Bull Flag Pattern How To Effectively Use This Classic Pattern To Profit

Bull Flag Chart Patterns The Complete Guide For Traders Learn how to effectively spot and then trade the classic bull flag pattern to profit. register for our free intensive trading webinar smbu mike#bu. Mastering the bull flag pattern: how to effectively profit from this classic. in this video for the trading community, learn how to effectively spot and then trade the classic bull flag pattern to profit. a proprietary trader from our firm shares in step by step detail how he used the bull flag technical pattern in qcom to make a winning trade.

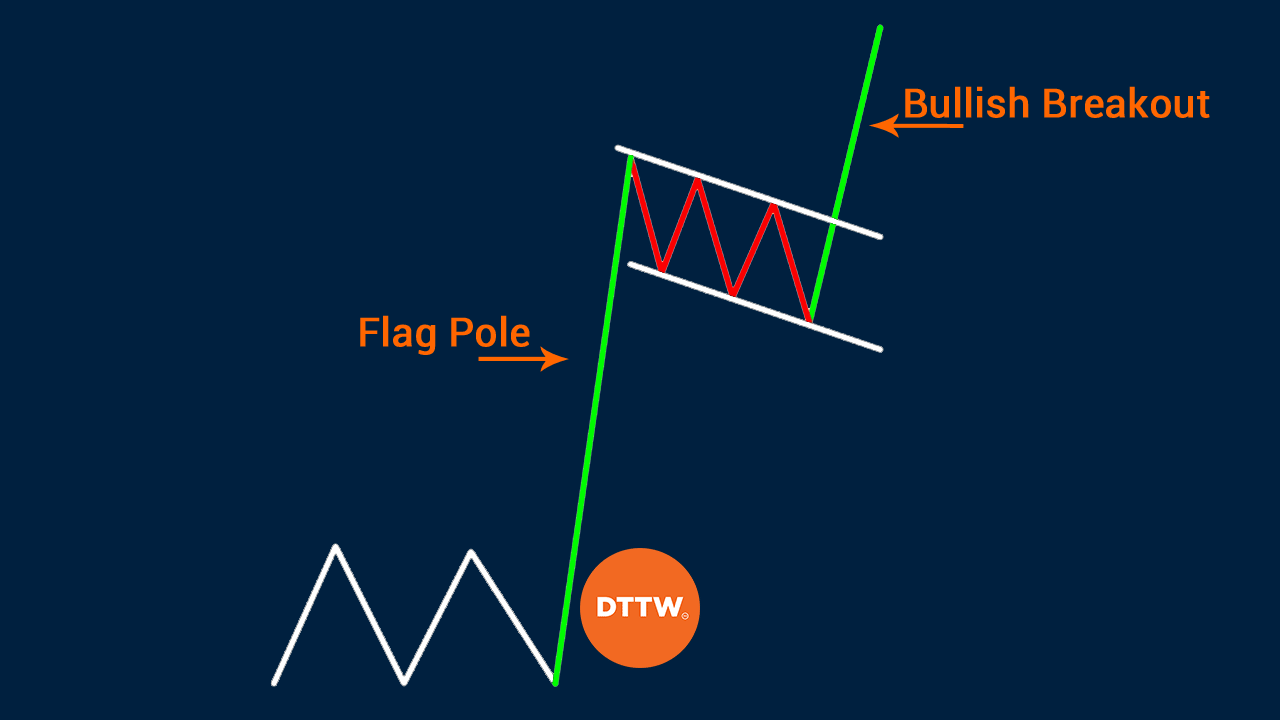

Bull Flag Chart Pattern Trading Strategies Warrior Trading Follow the steps below, and you can quickly integrate the bull flag into your financial markets trading: identify an evolving uptrend in an fx pair. use a trend line and draw the vertical flag pole. use a channel, parallel lines, or separate horizontal lines to draw the flag. place a buy order immediately above the flag’s upper line. Key points. a bull flag pattern consists of three parts: the flagpole (a parabolic price rise), the flag (a consolidation phase), and the breakout (where the price exits the flag pattern and surges through the upper trendline). most effective in rising markets, a bull flag signals that a bullish trend is likely to persist. Strategy #1: bull flag trend continuation strategy. let’s say you want to capture medium term trends. therefore, you’d be using a 50 period moving average. now, what you want is for the price to be above the 50 period moving average. price above the 50 period moving average on mara daily timeframe:. Trading bull flag strategies involves identifying the completion of the flag formation and preparing for a potential breakout. the key is to wait for the price action to break above the resistance level of the flag, signaling a continuation of the initial uptrend. this breakout point is often accompanied by increased volume, serving as a.

Bull Flag Pattern New Trader U Strategy #1: bull flag trend continuation strategy. let’s say you want to capture medium term trends. therefore, you’d be using a 50 period moving average. now, what you want is for the price to be above the 50 period moving average. price above the 50 period moving average on mara daily timeframe:. Trading bull flag strategies involves identifying the completion of the flag formation and preparing for a potential breakout. the key is to wait for the price action to break above the resistance level of the flag, signaling a continuation of the initial uptrend. this breakout point is often accompanied by increased volume, serving as a. The bull flag pattern is easily spotted by its small, rectangular consolidation after a significant upward price movement, similar to a flag flying high on a pole. this formation usually takes place over a brief period and can be seen as the market catching its breath after a surge, with prices gathering in a tight band before the next upward move. The bull flag pattern is a popular chart pattern used in technical analysis to identify a potential continuation of a bullish trend. it is formed when there is a steep rise in prices (the flagpole) followed by a consolidation period (the flag) before a continuation of the upward trend. this pattern is widely used by traders and investors to.

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttwв ў The bull flag pattern is easily spotted by its small, rectangular consolidation after a significant upward price movement, similar to a flag flying high on a pole. this formation usually takes place over a brief period and can be seen as the market catching its breath after a surge, with prices gathering in a tight band before the next upward move. The bull flag pattern is a popular chart pattern used in technical analysis to identify a potential continuation of a bullish trend. it is formed when there is a steep rise in prices (the flagpole) followed by a consolidation period (the flag) before a continuation of the upward trend. this pattern is widely used by traders and investors to.

What Is A Bull Flag Pattern Bullish How To Trade With It Bybit Learn

Comments are closed.