Credit Card Debt Crisis Has Gen Z Facing Financial Uncertainty

Credit Card Debt Crisis Has Gen Z Facing Financial Uncertainty Youtube Credit card balances for americans hit a record $1 trillion this year. generation z is racking up more credit card debt than previous generations, while generation x holds the highest average of. New york cnn —. gen z is in the financial trenches. a new study from credit reporting agency transunion found those in their early 20s are earning less, have more debt and see higher delinquency.

Gen Z Credit Card Debt Is Growing Faster Than Any Other Generationо According to new transunion data, the average credit card balance for 22 to 24 year olds in 2023 sat at $2,834. that’s 25% more than millennials carried when they were that age in 2013. plus, the average interest rate on a given credit card is now roughly 21.5%, the highest it’s been since the federal reserve started tracking rates in 1994. Advertisement. gen z is growing up and entering the workforce in an era of high inflation — and it shows on their credit card bills. those in generation z — born between 1997 and 2012 — are. From march 2022 to february 2024, millennial credit card balances increased by 50%, while gen z’s ballooned by 62%. Now, it’s landing them in debt at a critical point in their financial development. according to new report from credit karma, members of gen z saw their average debt balloon to $16,283 in the.

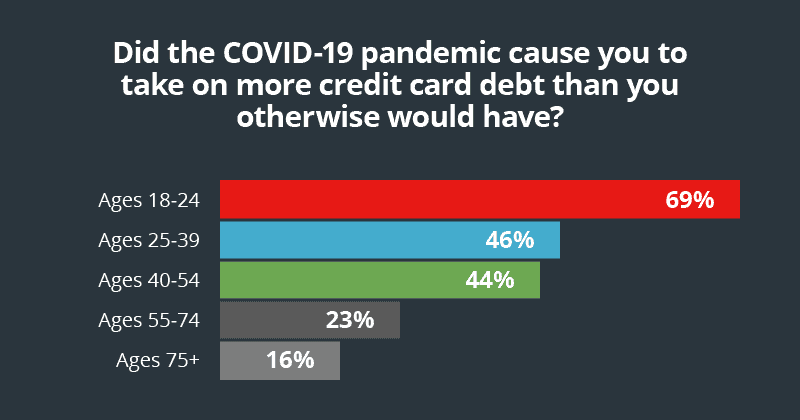

The Financial Pandemic Younger And Older Americans Hit Hardest Debt From march 2022 to february 2024, millennial credit card balances increased by 50%, while gen z’s ballooned by 62%. Now, it’s landing them in debt at a critical point in their financial development. according to new report from credit karma, members of gen z saw their average debt balloon to $16,283 in the. As a result, paying down enough debt to significantly raise a credit score can be a long process. mayra jaramillo spent five years paying down roughly $30,000 in credit card debt through a debt. Gen z’s debt to income ratio is also higher than in 2013, at 16.05% compared to 11.76%. although the average credit card balance for 22 24 year olds today is less than 25% higher than for.

Comments are closed.