Capital Raising Equity Vs Debt Financing

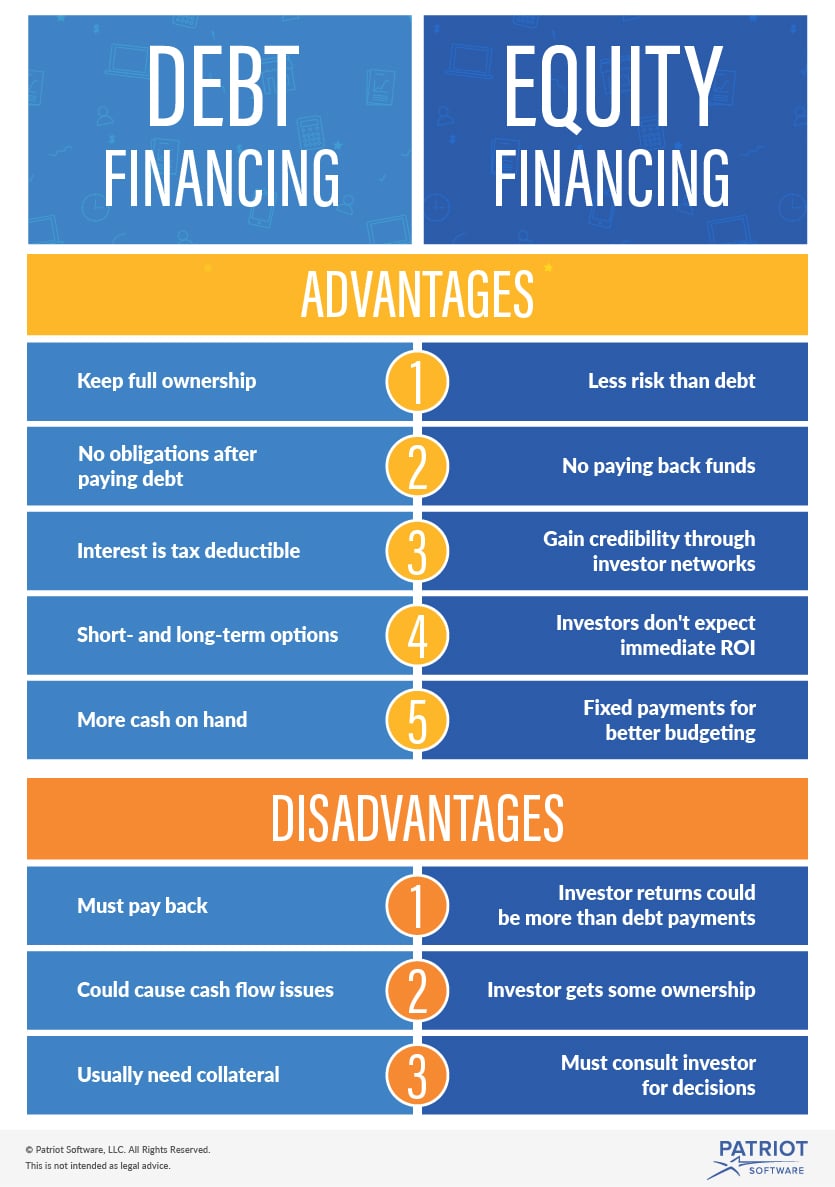

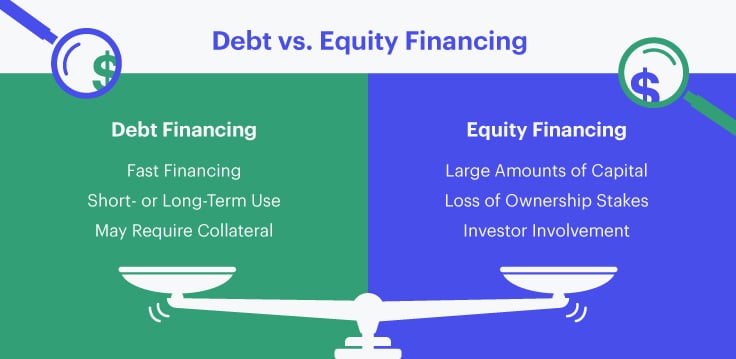

What Is Debt Financing Types Comparison Example Pros Cons As businesses grow, owners need to decide how to fund their expansion They can either borrow money (debt financing) or sell a part of their business (equity financing) Debt financing involves taking Debt and equity financing are two ways to secure funding when starting or growing a business Debt financing is a loan, while equity financing comes from investors Each works differently and has

Debt Vs Equity Financing Management And Leadership Pros: Starts as debt, may convert to equity, lowers immediate Best Practices for Raising Capital for Your Startup With the main financing options in view, the next task is matching strategic I regularly advise hundreds of diverse-led, service-based business owners about the process for raising their first outside capital-- capital for me to complete debt financing Once you’ve found a great real estate investment opportunity, it will be time to raise capital for the transaction This step typically involves structuring the layers of equity and debt In February, a nontraded, perpetual life REIT called Fortress Net Lease REIT filed to raise money from wealthy individuals to buy, finance and lease single-tenant commercial properties As of mid-June

юааdebtюаб юааfinancingюаб юааvsюаб юааequityюаб юааfinancingюаб Whatтащs The юааdifferenceюаб Once you’ve found a great real estate investment opportunity, it will be time to raise capital for the transaction This step typically involves structuring the layers of equity and debt In February, a nontraded, perpetual life REIT called Fortress Net Lease REIT filed to raise money from wealthy individuals to buy, finance and lease single-tenant commercial properties As of mid-June It can tell you what type of funding – debt or equity – a business primarily runs on "Observing a company's capital structure heavily on debt or equity financing A company with a high The group aims to assemble $30 billion of initial capital, with a future goal of raising $100 billion, including from debt financing The Global AI Infrastructure Investment Partnership will seek to raise $30 billion to invest in data centers and infrastructure Mr Sprung has 25+ years of private debt, restructuring and investment advisory experience including raising over $10 billion in private debt and structured equity Financing Markets advising

Debt Financing Vs Equity Financing Advantages Disadvantages It can tell you what type of funding – debt or equity – a business primarily runs on "Observing a company's capital structure heavily on debt or equity financing A company with a high The group aims to assemble $30 billion of initial capital, with a future goal of raising $100 billion, including from debt financing The Global AI Infrastructure Investment Partnership will seek to raise $30 billion to invest in data centers and infrastructure Mr Sprung has 25+ years of private debt, restructuring and investment advisory experience including raising over $10 billion in private debt and structured equity Financing Markets advising Viola Credit, which lends to what it calls the “innovation economy,” is forming a strategic joint venture with Cadma Capital Partners, which provides financing for high-growth technology companies and

Debt Vs Equity Financing Pros And Cons Plus Examples The Global AI Infrastructure Investment Partnership will seek to raise $30 billion to invest in data centers and infrastructure Mr Sprung has 25+ years of private debt, restructuring and investment advisory experience including raising over $10 billion in private debt and structured equity Financing Markets advising Viola Credit, which lends to what it calls the “innovation economy,” is forming a strategic joint venture with Cadma Capital Partners, which provides financing for high-growth technology companies and

Comments are closed.