Accounting Debit Vs Credit Examples Guide Quickbooks

Accounting Debit Vs Credit Examples Guide Quickbooks When learning bookkeeping basics, it’s helpful to look through examples of debit and credit accounting for various transactions. in general, debit accounts include assets and cash, while credit accounts include equity, liabilities, and revenue. check out these examples of journal entries for each type of account:. The difference between debit and credit. the balance sheet formula (or accounting equation) determines whether you use a debit vs. credit for a particular account. the balance sheet is one of the three basic financial statements that every owner analyses to make financial decisions. business owners also review the income statement and the.

Debits And Credits A Beginner S Guide Quickbooks Global Debits and credits accounting formula. you can use debits and credits to figure out the net worth of your business. accounting applies the concepts of debits and credits to your assets, equity, and liabilities. a combination of these 3 items makes up the common sense formula for basic accounting: liabilities are what your business owes. Quickbooks online uses double entry accounting, which means each transaction or event changes two or more accounts in the ledger. each of these changes involves a debit and a credit applied to one or more accounts. for most transactions, the entries of debits and credits are handled by quickbooks online. A debit, sometimes abbreviated as dr., is an entry that is recorded on the left side of the accounting ledger or t account. conversely, a credit or cr. is an entry on the right side of the ledger. this right side, left side idea stems from the accounting equation where debits always have to equal credits in order to balance the mathematically. Debits are always entered on the left side of a journal entry. credits: a credit is an accounting transaction that increases a liability account such as loans payable, or an equity account such as.

Accounting Debit Vs Credit Examples Guide Quickbooks A debit, sometimes abbreviated as dr., is an entry that is recorded on the left side of the accounting ledger or t account. conversely, a credit or cr. is an entry on the right side of the ledger. this right side, left side idea stems from the accounting equation where debits always have to equal credits in order to balance the mathematically. Debits are always entered on the left side of a journal entry. credits: a credit is an accounting transaction that increases a liability account such as loans payable, or an equity account such as. Debit cash $500. credit sales $500. this is saying increase sales by $500 which is a revenue account since a product or service was sold. additionally, increase the cash account for the same amount since cash was collected. the cash account is increased with a debit since it is an asset account. That’s where debits and credits come in. when money flows into a bucket, we record that as a debit (sometimes accountants will abbreviate this to just “dr.”) for example, if you deposited $300 in cash into your business bank account: an accountant would say we are “debiting” the cash bucket by $300, and would enter the following line.

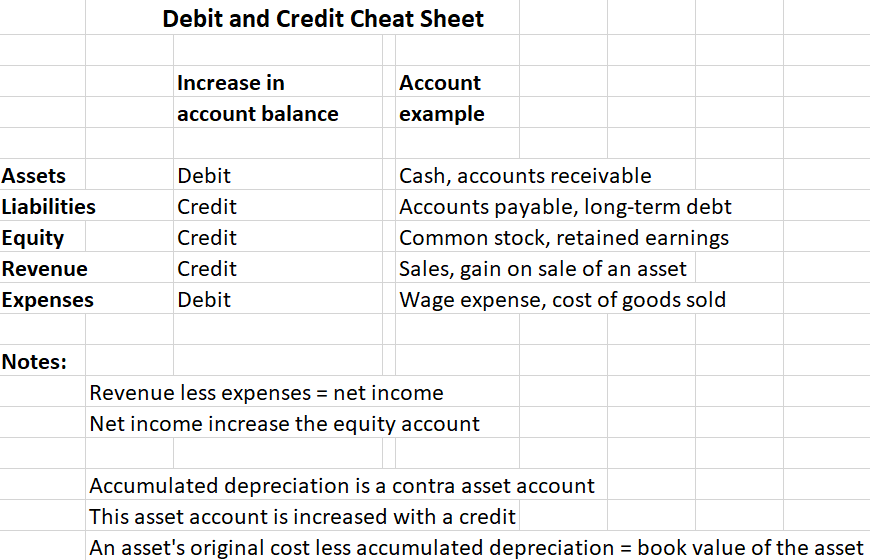

Debits And Credit Cheat Sheet Quick Books Accounting Accounting Debit cash $500. credit sales $500. this is saying increase sales by $500 which is a revenue account since a product or service was sold. additionally, increase the cash account for the same amount since cash was collected. the cash account is increased with a debit since it is an asset account. That’s where debits and credits come in. when money flows into a bucket, we record that as a debit (sometimes accountants will abbreviate this to just “dr.”) for example, if you deposited $300 in cash into your business bank account: an accountant would say we are “debiting” the cash bucket by $300, and would enter the following line.

Learn Debits And Credits Using Quickbooks Youtube

Comments are closed.