As A Federal Employee How Much Money Can I Put Into My Roth Plan

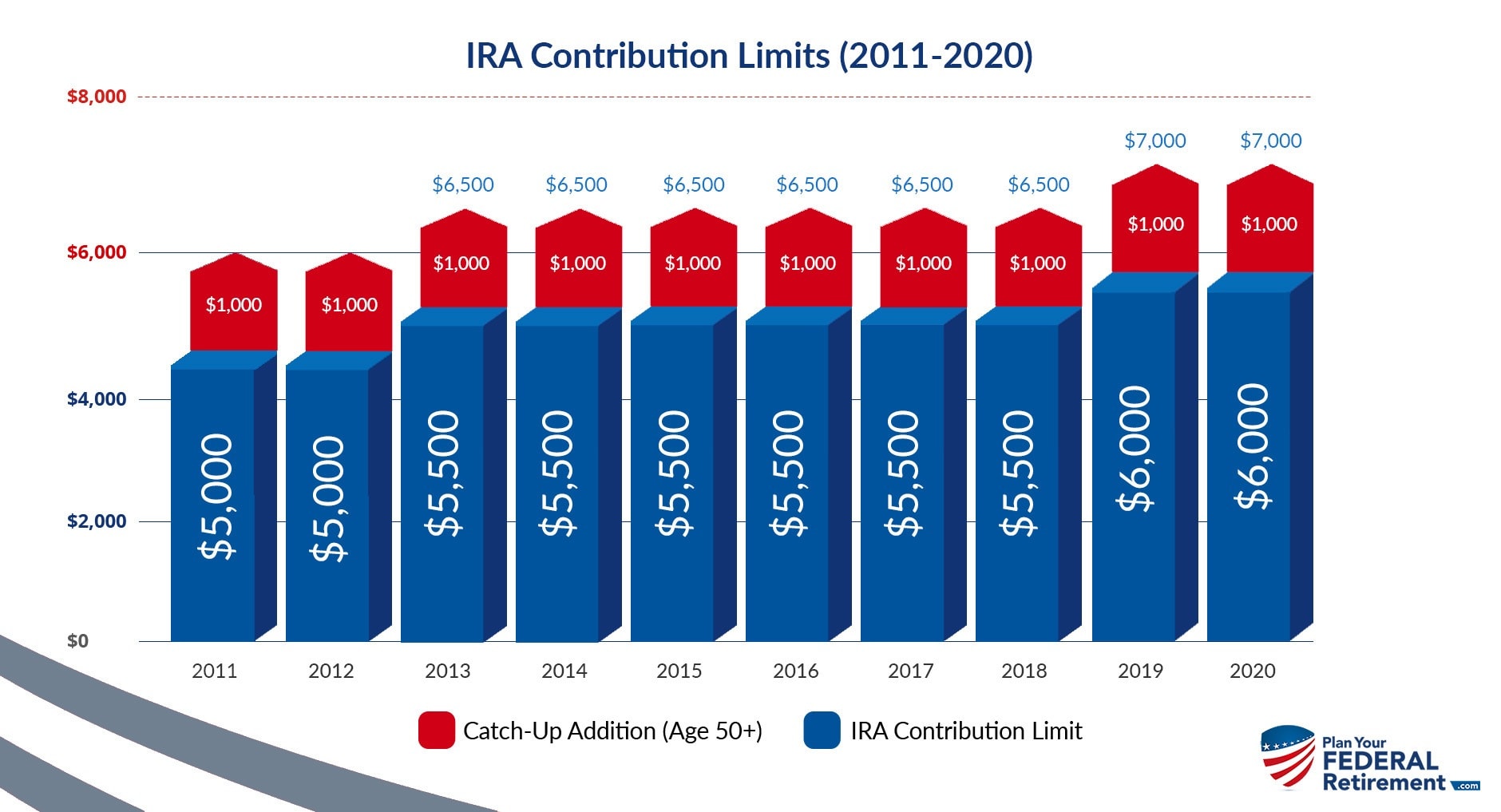

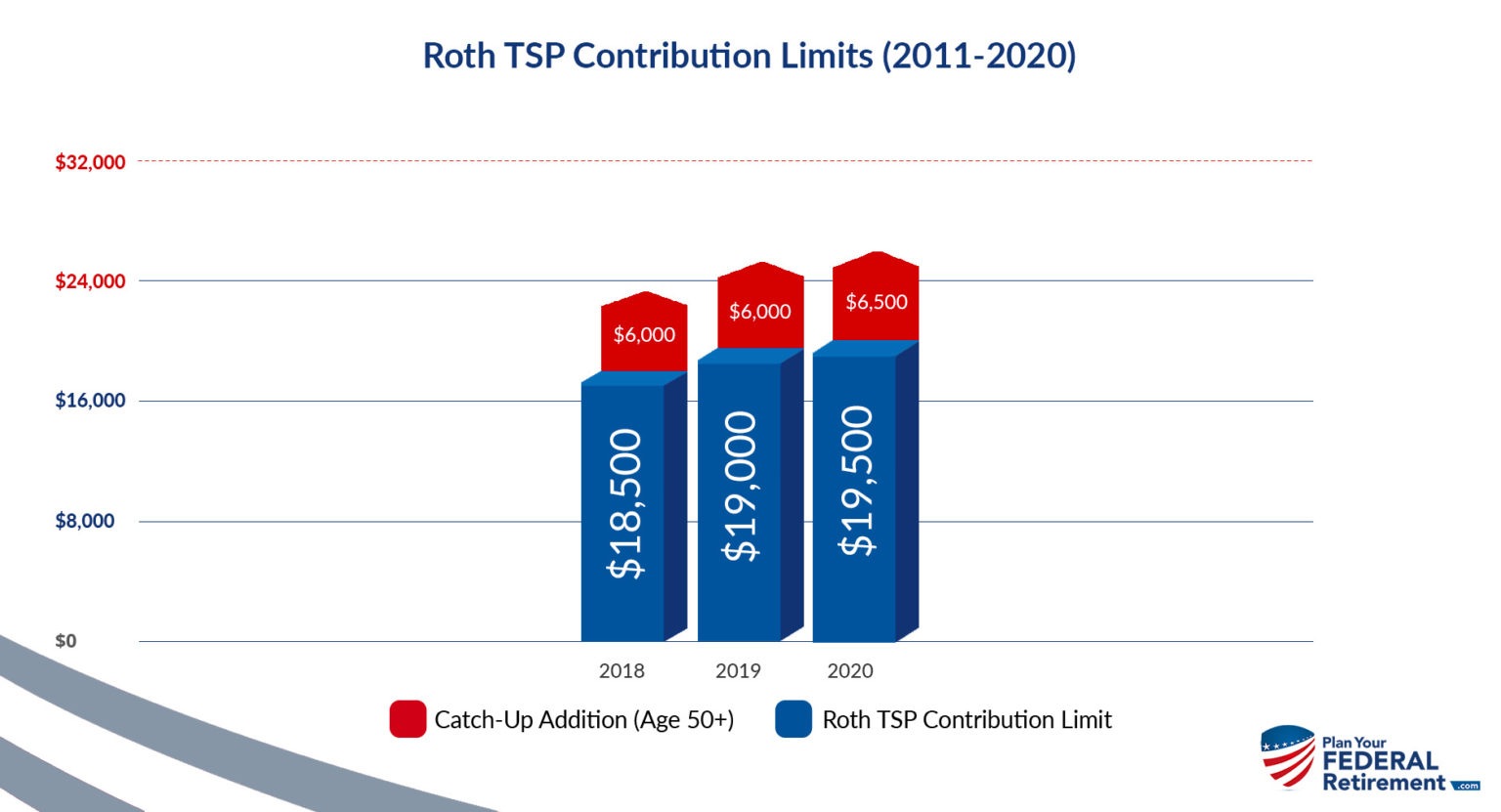

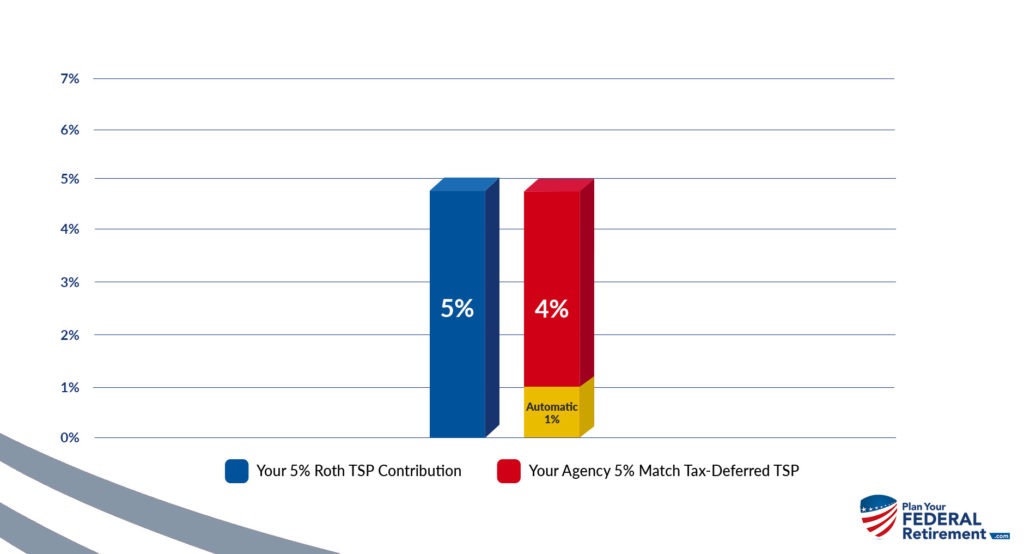

As A Federal Employee How Much Money Can I Put Into My Roth Plan The thrift savings plan (tsp) is a retirement savings and investment plan for federal employees and members of the uniformed services, including the ready reserve. it was established by congress in the federal employees’ retirement system act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans. However, your tsp contribution limits are $19,000.00 and an additional $6,000.00 catch up contribution for those ages 50 . federal employees could put up to $25,000.00 into their tsp as roth contributions if they are ages 50 in the year 2019. a roth ira and a tsp roth contribution are two entirely different retirement vehicles with different.

As A Federal Employee How Much Money Can I Put Into My Roth Plan The thrift savings plan (tsp) is a retirement savings and investment plan for federal employees and members of the uniformed services, including the ready reserve. it was established by congress in the federal employees’ retirement system act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans. The thrift savings plan (tsp) is a retirement savings and investment plan for federal employees and members of the uniformed services, including the ready reserve. it was established by congress in the federal employees’ retirement system act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans. Contributions to a roth ira can be withdrawn at any time for any reason, and tax and penalty free. this is unlike traditional deductible iras in which pre age 59.5 withdrawals are subject to federal and state income taxes and a 10 percent early withdrawal penalty. despite all of these advantages, only a small percentage of federal employees. Answer 1. yes and no. the roth tsp and traditional tsp have a shared contribution limit and the traditional ira and roth ira have a shared contribution limit. for example, in 2021 the shared limit (without catch up contributions) is $19,500 for the roth and traditional tsp. so you can split it up any way you’d like but when you add up how.

As A Federal Employee How Much Money Can I Put Into My Roth Plan Contributions to a roth ira can be withdrawn at any time for any reason, and tax and penalty free. this is unlike traditional deductible iras in which pre age 59.5 withdrawals are subject to federal and state income taxes and a 10 percent early withdrawal penalty. despite all of these advantages, only a small percentage of federal employees. Answer 1. yes and no. the roth tsp and traditional tsp have a shared contribution limit and the traditional ira and roth ira have a shared contribution limit. for example, in 2021 the shared limit (without catch up contributions) is $19,500 for the roth and traditional tsp. so you can split it up any way you’d like but when you add up how. For 2023, the annual limit is $22,500 or $30,000 if you are age 50 or older. so if you are 48 you can put up to $22,500 into your tsp every year and you can split that $22,500 however you’d like between the traditional and roth. how much money can i put in my tsp between the traditional and roth? for 2023, the annual limit is $22,500 or. Maximum tsp contribution limit in 2024. the contribution limit for employees who participate in 401 (k), 403 (b), and most 457 plans, as well as the federal government’s thrift savings plan is increased to $23,000, up from $22,500. the catch up contribution limit for employees aged 50 and over who participate in 401 (k), 403 (b), and most 457.

As A Federal Employee How Much Money Can I Put Into My Roth Plan For 2023, the annual limit is $22,500 or $30,000 if you are age 50 or older. so if you are 48 you can put up to $22,500 into your tsp every year and you can split that $22,500 however you’d like between the traditional and roth. how much money can i put in my tsp between the traditional and roth? for 2023, the annual limit is $22,500 or. Maximum tsp contribution limit in 2024. the contribution limit for employees who participate in 401 (k), 403 (b), and most 457 plans, as well as the federal government’s thrift savings plan is increased to $23,000, up from $22,500. the catch up contribution limit for employees aged 50 and over who participate in 401 (k), 403 (b), and most 457.

How Much Can I Contribute To My Roth Ira 2023 Inflation Protection

Comments are closed.