Are U S Consumers Getting Exhausted By Debt See It Market

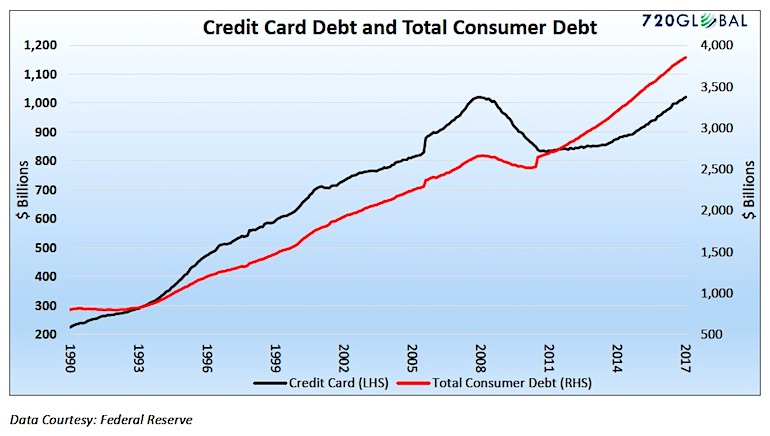

Are U S Consumers Getting Exhausted By Debt Page 2 Of 2 Seeођ Barring negative interest rates, debt service costs will be an insurmountable burden by 2020. however, if the debt trajectory slows as it did in 2008 that too will bring about painful consequences. Credit card debt recently hit a record high at $1.02 trillion, and total consumer credit, which includes auto and education loans and excludes mortgages, is fast approaching $4 trillion.

Are U S Consumers Getting Exhausted By Debt See It Market While the large stock of excess savings that was accumulated in 2020 and 2021 played a role in supporting the overall financial health of american households, it was only one of many possible factors that helped consumers maintain robust spending levels. for example, the u.s. labor market has been very strong over the past few years. And it still leaves consumers with record levels of credit card debt. another report from the federal reserve bank of new york showed total household debt rose by $212 billion to a total of $17.5. Meanwhile, u.s. household debt has accelerated its growth since 2021, now increasing by more than 6% annually, up from around 3% in previous years. 2023 could see a further escalation of this. U.s. credit card debt briefly fell during the pandemic but has climbed since 2022 federal reserve bank of new york consumer credit panel the surge coincided with a rapid rise in prices, however.

Comments are closed.