Chapter 7 Bankruptcy Reaffirmation Agreements Need To Know

Chapter 7 Bankruptcy Reaffirmation Agreements Need To Know Reaffirmation agreements are a special feature of chapter 7 bankruptcy. they give your creditors a chance to get you back on the hook for debt you would have otherwise discharged in the bankruptcy by allowing you to reaffirm, or re sign, liability for a specific debt. because of this, reaffirmation agreements should be avoided, unless there is. Reaffirmation: 7 things every creditor’s attorney should know. filing a reaffirmation agreement in a chapter 7 bankruptcy proceeding is a commonplace occurrence for many attorneys. however, the reaffirmation process is fraught with nuances and traps for the unwary attorney. absent appropriate planning, these nuances may transform an otherwise.

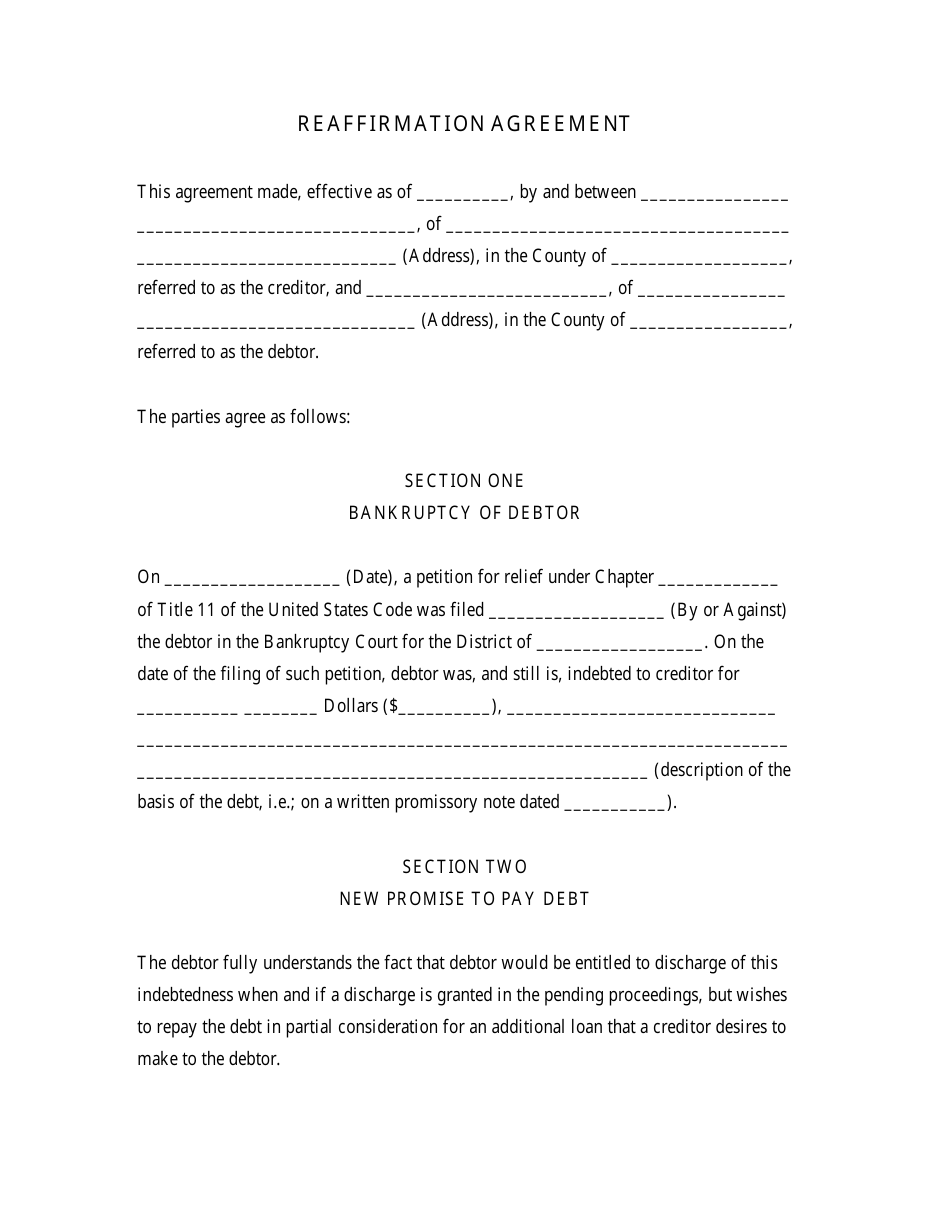

Reaffirmation Agreement Form Fill Out Sign Online And Download Pdf Process for signing a reaffirmation agreement. if you wish to sign a reaffirmation agreement it must be filed with the court before you receive a discharge in your case. an order of discharge is usually received 60 days after your 341 meeting. the creditor will file the reaffirmation agreement once you have reviewed its terms and signed it. Per the bankruptcy code, specifically 11 u.s.c. §341 (a), the debtor must file the reaffirmation agreement within 60 days of the date first set for the meeting of creditors. failure to meet this deadline can lead to the agreement being considered null and void, leading to potential legal complications. A reafirmation agreement can be cancelled by a debtor by the later of: (1) the issuance of a discharge in the bankruptcy case or (2) 60 days from the date the reafirmation agreement is filed with the bankruptcy court. as with any contract, you should think very carefully before signing a reafirmation agreement. In a nutshell. people who file bankruptcy are often concerned about what's going to happen to their car. signing a reaffirmation agreement is one option that lets you keep your car and continue making the payments, but it's not the only option and might not be the best option in your situation. read on to learn about how reaffirmations work and.

What Is Chapter 7 Bankruptcy Overview Filing Information A reafirmation agreement can be cancelled by a debtor by the later of: (1) the issuance of a discharge in the bankruptcy case or (2) 60 days from the date the reafirmation agreement is filed with the bankruptcy court. as with any contract, you should think very carefully before signing a reafirmation agreement. In a nutshell. people who file bankruptcy are often concerned about what's going to happen to their car. signing a reaffirmation agreement is one option that lets you keep your car and continue making the payments, but it's not the only option and might not be the best option in your situation. read on to learn about how reaffirmations work and. Suppose you owe $25,000 on your car before filing for chapter 7 bankruptcy. you most likely will continue to owe $25,000 on your car after you file for bankruptcy (unless you negotiate a lower amount in your reaffirmation agreement). if you can't keep up your payments and the car is repossessed, you'll owe the difference between the $25,000. To keep your car during and after a chapter 7 bankruptcy, you sometimes need to sign a reaffirmation agreement with the lender and have it approved by the bankruptcy court. this agreement is a contract that confirms you're committed to continue paying your car loan after bankruptcy. it comes with a risk: if you fall behind on your car payments.

Comments are closed.