56 Of Social Security Households Pay Tax On Their Benefits вђ Will You

56 Of Social Security Households Pay Tax On Their Benef At that time, only 10% of social security beneficiaries paid the tax. but during the 2015 tax season, an estimated 56% of social security beneficiary households will owe federal income taxes on part of their benefit income according to the social security administration. the income thresholds that subject up to 50 percent of social security. Here are seven things social security recipients, present and future, should know about taxation of benefits. 1. income matters — age doesn’t. contrary to another common misperception, you don’t stop paying taxes on your social security when you reach a certain age. income, and income alone, dictates whether you owe federal taxes on your.

Do You Have To Pay Tax On Your Social Security Benefits Greenbus Social security benefits are 100% tax free when your income is low. as your total income goes up, you’ll pay federal income tax on a portion of the benefits while the rest of your social security income remains tax free. this taxable portion goes up as your income rises, but it will never exceed 85%. even if your annual income is $1 million. This new tier allows up to 85% of social security benefits to be taxed at the federal ordinary income tax rate. now, here's the catch: these income thresholds have never been adjusted for. Divide their social security benefits ($12,000) in half to get $6,000. subtract the 50% taxation threshold for the individual's tax filing status ($25,000) from their combined income ($30,000) to. Projections 1 show that an annual average of about 56 percent of beneficiary families will owe federal income tax on their benefits from 2015 through 2050. among beneficiary families that owe income tax on their benefits, the median percentage of benefits owed as income taxes will increase from about 11 percent in 2015 to 12 percent in 2025 and.

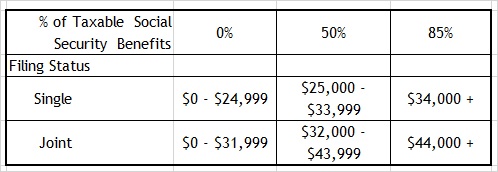

How To Calculate Taxes On Social Security Benefits Divide their social security benefits ($12,000) in half to get $6,000. subtract the 50% taxation threshold for the individual's tax filing status ($25,000) from their combined income ($30,000) to. Projections 1 show that an annual average of about 56 percent of beneficiary families will owe federal income tax on their benefits from 2015 through 2050. among beneficiary families that owe income tax on their benefits, the median percentage of benefits owed as income taxes will increase from about 11 percent in 2015 to 12 percent in 2025 and. The highest rate that you'll pay in federal income taxes on your benefits is 31.45%. that rate applies if you're in the top 37% income tax bracket, and the maximum 85% of benefits gets included as. You will pay tax on your social security benefits based on internal revenue service (irs) rules if you: file a federal tax return as an "individual" and your combined income* is. between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. more than $34,000, up to 85% of your benefits may be taxable.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

How Working After Full Retirement Age Affects Social Security Benefits The highest rate that you'll pay in federal income taxes on your benefits is 31.45%. that rate applies if you're in the top 37% income tax bracket, and the maximum 85% of benefits gets included as. You will pay tax on your social security benefits based on internal revenue service (irs) rules if you: file a federal tax return as an "individual" and your combined income* is. between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. more than $34,000, up to 85% of your benefits may be taxable.

Your Social Security Benefits May Be Taxable Clay Northam Wealth

Comments are closed.