6 Trends Shaping Digital Payments In 2024

6 Trends Shaping Digital Payments In 2024 In 2018, this number was only 18.9%. according to juniper research, payments made using digital wallets will exceed $10 trillion by 2025, almost doubling 2020’s $5.5 trillion. in the near future, expect to see a lot more biometric authentication used to secure digital wallets. 6. Juniper research forecasts that by 2024, unique contactless mobile payment users will hit 1 billion worldwide and digital wallet spending will surpass $10 trillion in 2025, an increase of $4.5.

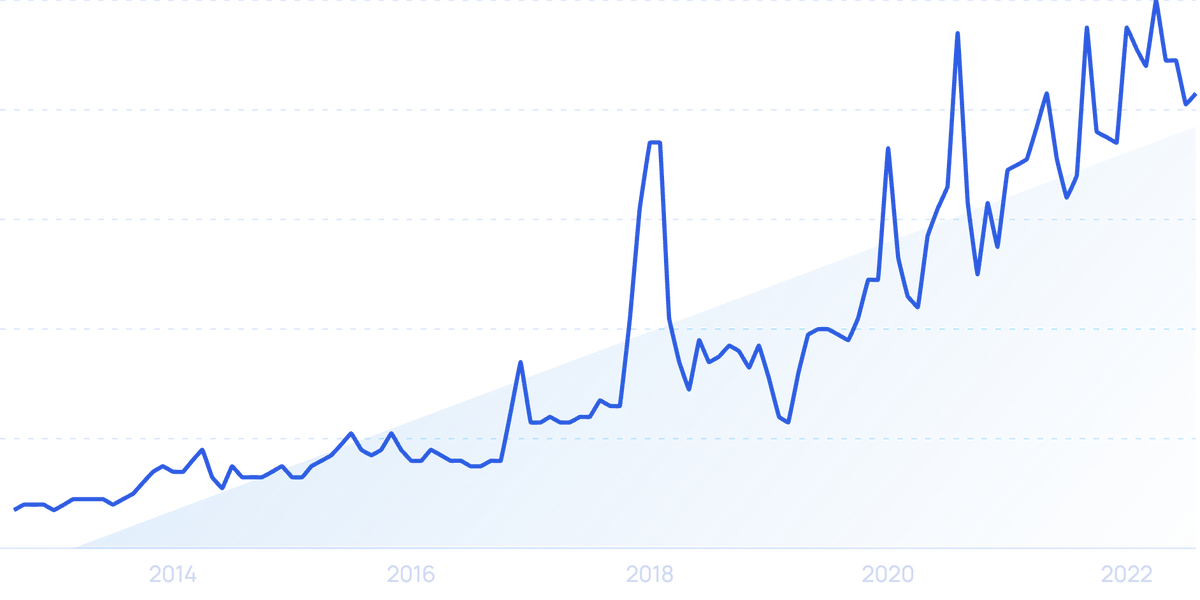

6 Key Payments Industry Trends Shaping 2024 Blankfactor Stay ahead of payments industry trends with the latest technologies. shifting payments industry trends are shaping business priorities faster than ever in 2024. from the increasing adoption of new payment methods like digital wallets and contactless payments to the transformative potential of generative ai, companies will need to continually. Anticipate continued payments industry transformation in 2024, with frontrunners streamlining processes and leveraging defi and ai. iso 20022, upcoming psd3 directives, and increasing payment offerings from bigtechs will all help to accelerate change. technology advancements are on track to revolutionize productivity and enhance data security. 10 min read. digital payments have taken center stage! in fact, the global digital payment market is expected to reach a volume of around $14.78 trillion by 2027 showing a growth of 11.58% during the forecast period (2024 2027). we can see an evolving digital payment landscape due to the ease, convenience, speed, and security it offers while. Still, recent forecasts predict a healthy compound annual growth rate (cagr) of 14.4% through 2027, with projected revenue of $64.9 billion in that year, compared to $34.9 billion in 2023. 10. low fees and speedy global transaction times could give digital currency a competitive edge over traditional payments.

Comments are closed.