Cds Vs High Yield Savings Accounts Overview Pros Cons

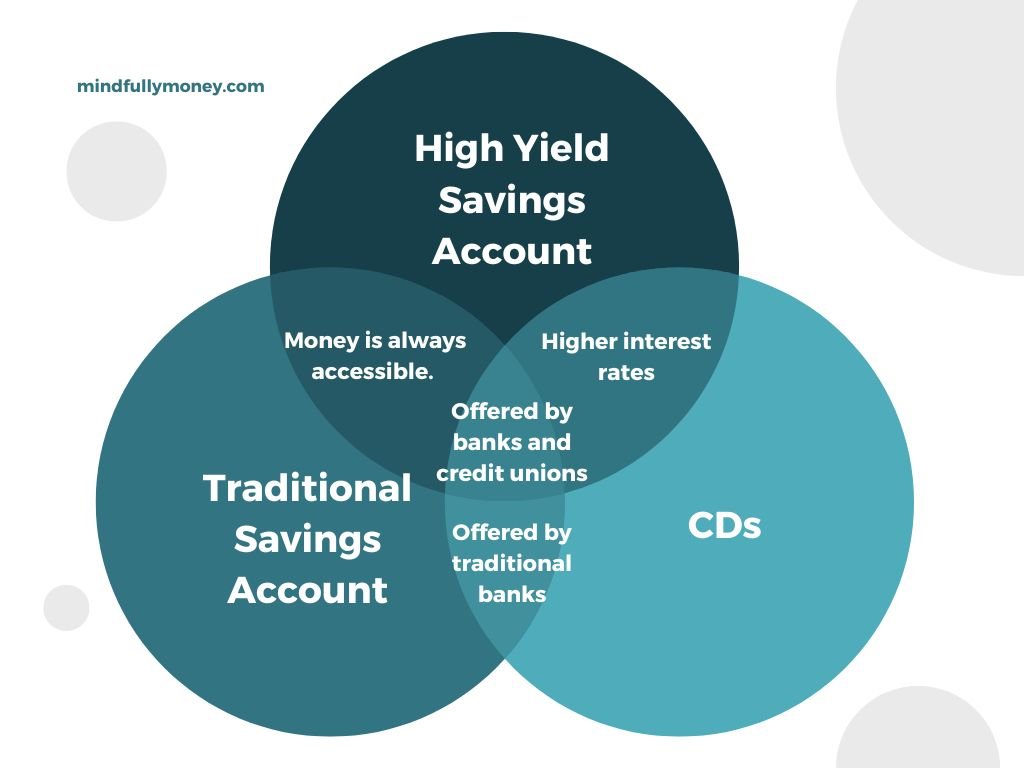

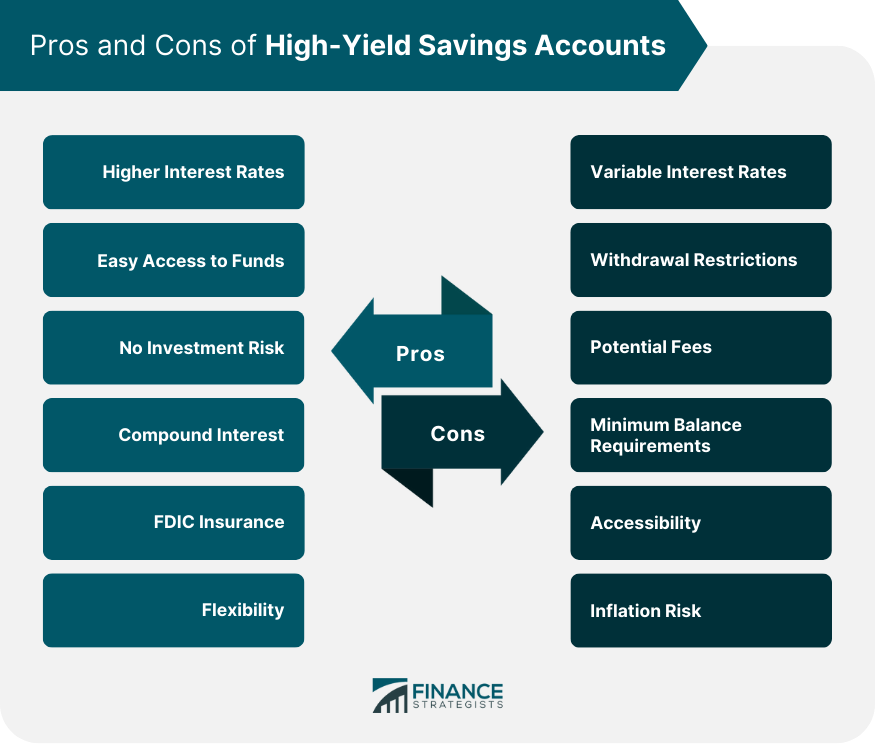

Cd Vs High Yield Savings Account Which Is Better вђ Mindfully Mo Both offer benefits such as guaranteed returns and protection of your principal. cds, or certificates of deposit, provide higher interest rates, especially for larger deposits, and offer the advantage of compound interest. on the other hand, high yield savings accounts offer better liquidity and easier access to your funds. Cds lack flexibility compared to a savings account. like savings accounts, cds are typically fdic or ncua insured. stocks, bonds, or other investments could offer a higher return than cds. cds.

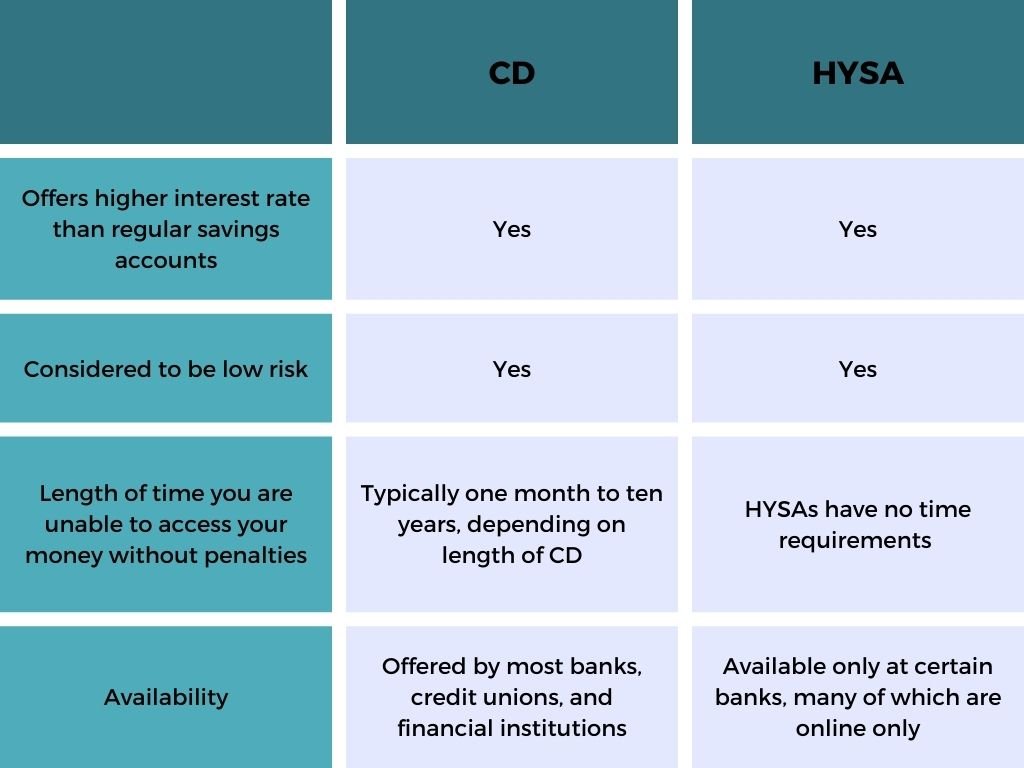

Cd Vs High Yield Savings Account Which Is Better вђ Mindfully Mo Cd vs. high yield savings account: at a glance. cd. high yield savings account. pros. higher rates on top cds than savings accounts typically. fixed rate locks in predictable rate of return. Similar to a high yield savings account, cds allow you to deposit money to earn interest on your balance. sometimes, the interest you earn on a cd can even be higher than what you earn on a high. Yes. interest rate. significantly higher than traditional savings accounts. may be higher than high yield savings accounts, depending on cd term. good for. emergency fund savings, short term goals. Interest rates: cds typically offer higher interest rates compared to high yield savings accounts. this is because cds require you to commit your money for a fixed period, ranging from a few months to several years. in return for this commitment, banks reward you with a higher interest rate. on the other hand, savings accounts offer lower but.

Cds Vs High Yield Savings Accounts Overview Pros Cons Yes. interest rate. significantly higher than traditional savings accounts. may be higher than high yield savings accounts, depending on cd term. good for. emergency fund savings, short term goals. Interest rates: cds typically offer higher interest rates compared to high yield savings accounts. this is because cds require you to commit your money for a fixed period, ranging from a few months to several years. in return for this commitment, banks reward you with a higher interest rate. on the other hand, savings accounts offer lower but. Cds typically earn more interest than a traditional (or even a high yield) savings account. on june 17, 2024, for instance, the average rate for a 12 month cd was 1.86%, several times higher than the average savings account rate of 0.45%. 1 and some cd rates were as high as 5.40% that same day. A high yield savings account generally pays a higher interest rate than the national average for savings accounts. however, a cd often pays a higher interest rate than a high yield savings account.

What Is A High Yield Savings Account And Do I Need One Ramsey Cds typically earn more interest than a traditional (or even a high yield) savings account. on june 17, 2024, for instance, the average rate for a 12 month cd was 1.86%, several times higher than the average savings account rate of 0.45%. 1 and some cd rates were as high as 5.40% that same day. A high yield savings account generally pays a higher interest rate than the national average for savings accounts. however, a cd often pays a higher interest rate than a high yield savings account.

Cds Vs High Yield Savings Accounts Overview Pros Cons

Comments are closed.