Best Forex Strategy For Consistent Profits Rules Of Powerful Tradin

Best Forex Strategy For Consistent Profits Rules Of Powerfulо 7. the london breakout strategy. the basic principle of this strategy is that the start of the london session (8 am british summer time) is typically when the day's direction is set for many trading pairs. to trade this strategy, open the 1 hour chart of the pair you are interested in and mark the high and low for the day (from the opening of. 1. 50 pips a day forex strategy. one of the latest forex trading strategies to be used is the 50 pips a day forex strategy which leverages the early market move of certain highly liquid currency pairs. the gbpusd and eurusd currency pairs are some of the best currencies to trade using this particular strategy.

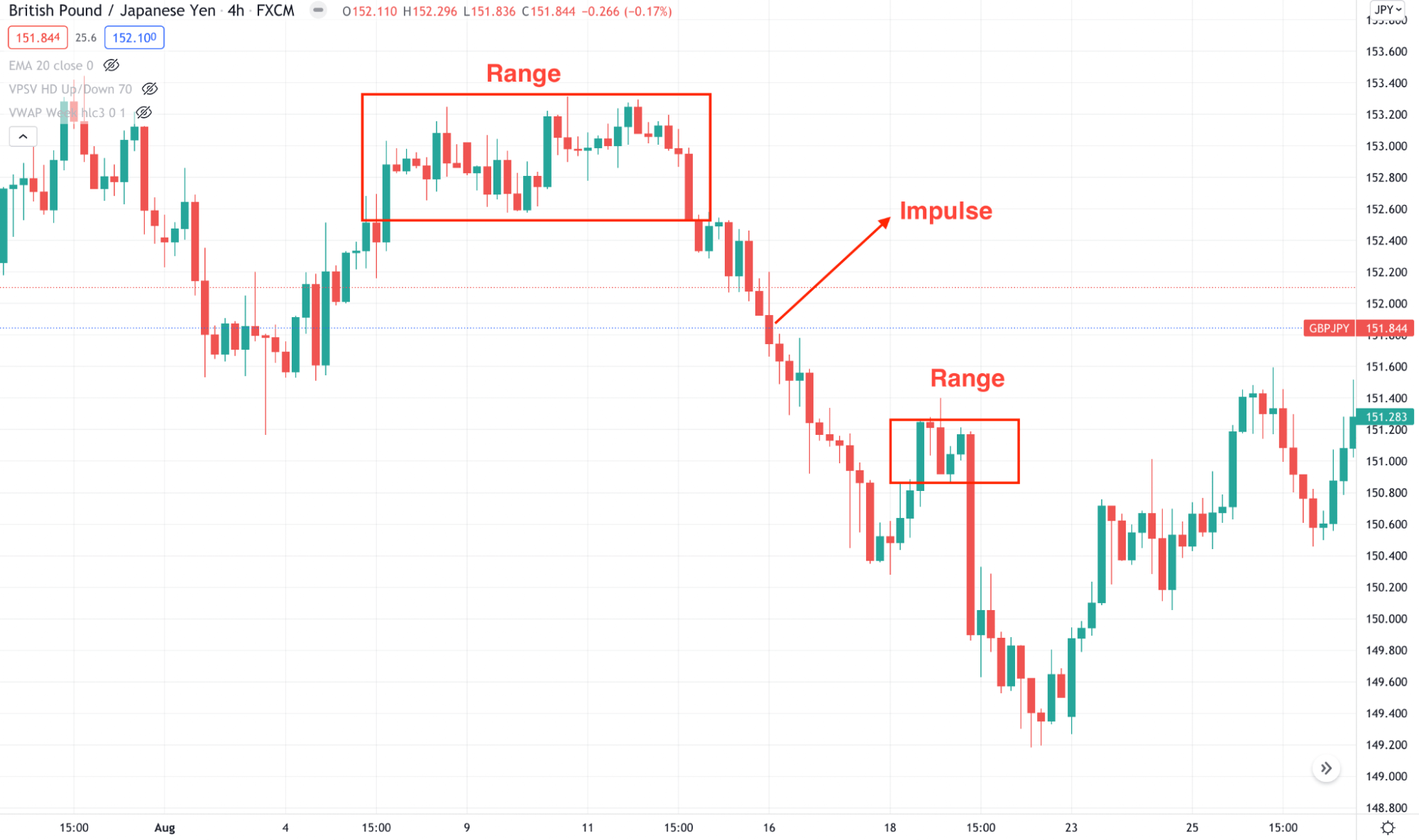

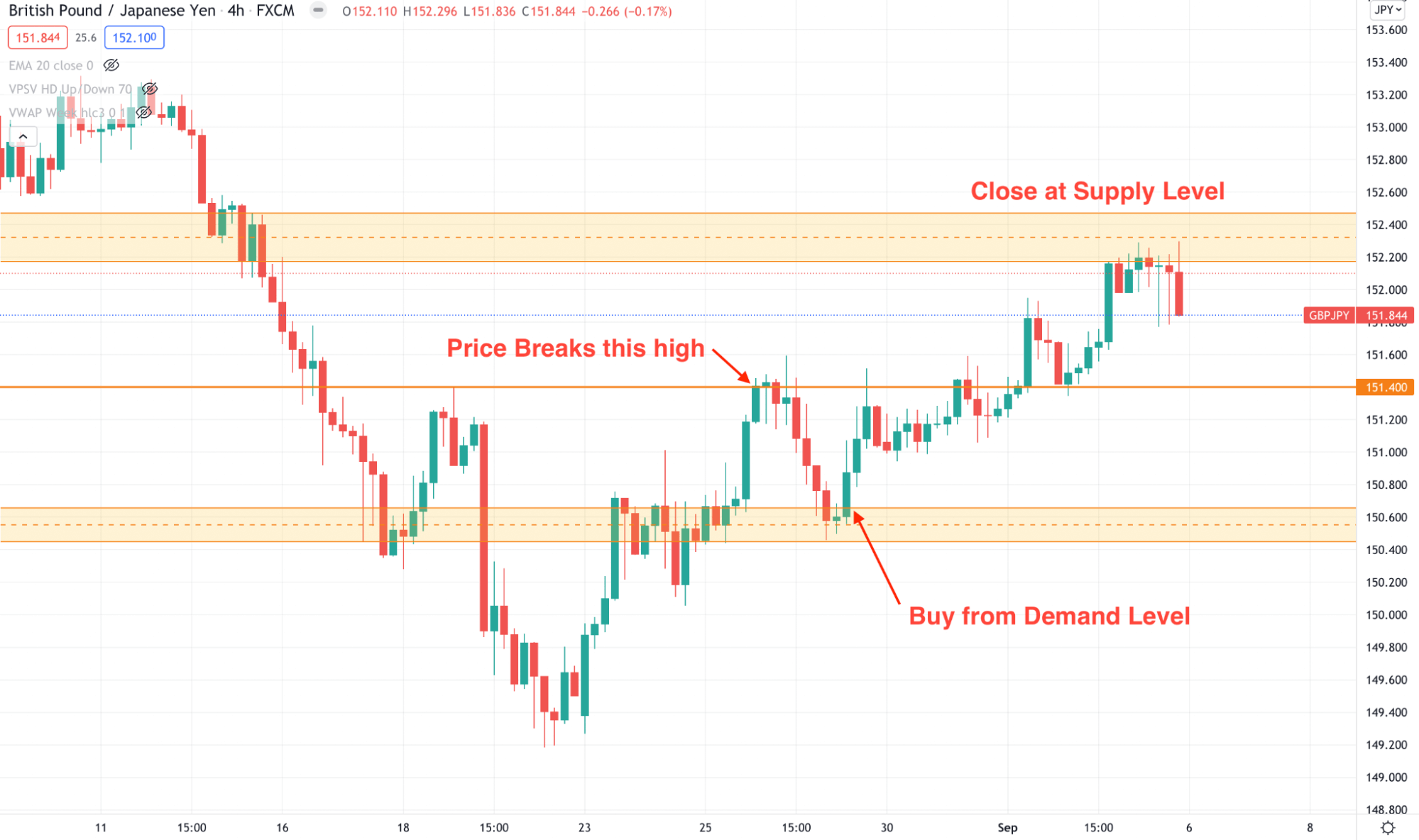

Best Forex Strategy For Consistent Profits Rules Of Powerfulо This strategy employs an array of technical analysis tools which include charts, trend lines, ranges denoting prices highs and lows, along with critical technical thresholds such as support and resistance levels in order to pinpoint potential opportunities for trading. 11. bollinger bands trading strategy. 5. the bollinger bounce strategy: volatility’s best friend. the bollinger bounce strategy is highly effective when markets are ranging. i recommend watching for a bullish candle bouncing off the lower bollinger band as a sign to go long, or a bearish one from the upper band to go short. 3. range trading: range trading is a strategy that is suitable for traders during periods of low volatility when the market is trading within a specific range. traders using this strategy identify strong support and resistance levels and take positions when the price reaches these levels. the goal is to profit from the price bouncing between. Choosing and testing a consistent trading strategy. setting a risk reward ratio to 1:2 or higher or have a good success rate. setting realistic profit targets. avoiding the use of high leverages. not investing more than 5% of trading capital on each trade. keeping a trade journal. doing regular fundamental research.

Comments are closed.