Biotechnology Industry Introduction Investmentbank

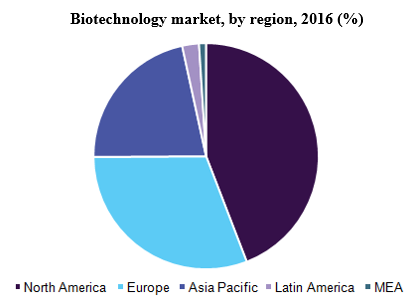

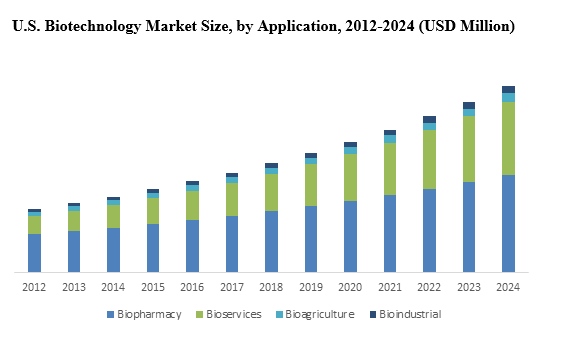

Biotechnology Industry Introduction Investmentbank Industry introduction. biotechnology, typically shortened to simply ‘biotech’, services markets such as agricultural, medical, environmental, and industrial. starting from humble beginnings, it became its own industry in the 1970s with the main purpose being to enhance the quality of human life. with biotech’s primary stake lying in the. The biotechnology report 2024 uses data from the discovery platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. the industry has seen a 1.95% growth in the last year, underscoring a steady advancement despite global economic challenges. with over 94000 companies in our database, the biotech.

Biotechnology Industry Introduction Investmentbank In recent years, biotech public markets have struggled to stage a meaningful comeback.the s&p biotechnology select industry index entered fourth quarter 2023 more than 50 percent lower than its peak in february 2021, and only 30 biotechs have undergone an ipo in the first three quarters of 2023 versus 114 ipos in 2021 (exhibit 1). 1 s&p capital iq, accessed october 2023. Basic statistic venture capital in u.s. and europe biotechnology industry 2015 2023 premium statistic biotechnology funding by national institutes for health 2013 2025. The level of competition is moderate and increasing in the biotechnology in the us industry in united states. expert industry market research on the biotechnology in the us (2014 2029). make better business decisions, faster with ibisworld's industry market research reports, statistics, analysis, data, trends and forecasts. Investment in next generation biotech platforms. from 2019 to 2021, vc companies invested more than $52 billion in therapeutic based biotech companies globally. two thirds of that went to start ups with platform technologies (exhibit 2). 2. vc investors appear focused on emerging technologies that can tailor treatments to individual patients.

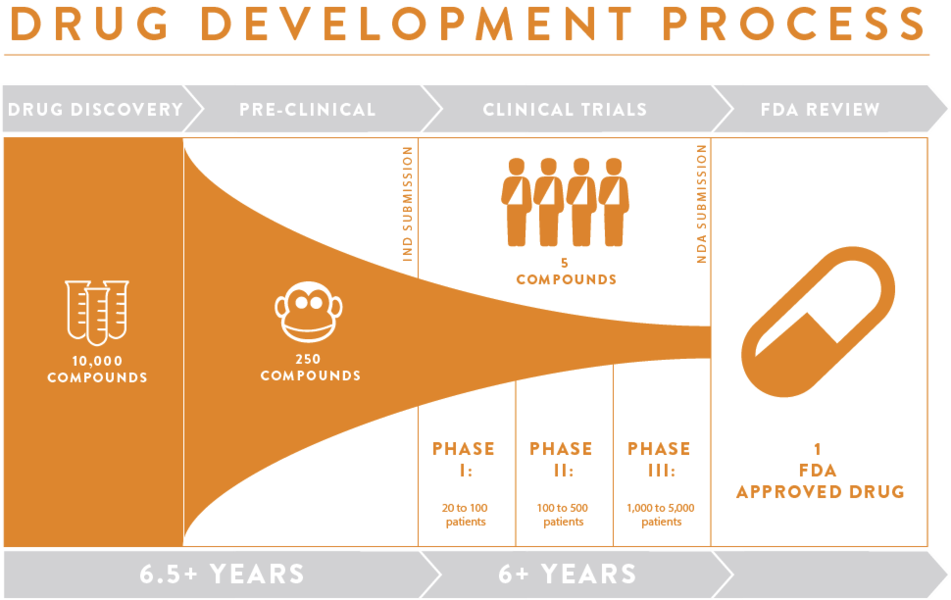

Biotechnology Industry Introduction Investmentbank The level of competition is moderate and increasing in the biotechnology in the us industry in united states. expert industry market research on the biotechnology in the us (2014 2029). make better business decisions, faster with ibisworld's industry market research reports, statistics, analysis, data, trends and forecasts. Investment in next generation biotech platforms. from 2019 to 2021, vc companies invested more than $52 billion in therapeutic based biotech companies globally. two thirds of that went to start ups with platform technologies (exhibit 2). 2. vc investors appear focused on emerging technologies that can tailor treatments to individual patients. Experts in the field believe that the biotech industry is poised for recovery in 2024, and one reason for that would be a favorable climate for m&a activity. a pwc report predicts the m&a deal totals could range from $225 billion to $275 billion. m&a will be among the trends that will influence the biotech market in 2024. From biotechnology to pharmaceuticals, medical devices to diagnostics—as you make history, we'll be with you. our bankers and specialists focus on solutions for life sciences companies at all stages—from startups to established businesses, pre clinical through commercialization. we have decades of experience in the sector and understand the.

Comments are closed.