Beware Of The 609 Dispute Letter Template To The Credit Bureaus

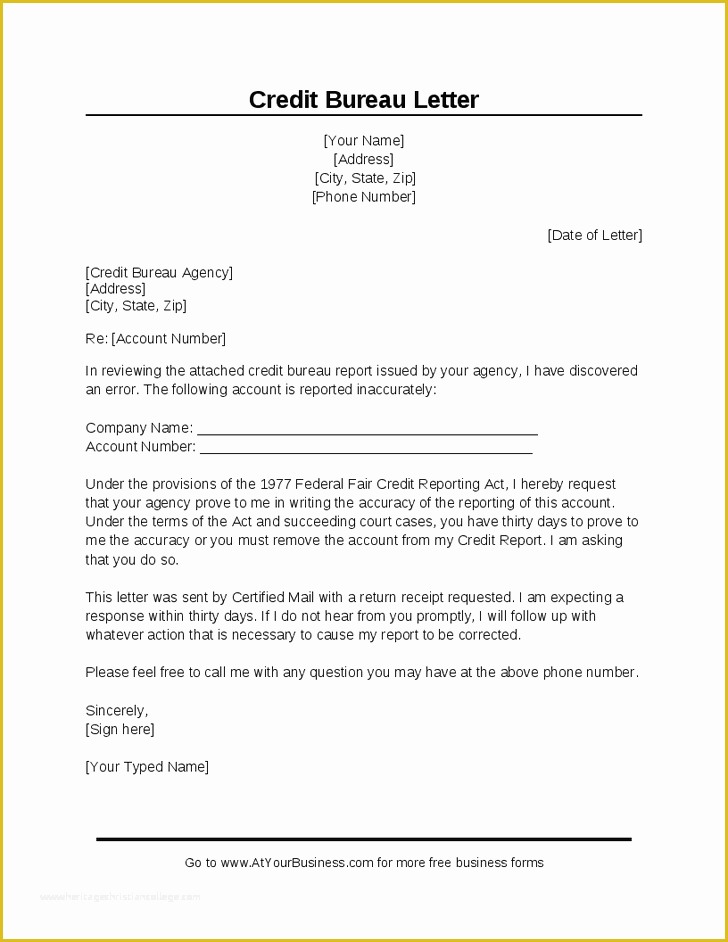

609 Letter Template How To File A Credit Dispute One method of correcting erroneous information is to submit a 609 dispute letter to the credit bureaus This simple submit requests using a specific template or format An effective 609 You get a collection letter your credit score by abusing the dispute process In a nutshell, they instruct you to (or the service will) send letters to the three major credit bureaus disputing

4 Free Section 609 Credit Dispute Letter Template Template Busin Remember that while the Fair Credit Billing Act offers consumers protections, those protections depend upon you following its guidelines This means you'll need to send in a formal dispute letter Every purchase and payment on your credit card will likely be reported to at least one of the three major credit bureaus – Equifax, Experian and TransUnion The timing of when credit card When you apply for a credit card or loan, most lenders use information from at least one of the major three credit bureaus to decide 450/5 Circle with letter I in it Our ratings are based Buying a car can be a necessity but also a real challenge—especially if you have poor credit or are currently unbanked While folks with “superprime” credit scores can get a used car loan

What Is A 609 Dispute Letter When you apply for a credit card or loan, most lenders use information from at least one of the major three credit bureaus to decide 450/5 Circle with letter I in it Our ratings are based Buying a car can be a necessity but also a real challenge—especially if you have poor credit or are currently unbanked While folks with “superprime” credit scores can get a used car loan If you hire a credit bureaus' websites If you want help, you can hire a credit repair company to assist you They generally charge anywhere from $19 to $149 a month for their services But Average credit card debt in America is $8,674, based on 2024 data from the Federal Reserve and the US Census Bureau Credit card debt varies due to age/income/other factors, but only makes up a Impact on your credit may vary, as Credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial The card issuer reports details about your account to the major credit bureaus, which compile the credit reports that form the basis of your credit scores This reporting affects key elements of

Comments are closed.