Can I Contribute To An Ira If I Have A 401 K At Work The Motley

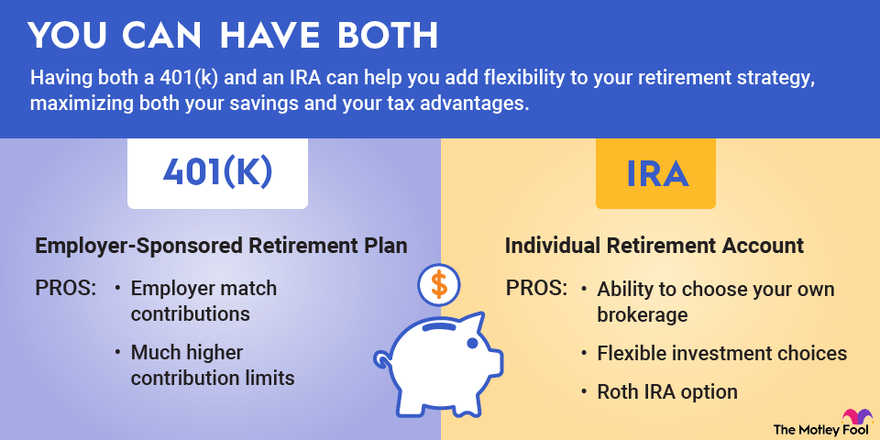

Can I Contribute To An Ira And A 401 K The Motley Fool Image source: the motley fool. although a 401 (k) and an ira will both help you save for your retirement, there are a few important differences. a 401 (k) is established by an employer; an ira is. The bottom line. you can contribute to both a 401 (k) and an ira, as long as you keep your contributions to certain limits. for 2024, you can contribute up to $23,000 to a 401 (k) unless you're 50.

Can I Contribute To A 401 K And An Ira 2024 Guide You can contribute to both a 401 (k) and a roth ira in the same year. making 401 (k) contributions could make those with high salaries eligible to fund a roth ira. a roth ira offers greater. Most workers are able to set aside up to $23,000 in a 401 (k) in 2024 or $30,500 if they're 50 or older. they can also save up to $7,000 in an ira or $8,000 if they're 50 or older. keep in mind. Both the 401 (k) plan and an ira have annual contribution limits set by the irs. in 2024, the 401 (k) contribution limit for employees under 50 is $23,000, while those 50 and older can add an. 401 (k) and ira contributions limits for 2023 and 2024. while contributing to both a 401 (k) and ira is certainly allowed, there are a few considerations to keep in mind. the first is the contribution limits the irs places on each type of account, which are outlined in the table below. 1.

Comments are closed.