Advisorsavvy Surviving Inflation Top 7 Tips

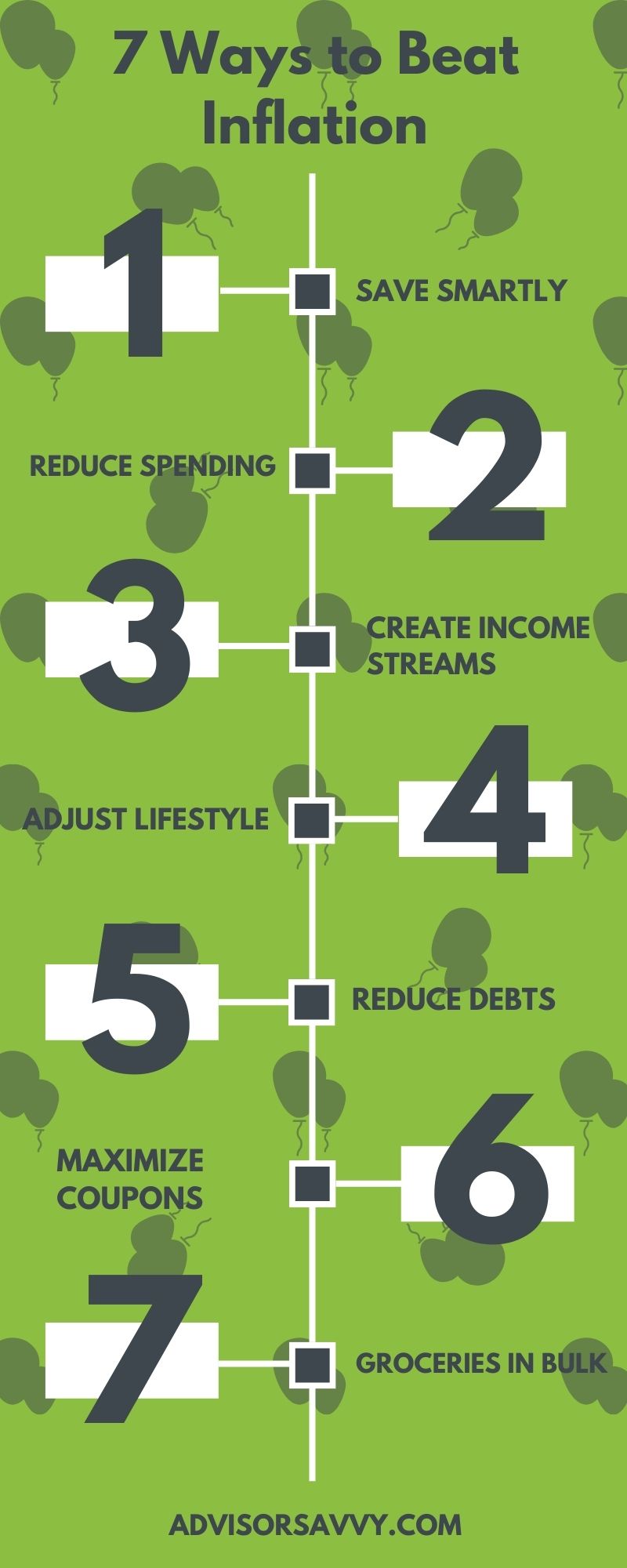

Advisorsavvy Surviving Inflation Top 7 Tips When things cost more than they used to, you lose buying power and have to be choosier about your expenditures. 3. create more income streams. one of the many things inflation brings is that you spend more money than you used to. therefore, planning how to survive inflation should include new ways to make more money. Inflation has been a hot topic in canada recently – and for good reason. at the end of 2022, inflation reached a peak of 6.3%. currently, it is about 5.2%, which means it has dropped about a full percentage point. for reference, inflation was in the normal range of 1% to 3% before the pandemic.

Advisorsavvy Surviving Inflation Top 7 Tips We hope the other tips on how to survive a recession were helpful. but if you find yourself with more questions than answers, a financial advisor can help. complete this quick questionnaire to be matched with a financial advisor who can help you prepare for a recession! read more: surviving inflation: top 7 tips. Consider reducing your speed by 5 to 10 miles per hour when you drive. doing so can improve your fuel economy by as much as 14%. also, turn off your car while waiting in the school pick up line. an idling car can use up to a half gallon of gas per hour! 5. pay off your debt. Here are five ways to take the sting out of the rising cost of living. 1. seek out cheaper substitutes. the cpi represents a basket of consumer goods, but not every good in the basket rises at the same time. food, for example, rose 4.6 percent the past 12 months. Insurance. inflation fighting tip: review those insurance bills. spend a day analyzing your insurance premiums. “you can lower your insurance premiums by 5% to 20% by bundling services.

Advisorsavvy Surviving Inflation Top 7 Tips Here are five ways to take the sting out of the rising cost of living. 1. seek out cheaper substitutes. the cpi represents a basket of consumer goods, but not every good in the basket rises at the same time. food, for example, rose 4.6 percent the past 12 months. Insurance. inflation fighting tip: review those insurance bills. spend a day analyzing your insurance premiums. “you can lower your insurance premiums by 5% to 20% by bundling services. Rethinking bond investments. budgeting and expense management. reevaluating large expenses. targeting small cost cuts. investment strategies to combat inflation. diversifying investment portfolio. considering real estate and commodities. analyzing stocks and bonds. incorporating systematic withdrawal plans. High inflation 40 years ago led to the birth of generic groceries — products with stark black and white labels that saved consumers money by forgoing fancy packaging.

Advisorsavvy Understanding The Various Types Of Inflation A Rethinking bond investments. budgeting and expense management. reevaluating large expenses. targeting small cost cuts. investment strategies to combat inflation. diversifying investment portfolio. considering real estate and commodities. analyzing stocks and bonds. incorporating systematic withdrawal plans. High inflation 40 years ago led to the birth of generic groceries — products with stark black and white labels that saved consumers money by forgoing fancy packaging.

Comments are closed.