Avoid The Buy Now Pay Later Debt Trap

Avoid The Buy Now Pay Later Debt Trap Consumers’ use of “buy now, pay later” or “pay in 4” services—short term loans for individual purchases, usually offered online at the point of sale—is exploding: twenty eight. Here are seven pitfalls to keep in mind with buy now, pay later services, along with tips to avoid a debt trap. 7 dangers of buy now, pay later. it may be convenient to delay paying off a purchase up front, but be wary of these risks that come with using bnpl. 1. buy now, pay later isn’t building your credit — but it could hurt your credit.

Avoid The Buy Now Pay Later Debt Trap Part 3: saving and delaying gratification. saving money and delaying gratification are key strategies in avoiding the “buy now, pay later” debt trap. instead of giving in to impulsive buying, consider saving a portion of your income for future purchases. by saving up for a purchase, you will not only avoid accumulating debt but also gain a. A recently released federal reserve report on the economic well being of american households found that 14 percent of adults used buy now, pay later in the prior 12 months, up two percentage. Consumers’ use of “buy now, pay later” or “pay in 4” services—short term loans for individual purchases, usually offered online at the point of sale—is exploding: twenty eight. When your buy now, pay later bills come due, consider these tactics as you strategize your way out of debt. updated may 31, 2023 2:10 p.m. pdt · 3 min read written by melissa lambarena.

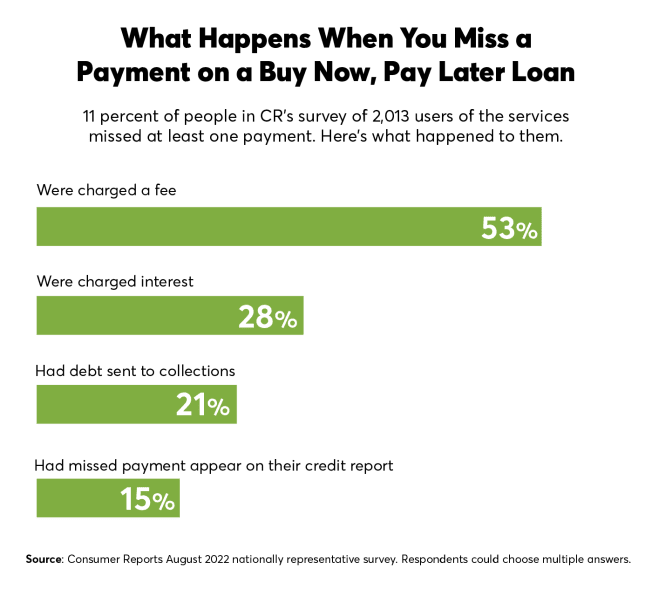

Buy Now Pay Later The True Cost Of Debt What First Time Borrowers Consumers’ use of “buy now, pay later” or “pay in 4” services—short term loans for individual purchases, usually offered online at the point of sale—is exploding: twenty eight. When your buy now, pay later bills come due, consider these tactics as you strategize your way out of debt. updated may 31, 2023 2:10 p.m. pdt · 3 min read written by melissa lambarena. This can quickly spiral into debt if you’re juggling multiple bnpl plans at the same time. plus, missing a payment can lead to hefty fees and interest charges, wiping out any of your initial savings. how to avoid the trap. before using a bnpl service, ask yourself if you need the item and whether you can afford to pay for it in full. Here’s a breakdown of what they offer for buy now, pay later: option 1: pay in 4. split the cost of your purchase into four interest free payments with 25% down and the rest paid every two weeks. option 2: pay in 30 days. get your stuff right away and have 30 days to pay up. option 3: 6–24 month financing.

Avoid The Tricks And Traps Of Buy Now Pay Later Loans Consumer R This can quickly spiral into debt if you’re juggling multiple bnpl plans at the same time. plus, missing a payment can lead to hefty fees and interest charges, wiping out any of your initial savings. how to avoid the trap. before using a bnpl service, ask yourself if you need the item and whether you can afford to pay for it in full. Here’s a breakdown of what they offer for buy now, pay later: option 1: pay in 4. split the cost of your purchase into four interest free payments with 25% down and the rest paid every two weeks. option 2: pay in 30 days. get your stuff right away and have 30 days to pay up. option 3: 6–24 month financing.

How To Get Away From The вђњbuy Now Pay Laterвђќ Debt Trap Credi

Comments are closed.