, there is no such thing as a simple ira loan, unlike with a 401 (k). however, you are allowed to take a penalty free early distribution from a simple ira to pay for qualified college expenses, or withdraw up to $10,000 for a first time home. The simple 401 (k) plan is a cross between a simple ira and a traditional 401 (k) plan and offers some features of both plans. for both the simple ira and the simple 401 (k), eligible employers. Iras have lower contribution limits than 401 (k)s. in 2024, individuals can contribute up to $7,000 in an ira (or $8,000 if you’re age 50 or older). that’s $16,000 less than the maximum allowed in a 401 (k) if you’re under 50, or $22,500 less if you’re over 50. there are no “matching” contributions for iras. Simple ira vs. simple 401 (k): what's the difference? while simple iras and simple 401 (k)s are very similar retirement plans offered by small businesses, they have a few subtle differences you should know.

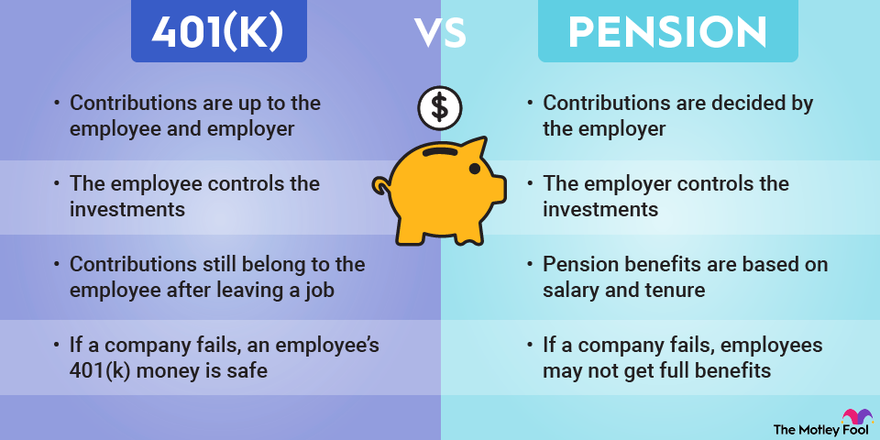

401 K Vs Pension Differences And Which Is Better The Motley Fool Iras have lower contribution limits than 401 (k)s. in 2024, individuals can contribute up to $7,000 in an ira (or $8,000 if you’re age 50 or older). that’s $16,000 less than the maximum allowed in a 401 (k) if you’re under 50, or $22,500 less if you’re over 50. there are no “matching” contributions for iras. Simple ira vs. simple 401 (k): what's the difference? while simple iras and simple 401 (k)s are very similar retirement plans offered by small businesses, they have a few subtle differences you should know.

Comments are closed.