Chapter 7 Bankruptcy Forms Explained 2019

Chapter 7 Bankruptcy Forms Explained Upsolve Notes the "current monthly income" received by the debtor is a defined term in the bankruptcy code and means the average monthly income received over the six calendar months before commencement of the bankruptcy case, including regular contributions to household expenses from nondebtors and including income from the debtor's spouse if the petition is a joint petition, but not including social. Chapter 7 statement of current monthly income. official form 122a 1, formally called the chapter 7 statement of your current monthly income is part one of the means test form. after completing the form, if you’re below the income limits for a chapter 7 bankruptcy, you’ll check the box that says there is no presumption of abuse.

The Most Essential Chapter 7 Bankruptcy Forms You Need To Complete Full article: upsolve.org learn chapter 7 bankruptcy forms explained what are the bankruptcy forms?at first glance, the bankruptcy process can seem o. Here's a list of the forms all individuals must file in chapter 7 bankruptcy. you'll notice that you have two means test form choices (the means test qualifies you for chapter 7). if you're exempt from taking the means test, use bankruptcy form 122a 1 supp. get debt relief now. we've helped 205 clients find attorneys today. Chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. however, some forms of debt, such as back taxes, court. Chapter 7 bankruptcy is a legal process where a debtor's non exempt assets are liquidated to pay off creditors. this type of bankruptcy allows individuals or businesses to discharge most of their.

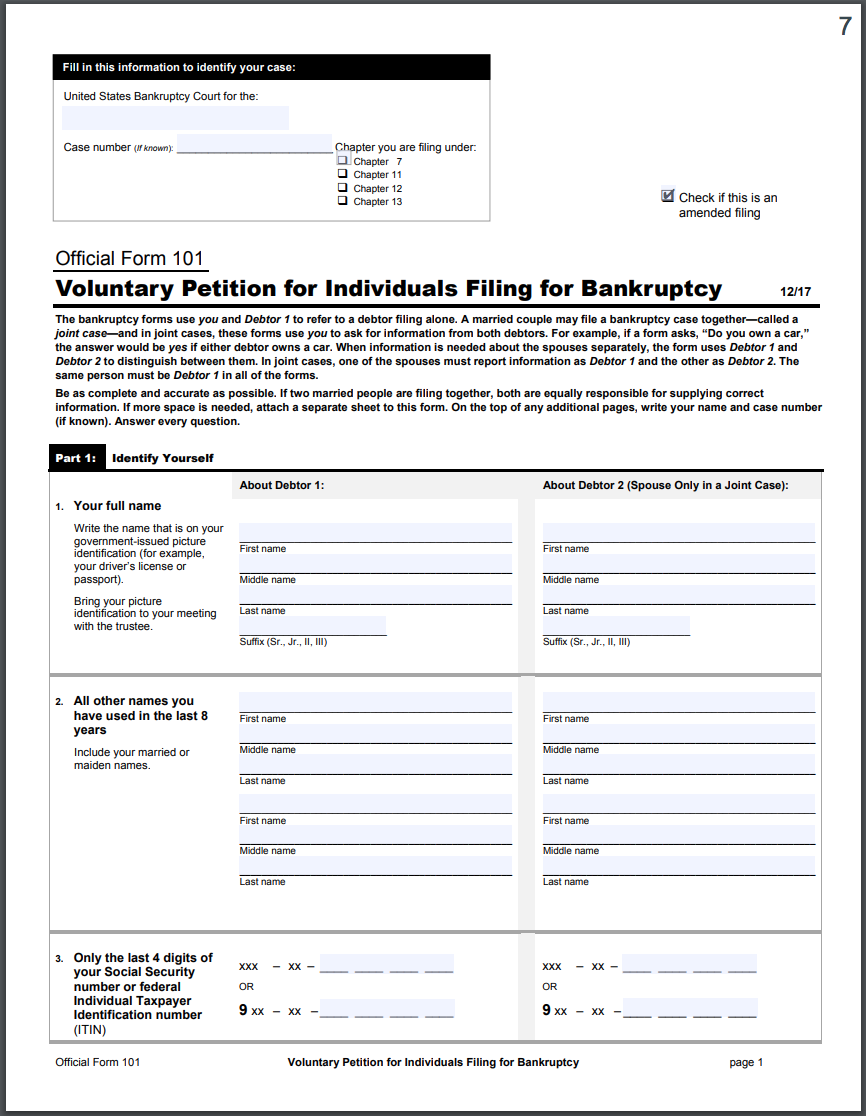

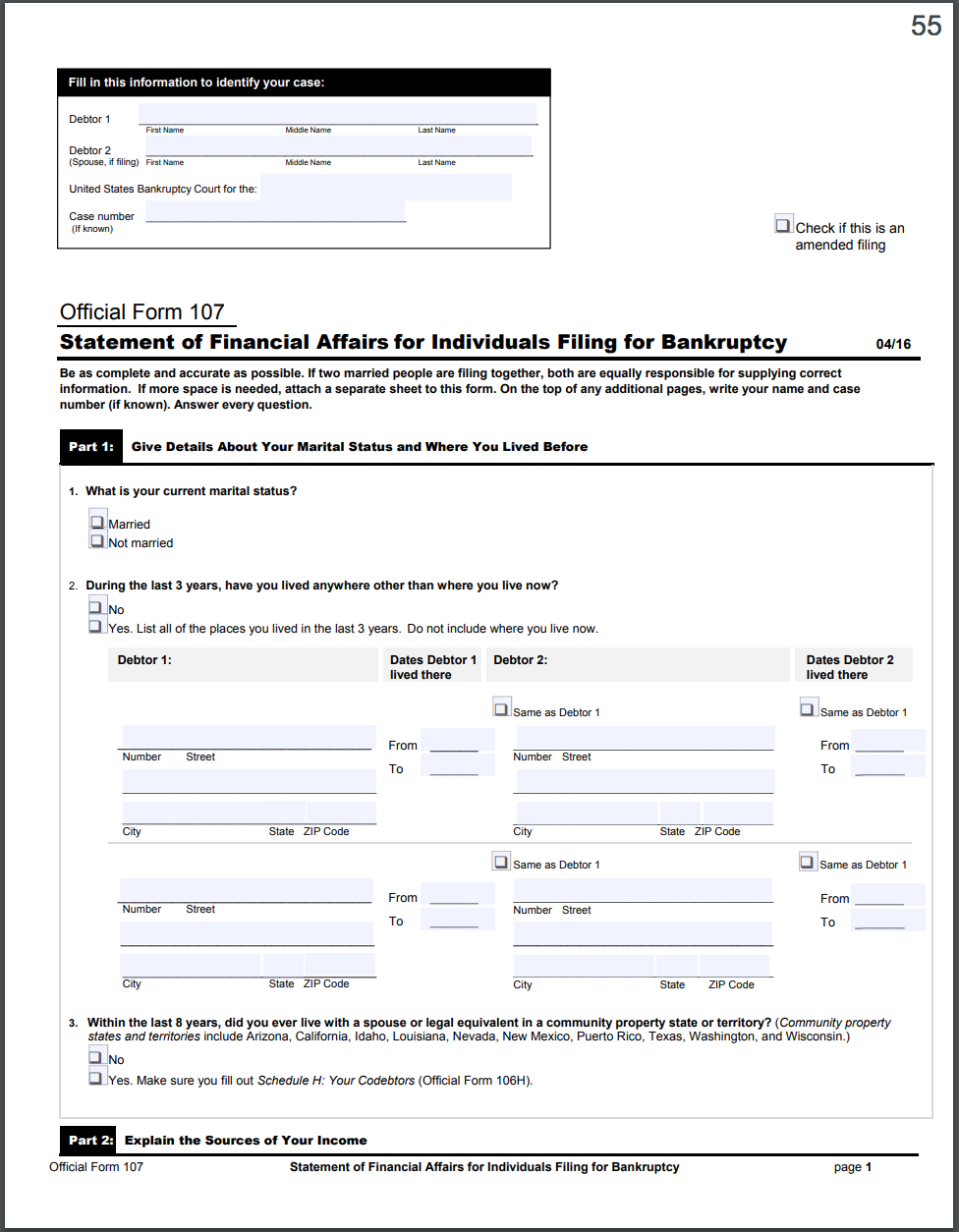

Chapter 7 Bankruptcy Forms Explained Upsolve Chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. however, some forms of debt, such as back taxes, court. Chapter 7 bankruptcy is a legal process where a debtor's non exempt assets are liquidated to pay off creditors. this type of bankruptcy allows individuals or businesses to discharge most of their. A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets. 3 in addition to the petition, the debtor must also file with the court: (1) schedules of assets and liabilities; (2) a schedule of current income and expenditures. Currently, the required court filing fee for a chapter 7 bankruptcy is $335. but court filing fees are updated periodically and can change. if you can't afford to pay the filing fee, you may be eligible for a waiver if your combined household income is less than 150% of the applicable poverty guideline in your area.

Chapter 7 Bankruptcy Definition And Forms вђ Db Excel A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets. 3 in addition to the petition, the debtor must also file with the court: (1) schedules of assets and liabilities; (2) a schedule of current income and expenditures. Currently, the required court filing fee for a chapter 7 bankruptcy is $335. but court filing fees are updated periodically and can change. if you can't afford to pay the filing fee, you may be eligible for a waiver if your combined household income is less than 150% of the applicable poverty guideline in your area.

What Is Chapter 7 Bankruptcy Experian

Comments are closed.