Chapter 7 Bankruptcy What You Need To Know Before Filing Chris M

Chapter 7 Bankruptcy What You Need To Know Before Filin Notes the "current monthly income" received by the debtor is a defined term in the bankruptcy code and means the average monthly income received over the six calendar months before commencement of the bankruptcy case, including regular contributions to household expenses from nondebtors and including income from the debtor's spouse if the petition is a joint petition, but not including social. To file chapter 7 bankruptcy, you start by filing a petition with your local bankruptcy court. according to the u.s. courts, you will also need to provide the following information: a list of all creditors and the amount and nature of their claims. the source, amount, and frequency of your income. a list of all your property.

Chapter 7 Chris Mudd Associates The average attorney fee for a chapter 7 bankruptcy is $1,250. it's $3,000 for a chapter 13 case. plus, you typically have to pay attorney fees up front, especially in chapter 7 cases. you'll also. 3. gather your chapter 7 financial documents. it takes a lot of financial information to complete the chapter 7 petition and schedules, including paycheck stubs, bank statements, tax returns, and more. if you don't know where to start, our chapter 7 document list will help. 4. Chapter 7 bankruptcy is a “second chance” to regain control of your finances by having most of your unsecured debt, including credit card debt, medical bills, and personal loans, legally discharged by a bankruptcy court. in virtually all cases, however, it does not discharge student loans, tax debt, alimony, or child support. Timeline for after you file chapter 7 bankruptcy. once your chapter 7 bankruptcy case has been filed, it will take approximately 4–6 months to receive your bankruptcy discharge. the act of submitting your petition to the bankruptcy court starts your chapter 7 bankruptcy timeline. here is what happens in the interim:.

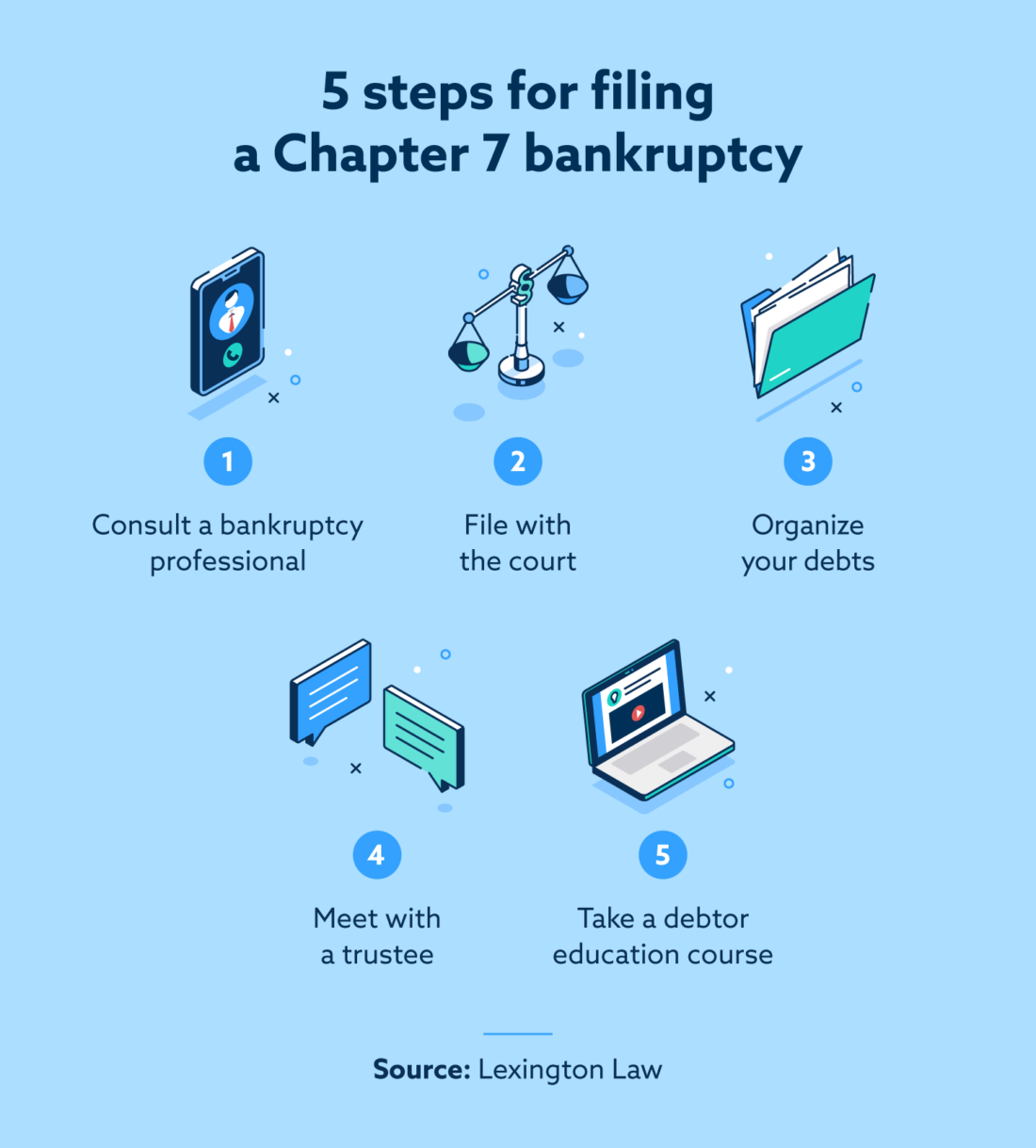

What Is Chapter 7 Bankruptcy A Liquidation Guide Lexington Law Chapter 7 bankruptcy is a “second chance” to regain control of your finances by having most of your unsecured debt, including credit card debt, medical bills, and personal loans, legally discharged by a bankruptcy court. in virtually all cases, however, it does not discharge student loans, tax debt, alimony, or child support. Timeline for after you file chapter 7 bankruptcy. once your chapter 7 bankruptcy case has been filed, it will take approximately 4–6 months to receive your bankruptcy discharge. the act of submitting your petition to the bankruptcy court starts your chapter 7 bankruptcy timeline. here is what happens in the interim:. Here's a list of the forms all individuals must file in chapter 7 bankruptcy. you'll notice that you have two means test form choices (the means test qualifies you for chapter 7). if you're exempt from taking the means test, use bankruptcy form 122a 1 supp. get debt relief now. we've helped 205 clients find attorneys today. Find an attorney: before diving into the various forms required to file chapter 7, find a qualified bankruptcy attorney to help. it’s hard to find money for a lawyer when you need debt relief.

What Is Chapter 7 Bankruptcy Overview Filing Information Here's a list of the forms all individuals must file in chapter 7 bankruptcy. you'll notice that you have two means test form choices (the means test qualifies you for chapter 7). if you're exempt from taking the means test, use bankruptcy form 122a 1 supp. get debt relief now. we've helped 205 clients find attorneys today. Find an attorney: before diving into the various forms required to file chapter 7, find a qualified bankruptcy attorney to help. it’s hard to find money for a lawyer when you need debt relief.

Comments are closed.