Amd Booming Business Nasdaq Amd Seeking Alpha

Amd Booming Business Nasdaq Amd Seeking Alpha Amd forecast another booming year in 2021. the chip company guided to 37% revenue growth, but the 2h number is conservative. combined with xilinx, amd could generate a $3 eps in 2022. this idea. In the past few months, advanced micro devices, inc. (nasdaq:amd) (other than from seeking alpha). i have no business relationship with any company whose stock is mentioned in this article.

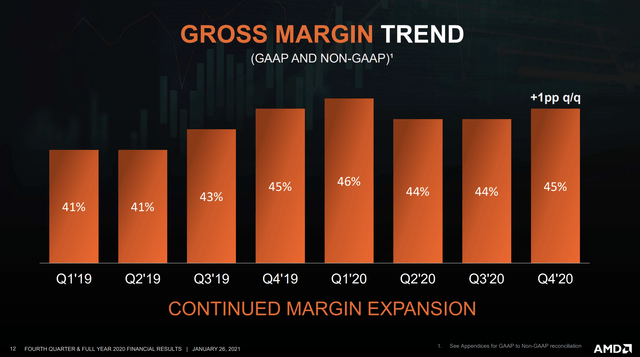

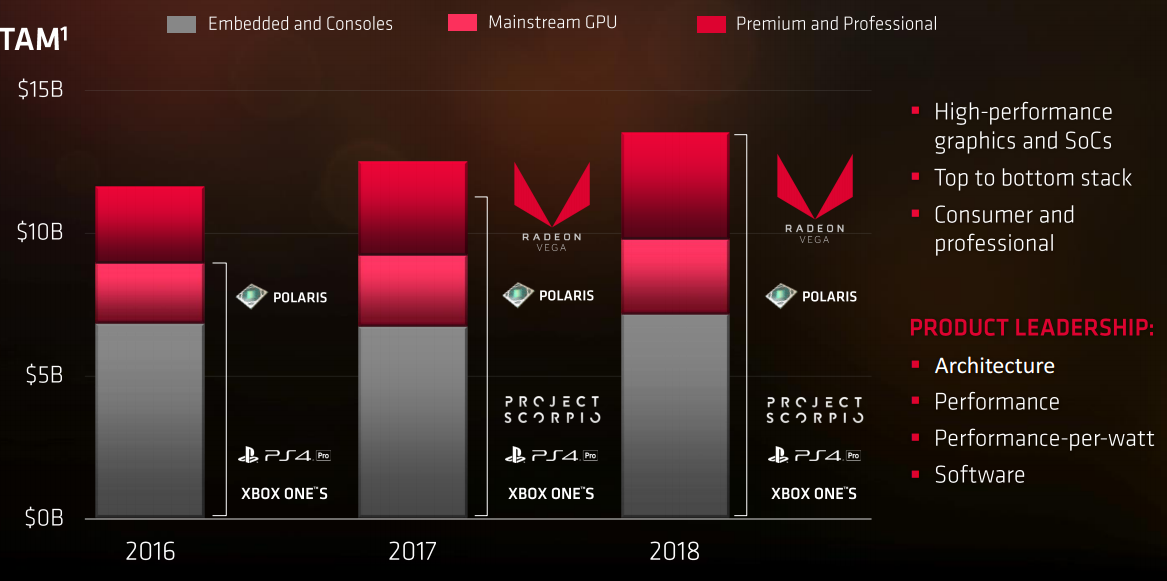

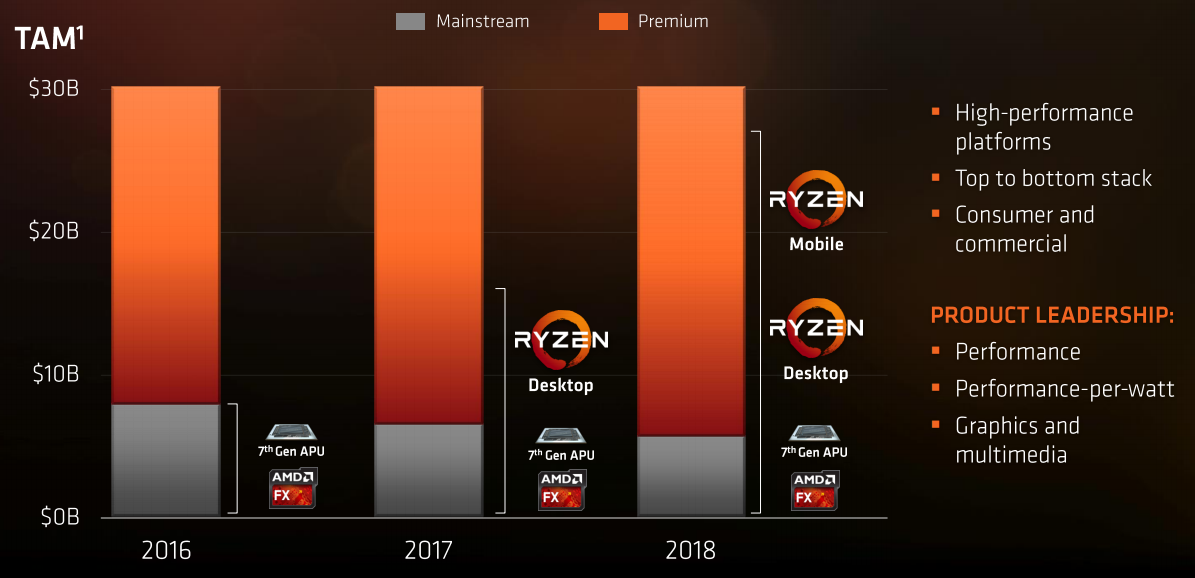

Amd Booming Business Nasdaq Amd Seeking Alpha Advanced micro devices (nasdaq: amd) (neoe: amd:ca) has been racking up wins lately as the company secured a major design win to supply apus to sony's (sony) upcoming playstation 6 console, has. Amd outlook fy 2022. amd’s outlook for q2’22 calls for $6.5b in revenues $200m and gross margins of 54%. for fy 2022, amd expects $26.3b in revenues, indicating 60% year over year growth. As alluded to, amd has seen weakness in other parts of its business, lowering the overall growth rate. while client revenue of $1.5b was up 49% and 9% qoq, continuing its recovery, gaming revenue. Advanced micro devices, inc. (nasdaq: amd) has performed well over the last year, but it has fallen over 20% since its march peak, despite posting strong q2 earnings. the company is unloved by the.

Amd Business Model Highlights And Implications Nasdaq Amd Seeking A As alluded to, amd has seen weakness in other parts of its business, lowering the overall growth rate. while client revenue of $1.5b was up 49% and 9% qoq, continuing its recovery, gaming revenue. Advanced micro devices, inc. (nasdaq: amd) has performed well over the last year, but it has fallen over 20% since its march peak, despite posting strong q2 earnings. the company is unloved by the. Justin sullivan getty images news. after another booming quarter, advanced micro devices (nasdaq:amd) should finally trade back above $100 for good.the market sold off the chip company on fears of. Advanced micro devices (nasdaq:amd) has been hard at work to catch up to nvda and establish a meaningful market share of their own. this week, amd reported q2 earnings which reflected significant.

Amd Business Model Highlights And Implications Advanced Micro Devices Justin sullivan getty images news. after another booming quarter, advanced micro devices (nasdaq:amd) should finally trade back above $100 for good.the market sold off the chip company on fears of. Advanced micro devices (nasdaq:amd) has been hard at work to catch up to nvda and establish a meaningful market share of their own. this week, amd reported q2 earnings which reflected significant.

Comments are closed.