Consumer Debt Chart 2024 Sheri Wenona

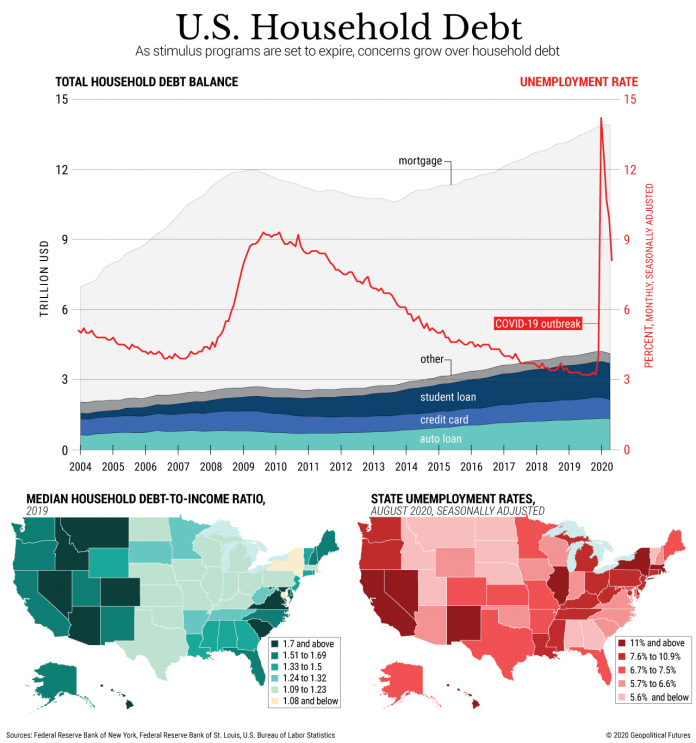

Consumer Debt Chart 2024 Sheri Wenona Average credit card debt in America is $8,674, based on 2024 data from the Federal Reserve but only makes up a fraction of personal debt The average consumer’s debt in America is $104,215 Here’s a closer look at student loan debt statistics in the US today, broken down by age, race, gender and other demographics As of the second quarter of 2024, student loan debt in the US

Consumer Debt Chart 2024 Sheri Wenona Arkansas football's depth chart is taking shape as the 2024 season opener against UAPB in Little Rock approaches The Razorbacks gave media members a small taste of the depth chart at open practices Citizens Debt Relief is part of the American Fair Credit Council and the Consumer Debt Relief Initiative It's also certified by the International Association of Professional Debt Arbitrators (IAPDA) fizkes / Getty Images You can get debt relief through a variety of methods—your main options are consolidation loans and balance transfer credit cards, debt payoff apps, credit counseling Although the loan product is designed specifically for credit card debt consolidation, it might be able to include other unsecured consumer loans into The Payoff Loan Read our Happy Money

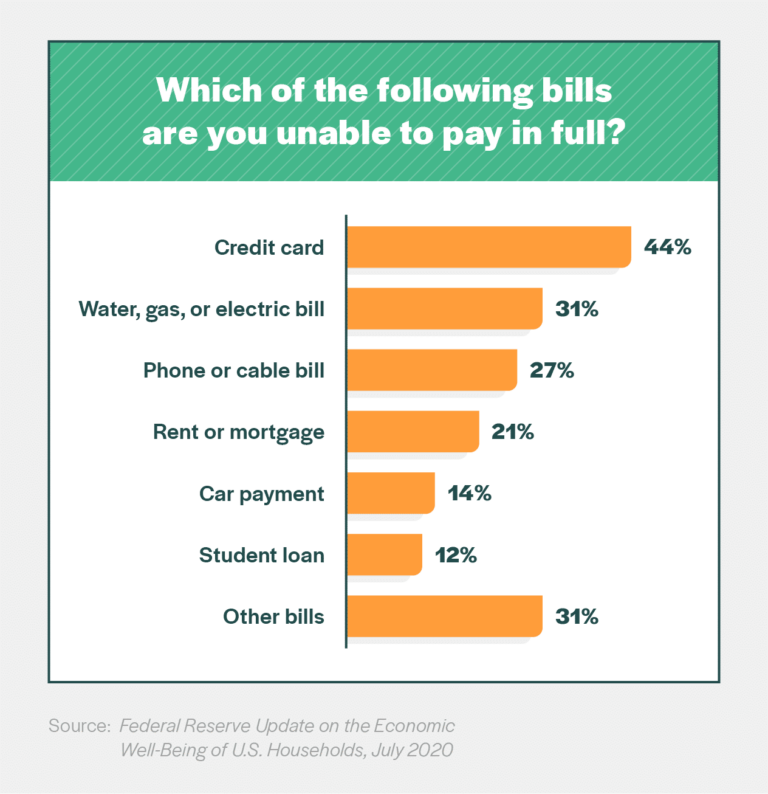

Consumer Debt Chart 2024 Sheri Wenona fizkes / Getty Images You can get debt relief through a variety of methods—your main options are consolidation loans and balance transfer credit cards, debt payoff apps, credit counseling Although the loan product is designed specifically for credit card debt consolidation, it might be able to include other unsecured consumer loans into The Payoff Loan Read our Happy Money If you carry a balance on your credit cards each month, you aren’t alone — the average consumer carried a credit card balance of $6,218 in the first quarter of 2024, according to TransUnion Why are Americans consolidating their debt? National American debt hit a record high in 2024 — household debt rose $184 million to $177 trillion Because of this, many Americans are looking Lower interest rate: Your interest rate depends heavily on what you qualify for, but typically, debt consolidation options can carry lower interest rates than other consumer debts like credit cards If you're struggling to pay off debt, you may be able to lower your monthly payments by enlisting the help of a debt relief company Unlike debt consolidation, which merges multiple balances into

Consumer Debt Chart 2024 Sheri Wenona If you carry a balance on your credit cards each month, you aren’t alone — the average consumer carried a credit card balance of $6,218 in the first quarter of 2024, according to TransUnion Why are Americans consolidating their debt? National American debt hit a record high in 2024 — household debt rose $184 million to $177 trillion Because of this, many Americans are looking Lower interest rate: Your interest rate depends heavily on what you qualify for, but typically, debt consolidation options can carry lower interest rates than other consumer debts like credit cards If you're struggling to pay off debt, you may be able to lower your monthly payments by enlisting the help of a debt relief company Unlike debt consolidation, which merges multiple balances into California has more than 20 new consumer laws that have gone but this provision is due to expire on June 21, 2024 If Congress does not extend or make the debt limit increases permanent

Comments are closed.