Chapter 7 Bankruptcy Explained Maryland Bankruptcy Attorney Chapter

Chapter 7 If you or a loved one is facing economic and financial hardships, contact maryland chapter 7 and 13 bankruptcy attorney, daniel j. guenther, (301) 475 3106. with over 43 years of experience, the law offices of daniel j. guenther can help you determine if filing for bankruptcy is the right step for you. The main goal of bankruptcy is to help you get a “fresh start,” either by discharging your debt or creating a repayment plan with affordable payments. most bankruptcy cases are filed under the three main chapters of the bankruptcy code, chapter 7 (liquidation), chapter 11 (reorganization), and chapter 13 (individual debt adjustment).

Chapter 7 Bankruptcy Explained Bankruptcy Family Civil Criminal Notes the "current monthly income" received by the debtor is a defined term in the bankruptcy code and means the average monthly income received over the six calendar months before commencement of the bankruptcy case, including regular contributions to household expenses from nondebtors and including income from the debtor's spouse if the petition is a joint petition, but not including social. Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. (see maryland exemptions) the trustee sells the assets and pays you, the debtor, any amount exempted. the net proceeds of the liquidation are then distributed to your creditors with a commission taken by the trustee. Ation.” the basic idea in a chapter 7 bankruptcy is to discharge your debts in exchange for giving u. property. most low income people do not need to give up any of their property because the law allows you to “exempt” or protect $12,000 worth of property ($24,000 if you are filing jointly with yo. A chapter 7 bankruptcy provides the filer with lasting debt relief in the form of a discharge, which can be granted within 3 months of filing their case in the bankruptcy court. in exchange, the filer gives up those possessions that are not protected by an exemption. a trustee takes those so called non exempt assets and sells them, using the.

Chapter 7 Bankruptcy Overview Ation.” the basic idea in a chapter 7 bankruptcy is to discharge your debts in exchange for giving u. property. most low income people do not need to give up any of their property because the law allows you to “exempt” or protect $12,000 worth of property ($24,000 if you are filing jointly with yo. A chapter 7 bankruptcy provides the filer with lasting debt relief in the form of a discharge, which can be granted within 3 months of filing their case in the bankruptcy court. in exchange, the filer gives up those possessions that are not protected by an exemption. a trustee takes those so called non exempt assets and sells them, using the. Chapter 7 bankruptcy eliminates debts without requiring filers to repay creditors, often making it the preferred choice of bankruptcy filers. chapter 7 is also the cheapest bankruptcy chapter to file and the quickest to complete, usually taking four months. this article explains what it means to file for chapter 7 bankruptcy so you can. Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, provides a legal route for individuals struggling with debt to get a fresh financial start. given the complexity of bankruptcy law, hiring a bankruptcy lawyer is the smart choice to help you navigate the process and avoid the pitfalls that can potentially have severe financial consequences.

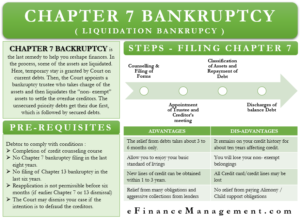

Chapter 7 Bankruptcy Conditions Steps Settlement Pros Cons Efm Chapter 7 bankruptcy eliminates debts without requiring filers to repay creditors, often making it the preferred choice of bankruptcy filers. chapter 7 is also the cheapest bankruptcy chapter to file and the quickest to complete, usually taking four months. this article explains what it means to file for chapter 7 bankruptcy so you can. Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, provides a legal route for individuals struggling with debt to get a fresh financial start. given the complexity of bankruptcy law, hiring a bankruptcy lawyer is the smart choice to help you navigate the process and avoid the pitfalls that can potentially have severe financial consequences.

Chapter 7 Bankruptcy Attorney Treasure Coast Bankruptcy

Comments are closed.