Consumer Credit Management

Important Guide About Consumer Credit And The 2 Types Of It Founded in 1991, american consumer credit counseling (accc) is a nonprofit (501) (c) (3) organization, offering confidential consumer credit counseling services, debt consolidation, debt management, budget counseling, bankruptcy counseling, housing counseling, and financial education to consumers nationwide. Credit counseling can help you manage your money and debts, develop a budget, and organize a debt management plan. learn how to choose a reputable and certified credit counselor and avoid scams.

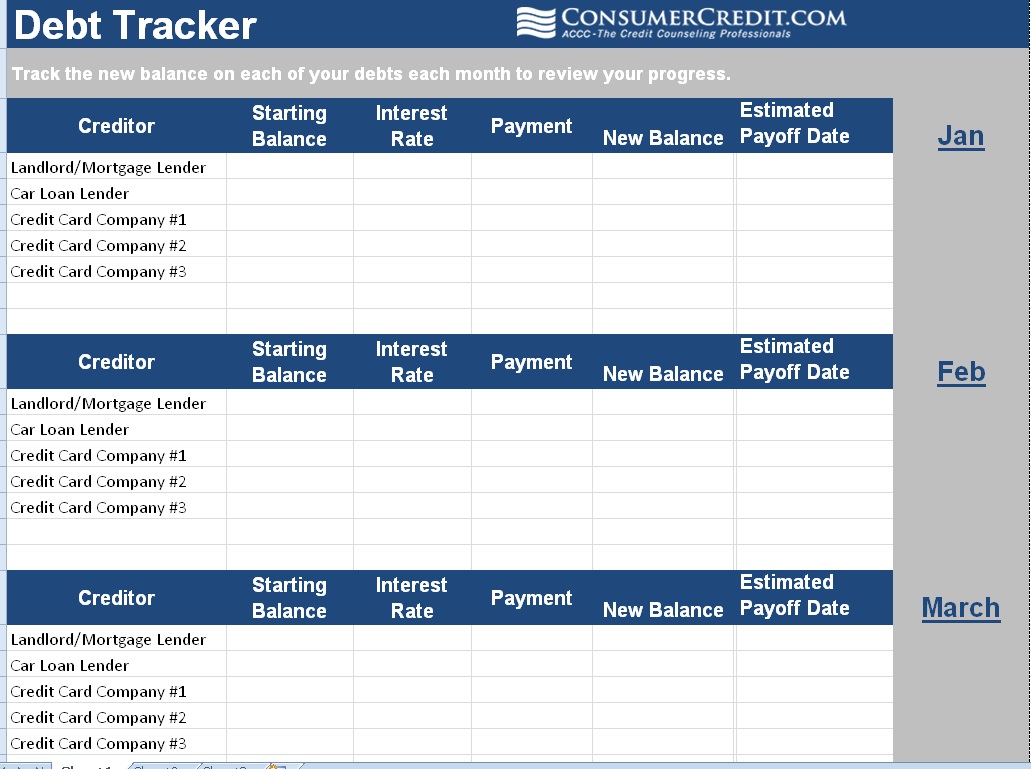

How To Manage Debt Tracking And Prioritizing Debts Consumer Credit Here’s how debt management plans generally work with consumer credit counseling: you tell your credit counselor about your debts, including balances owed, interest rates and minimum payments. Consumer credit counseling foundation (cccf) offers personalized credit counseling, debt management solutions, and financial education programs to help individuals and families achieve financial stability and freedom. our certified credit counselors provide expert guidance and support, creating tailored action plans for debt management, budgeting, and credit score improvement. with a. A book chapter that explains the theory and practice of credit management in financial services organizations. it covers topics such as credit cards, credit unions, saving accounts and consumer credit products. Learn how to protect your business from late payments and defaults by your customers with a credit management plan. find out the key steps, best practices and tips for contract management, accounts receivable collections, and credit risk analysis.

Customer Credit Management Functionality In Ifs 8 Ifs Community A book chapter that explains the theory and practice of credit management in financial services organizations. it covers topics such as credit cards, credit unions, saving accounts and consumer credit products. Learn how to protect your business from late payments and defaults by your customers with a credit management plan. find out the key steps, best practices and tips for contract management, accounts receivable collections, and credit risk analysis. Consumer credit counseling (ccc) is a non profit agency that offers free debt counseling and consolidation services to help you get out of debt. learn how ccc can work with your creditors to lower your payments and interest rates, and provide you with educational resources and support. American consumer credit counseling (accc), a nonprofit credit counseling agency and member of the nfcc, was ranked best overall for debt management due to its strong track record of customer.

What Is Credit Management Why It Matters Trevipay Consumer credit counseling (ccc) is a non profit agency that offers free debt counseling and consolidation services to help you get out of debt. learn how ccc can work with your creditors to lower your payments and interest rates, and provide you with educational resources and support. American consumer credit counseling (accc), a nonprofit credit counseling agency and member of the nfcc, was ranked best overall for debt management due to its strong track record of customer.

Comments are closed.