Americans Are In Heavy Credit Card Debt

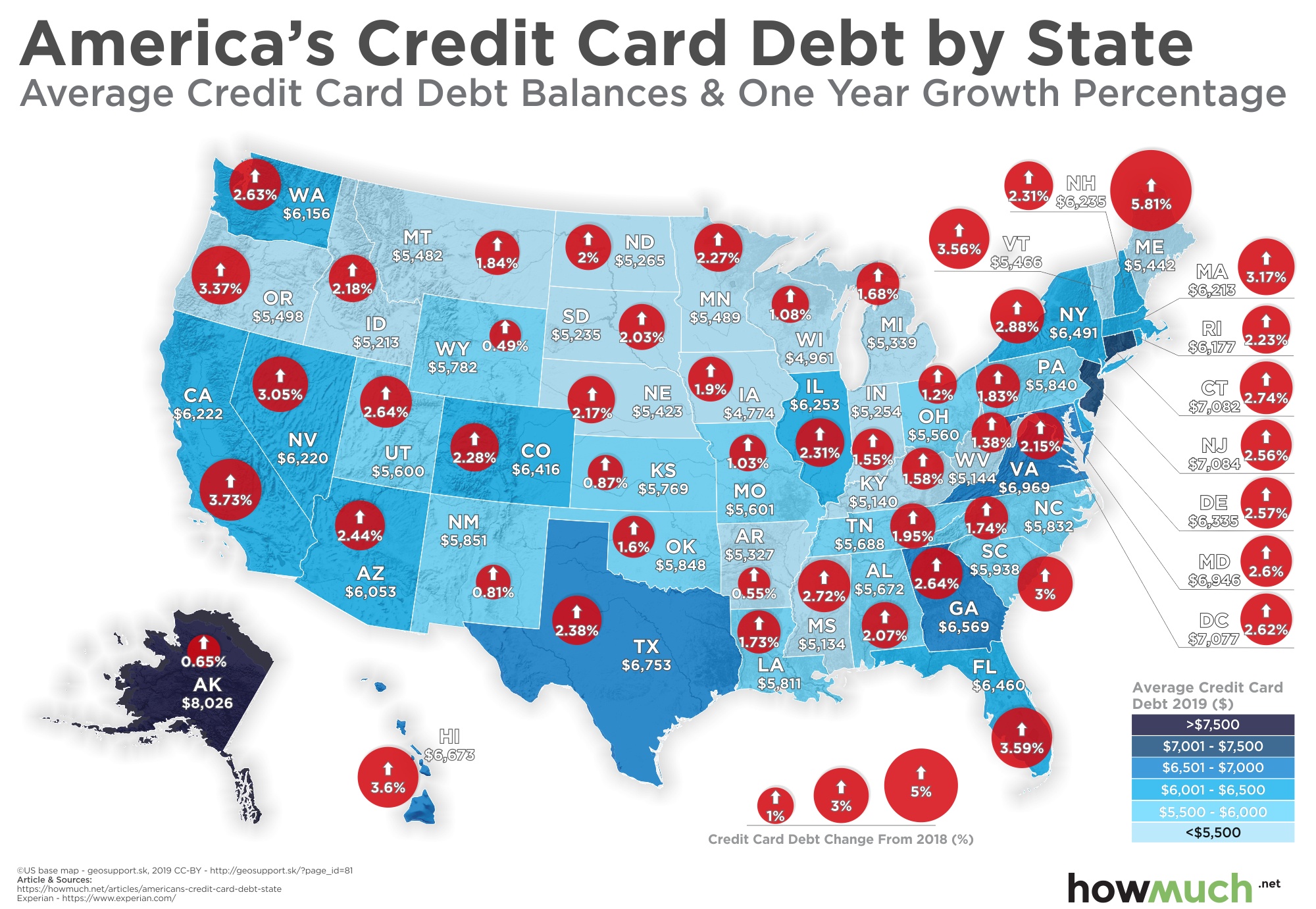

Visualizing The Average Credit Card Debt In America Across the country, many americans are struggling with mounting credit card debt. the most recent data from the federal reserve reveals that credit card debt sits at $1.14 trillion—yes, that’s. U.s. consumers collectively owe a record $1.14 trillion in credit card debt, figures released tuesday by the federal reserve bank of new york show. that's $27 billion more than the $1.13 trillion.

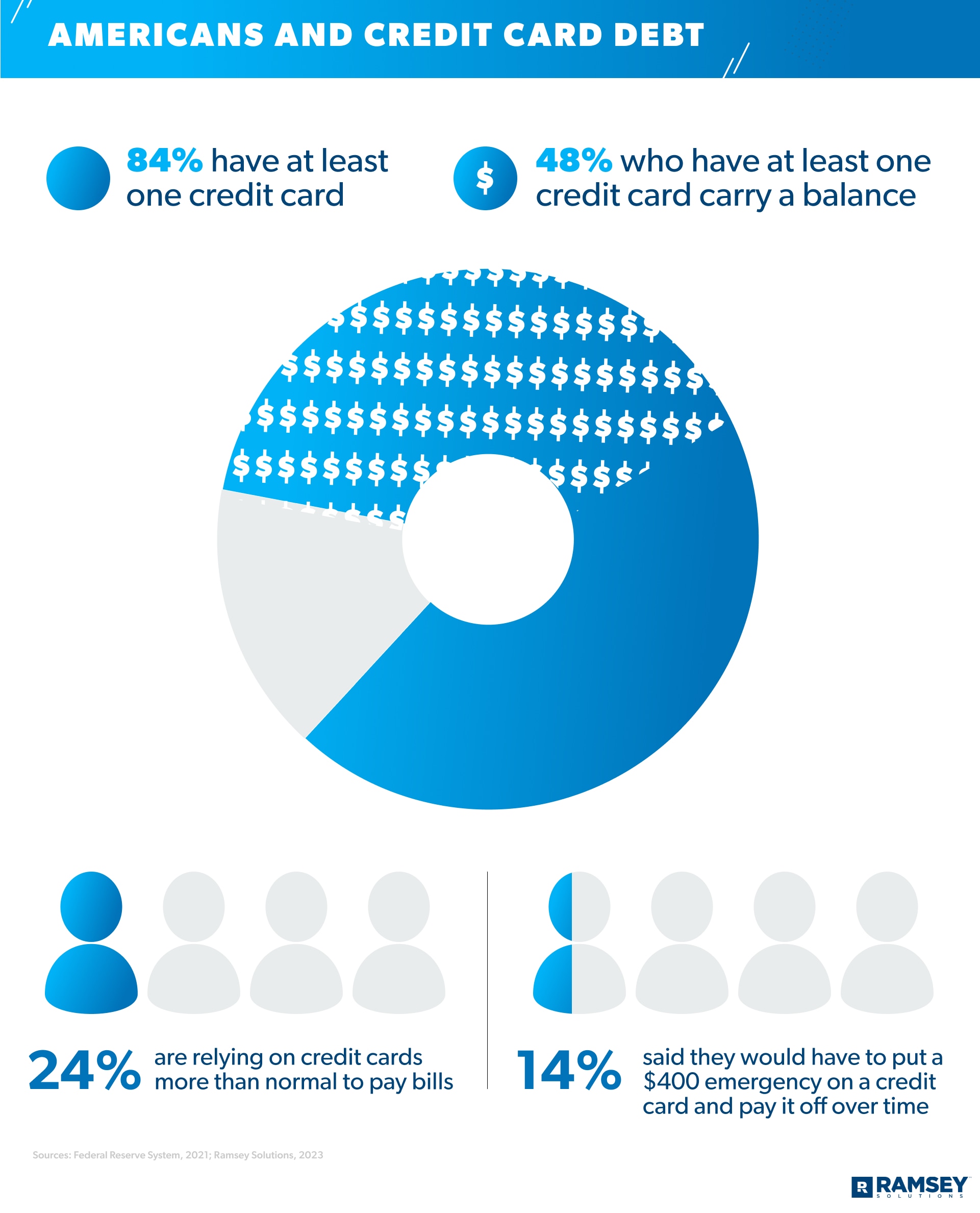

Chart Americans Far From Maxed Out On Credit Card Debt Statista Credit card debt, the amount owed by all americans on their credit cards, rose to a record $1.13 trillion at the end of last year, the federal reserve bank of new york reported tuesday card. About 55% of americans live paycheck to paycheck, 36% have more credit card debt than emergency savings and 22% have no emergency fund at all. many people lean into credit cards for emergency. Experian data shows generation z (25 years or younger) experienced the greatest year over year percentage increase in credit card debt of any age demographic (just above 25% from 2021 2022 and. Credit card debt hit a record $1.13 trillion at the end of 2023, while delinquencies have surged more than 50% from a year ago. particularly among younger and lower income americans. total.

Average Credit Card Debt In America Ramsey Experian data shows generation z (25 years or younger) experienced the greatest year over year percentage increase in credit card debt of any age demographic (just above 25% from 2021 2022 and. Credit card debt hit a record $1.13 trillion at the end of 2023, while delinquencies have surged more than 50% from a year ago. particularly among younger and lower income americans. total. Getty images. americans collectively owed $1.14 trillion in credit card debt as of the second quarter of 2024, according to the federal reserve. this is up 5.8% year over year and reflects a $27. To put this into perspective, the average u.s. household with credit card debt has a balance of around $6,065. in november 2021, the interest rate on this debt was around 15%, meaning that the average indebted household was paying $76 per month in credit card interest. by november 2023, the interest rate had risen to around 21%.

Comments are closed.