Can I Rollover A 401k Into A Roth Ira Rollover 401k Into A Roth

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

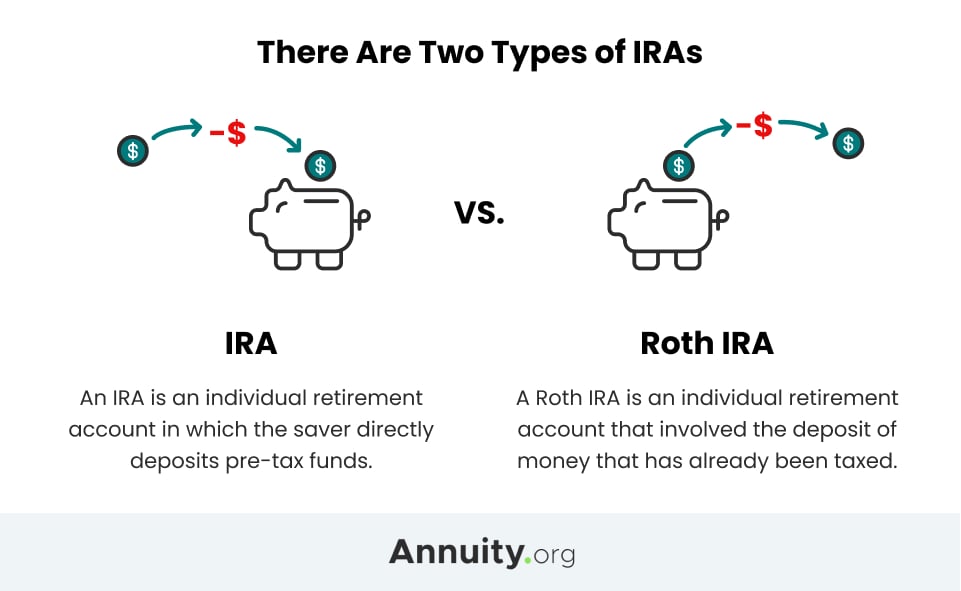

Rollover 401 K To Roth Ira Rules Pros Cons Signs How To Rollover You should be able to roll over your 401(k) into a Roth IRA, but be sure you understand the tax consequences first Discover what a backdoor Roth IRA is and how it works, how to set one up, the rules you must follow, and when a backdoor IRA might not be the right choice for you

How To Roll A 401k Into A Roth Ira The Wicked Wallet In reviewing his documents, I found that he had been making after-tax contributions to his 401(k) plan all these years I know that nowadays you would put those after tax amounts into a Roth 401(k), Here are three primary reasons you might want to consider moving your retirement money from your 401(k) to an IRA once you retire The Federal Reserve has made its first rate cut in 14 months, with more expected in 2024 Here are the smart money moves to consider In any case, the SECURE Act 20 allows small 401(k) balances to be transferred into a default IRA rollover will be facilitated by the new plan If you have not yet begun contributing, contact your

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity The Federal Reserve has made its first rate cut in 14 months, with more expected in 2024 Here are the smart money moves to consider In any case, the SECURE Act 20 allows small 401(k) balances to be transferred into a default IRA rollover will be facilitated by the new plan If you have not yet begun contributing, contact your Both firms offer options and charge a 65-cent fee for each contract you trade However, each platform offers some investment opportunities that you won't find on the other Fidelity is the brokerage you could reduce your contribution to 5% and put the rest in a lower-cost vehicle such as a Roth IRA or traditional IRA If you decide to move your money out of your 401(k), make sure to do so as soon

401k Rollover Into Roth Ira Youtube Both firms offer options and charge a 65-cent fee for each contract you trade However, each platform offers some investment opportunities that you won't find on the other Fidelity is the brokerage you could reduce your contribution to 5% and put the rest in a lower-cost vehicle such as a Roth IRA or traditional IRA If you decide to move your money out of your 401(k), make sure to do so as soon

Comments are closed.