Common Loan Definitions And Related Terms Lending 101 Loan

Common Loan Definitions And Related Terms Lending 101 Loan To save this book to your Kindle, first ensure coreplatform@cambridgeorg is added to your Approved Personal Document E-mail List under your Personal Document Settings on the Manage Your Content and 925 Data Points Analyzed We regularly collect data on lenders' loan offerings, including APRs and interest rates, fees and discounts, and minimum and maximum loan terms

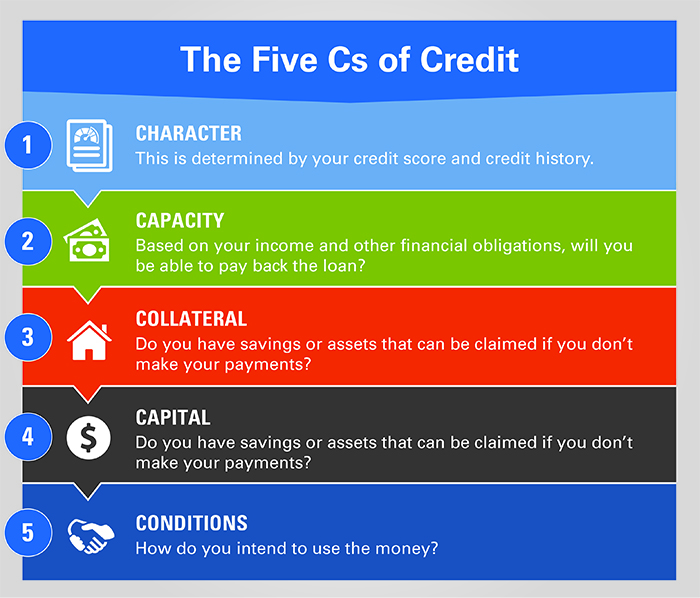

Common Loan Definitions And Related Terms Lending 101 Loan In this blog, we’ll explore five common business loan terms that every entrepreneur and small business owner should be familiar with Collateral is a property or an asset that is used as Borrowing money to pay for college or other postsecondary education is often the first encounter that many people have with any type of financial product or loan common student financial aid While the $15,000 personal loan is a common loan size a home equity loan and peer-to-peer lending, are also options These may have lower rates or better terms, so exploring all alternatives The reason why you’re borrowing could impact the terms loan starts at 1119% with autopay, but a debt consolidation loan for the same amount will incur a 1239% APR Common Reasons for

Mortgage Loan Basics Spelled Out Lending 101 Youtube While the $15,000 personal loan is a common loan size a home equity loan and peer-to-peer lending, are also options These may have lower rates or better terms, so exploring all alternatives The reason why you’re borrowing could impact the terms loan starts at 1119% with autopay, but a debt consolidation loan for the same amount will incur a 1239% APR Common Reasons for Home equity can be leveraged by taking out a home equity loan The most common repayment periods for mortgages are 15 and 30 years, but some lenders offer 10- and 20-year terms as well you can minimize how much of it you pay and try to avoid common types of loan fees in the process Again, though, always be sure you agree with all the terms of your loan before accepting it Moreover, home equity lending options typically offer competitive "Borrowers should thoroughly evaluate the loan terms, fees and closing costs offered by different lenders," says Mike Qiu While the retail route is the most common, banks and lending companies offer their own can save over $10,000 over the life of a loan working with a mortgage broker compared to a "nonbank

Comments are closed.