Can I Contribute To An Ira And A 401 K The Motley Fool

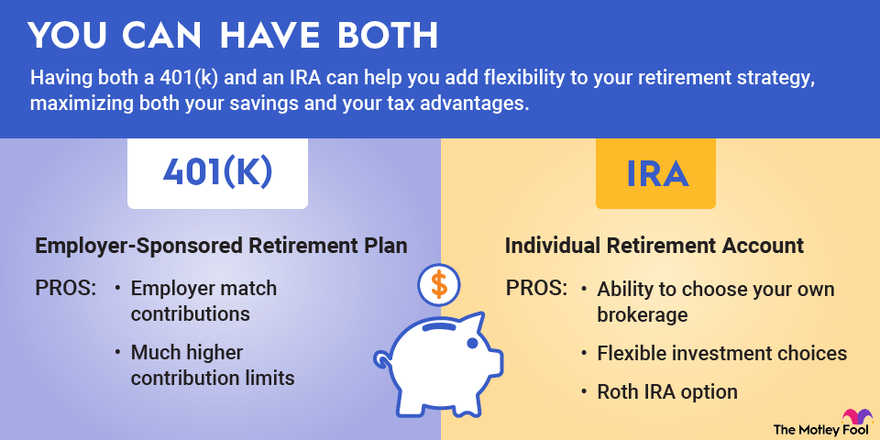

Can I Contribute To An Ira And A 401 K The Motley Fool Image source: the motley fool. although a 401 (k) and an ira will both help you save for your retirement, there are a few important differences. a 401 (k) is established by an employer; an ira is. Most workers are able to set aside up to $23,000 in a 401 (k) in 2024 or $30,500 if they're 50 or older. they can also save up to $7,000 in an ira or $8,000 if they're 50 or older. keep in mind.

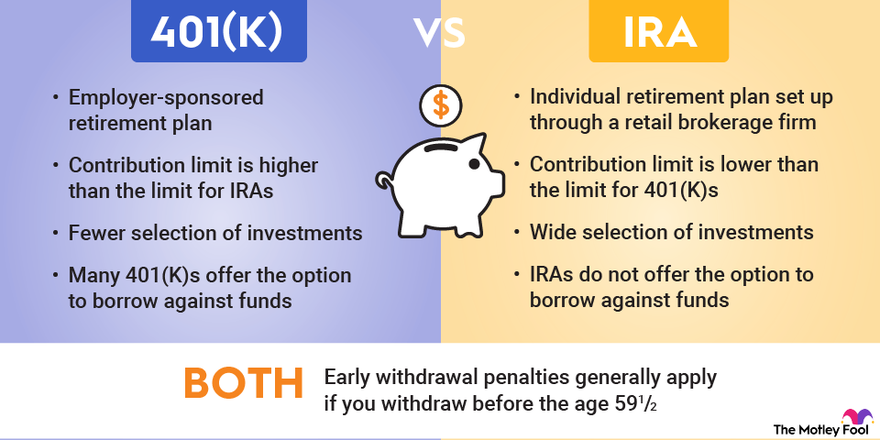

401 K Vs Ira Which Is Better For You The Motley Fool You can contribute to both a 401 (k) and a roth ira in the same year. making 401 (k) contributions could make those with high salaries eligible to fund a roth ira. a roth ira offers greater. Iras have lower contribution limits than 401 (k)s. in 2024, individuals can contribute up to $7,000 in an ira (or $8,000 if you’re age 50 or older). that’s $16,000 less than the maximum allowed in a 401 (k) if you’re under 50, or $22,500 less if you’re over 50. there are no “matching” contributions for iras. The bottom line. you can contribute to both a 401 (k) and an ira, as long as you keep your contributions to certain limits. for 2024, you can contribute up to $23,000 to a 401 (k) unless you're 50. Iras have lower contribution limits than 401 (k)s. in 2024, individuals can contribute up to $7,000 in an ira (or $8,000 if you’re age 50 or older). that’s $16,000 less than the maximum allowed in a 401 (k) if you’re under 50, or $22,500 less if you’re over 50. there are no “matching” contributions for iras.

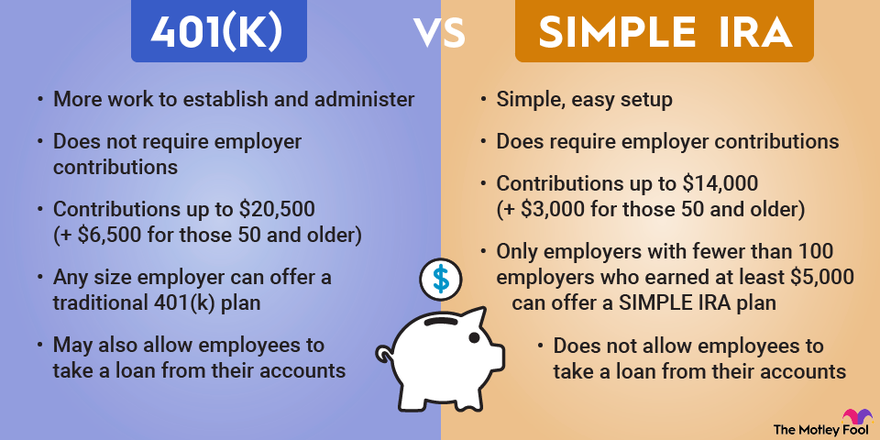

401 K Vs Simple Ira What S The Difference The Motley Fool The bottom line. you can contribute to both a 401 (k) and an ira, as long as you keep your contributions to certain limits. for 2024, you can contribute up to $23,000 to a 401 (k) unless you're 50. Iras have lower contribution limits than 401 (k)s. in 2024, individuals can contribute up to $7,000 in an ira (or $8,000 if you’re age 50 or older). that’s $16,000 less than the maximum allowed in a 401 (k) if you’re under 50, or $22,500 less if you’re over 50. there are no “matching” contributions for iras. The motley fool is a usa today content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. its content is produced independently of usa today. offer from the motley fool: offer from the motley fool: the 10 best stocks to buy now motley fool co founders tom and david gardner. The annual contribution limits for 401(k)s are higher than the ira contribution limits. early 401(k) and ira withdrawals may be subject to a 10% penalty. motley fool issues rare “all in” buy alert.

Here S The Average Ira And 401 K Balance How Does Yours Compare The motley fool is a usa today content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. its content is produced independently of usa today. offer from the motley fool: offer from the motley fool: the 10 best stocks to buy now motley fool co founders tom and david gardner. The annual contribution limits for 401(k)s are higher than the ira contribution limits. early 401(k) and ira withdrawals may be subject to a 10% penalty. motley fool issues rare “all in” buy alert.

Comments are closed.