Balance Sheet Equation Explained

Balance Sheet Accounts Examples And Equation Financial Falconet The balance sheet is based on the fundamental equation: assets = liabilities equity. image: cfi’s financial analysis course. as such, the balance sheet is divided into two sides (or sections). the left side of the balance sheet outlines all of a company’s assets. on the right side, the balance sheet outlines the company’s liabilities. The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out: \text {assets} = \text {liabilities.

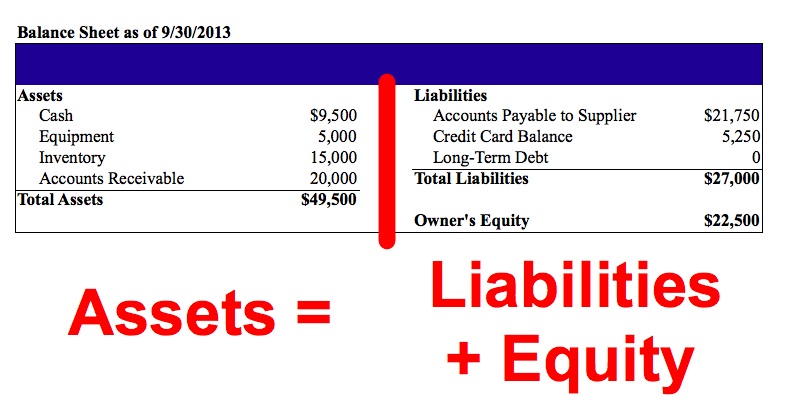

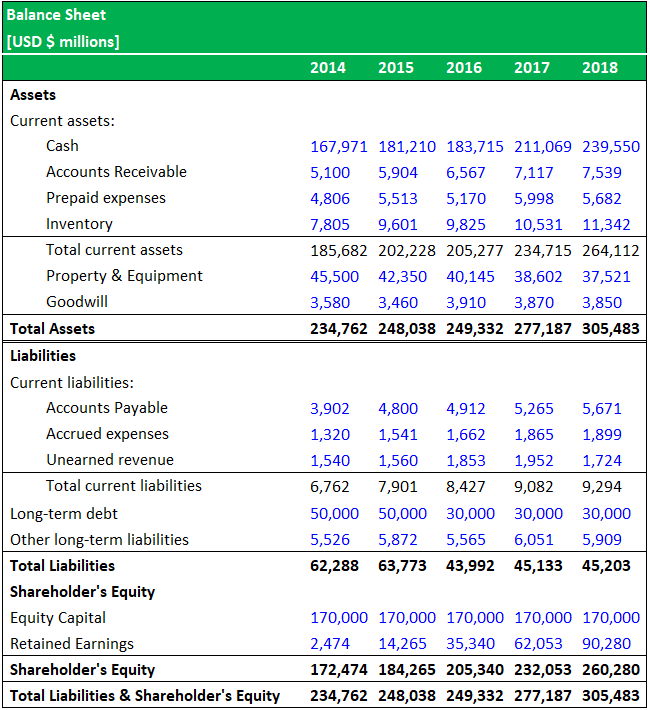

How To Read A Balance Sheet The Non Boring Version While this equation is the most common formula for balance sheets, it isn’t the only way of organizing the information. here are other equations you may encounter: owners’ equity = assets liabilities. liabilities = assets owners’ equity. a balance sheet should always balance. assets must always equal liabilities plus owners’ equity. Contents [show] in its most basic form, the balance sheet equation shows what a company owns, what a company owes, and what stake the owners have in the business. the equation starts off with the company assets. these are the resources that the company has to use in the future like cash, accounts receivable, and fixed assets. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. balance sheets are useful tools for. The balance sheet equation follows the accounting equation, where assets are on one side, liabilities and shareholder’s equity are on the other side, and both sides balance out. assets = liabilities shareholder’s equity. according to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or.

Balance Sheet Equation Explained Tessshebaylo A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. balance sheets are useful tools for. The balance sheet equation follows the accounting equation, where assets are on one side, liabilities and shareholder’s equity are on the other side, and both sides balance out. assets = liabilities shareholder’s equity. according to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. it reports a company’s assets, liabilities, and equity at a single moment in time. you can think of it like a snapshot of what the business looked like on that day in time. Assets = liabilities shareholder’s equity. this equation sets the foundation of double entry accounting, also known as double entry bookkeeping, and highlights the structure of the balance sheet. double entry accounting is a system where every transaction affects at least two accounts. for example, an increase in an asset account can be.

Comments are closed.