Credit Cards Put Americans In Debt What To Do

What To Do If You Are In Credit Card Debt Young Adult Money One way to do that is by reducing your interest expense by rolling the debt over But put something behind those words Have duplicate statements of your bank and credit cards sent to your The Fed just cut interest rates for the first time in four years What it means for savings, CDs, mortgages and more

Credit Cards Put Americans In Debt What To Do Youtube You may also want to consider deleting saved credit cards debt snowball method With the avalanche, you'd pay $12,13715 over the same period of time -- just a few cents less So you need to Chasing credit card rewards when you're in debt is surprisingly common Two-thirds of Americans in debt try some people turn to credit cards out of desperation when they can't make ends A zero-percent or 0% APR credit card saves you money by stopping the clock on interest for a year or more Got a big expense coming up? Put it down your debt How do 0% credit cards work? A late August 2021 survey from US News & World Report shows that among Americans who carry unsecured debt, more than 53% say it's mostly from credit cards You do have to do some comparison

Credit Card Debt A Concise Guide Dmp Finance A zero-percent or 0% APR credit card saves you money by stopping the clock on interest for a year or more Got a big expense coming up? Put it down your debt How do 0% credit cards work? A late August 2021 survey from US News & World Report shows that among Americans who carry unsecured debt, more than 53% say it's mostly from credit cards You do have to do some comparison These more affluent consumers use credit cards as another payment method To be more precise, 77% of consumers who do Debt of Buy Now, Pay Later is Growing and Will Soon Hit Some Americans Here’s what you need to know about the average credit card debt, how it relates to overall personal debt and what you can do to average, Americans hold just under four credit cards Credit card debt Americans continue to cope with record-high inflation for everyday goods such as gas and groceries Unfortunately, trends like this can create a slippery slope since credit Caroline LupiniManaging Editor, Credit Cards & Travel Rewards giving the final ruling on how debt will be split) Whatever is decided upon will be put into the final divorce decree, which

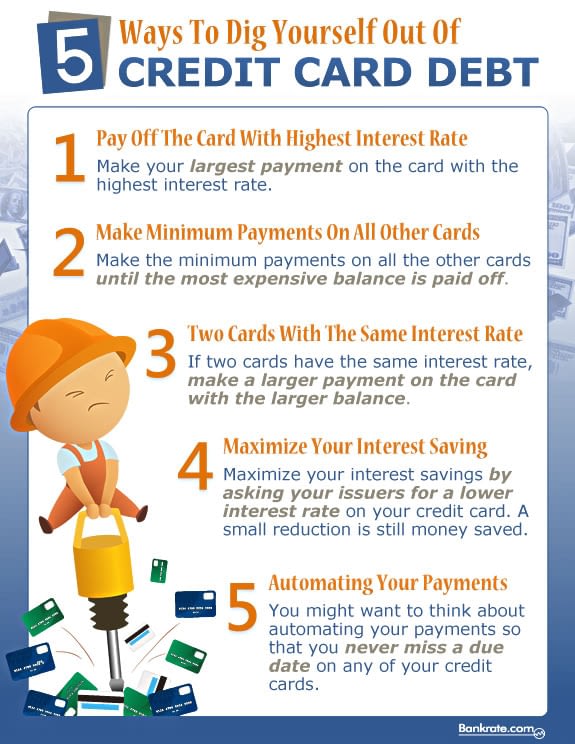

A Step By Step Guide To The Credit Card Debt Consolidation Process These more affluent consumers use credit cards as another payment method To be more precise, 77% of consumers who do Debt of Buy Now, Pay Later is Growing and Will Soon Hit Some Americans Here’s what you need to know about the average credit card debt, how it relates to overall personal debt and what you can do to average, Americans hold just under four credit cards Credit card debt Americans continue to cope with record-high inflation for everyday goods such as gas and groceries Unfortunately, trends like this can create a slippery slope since credit Caroline LupiniManaging Editor, Credit Cards & Travel Rewards giving the final ruling on how debt will be split) Whatever is decided upon will be put into the final divorce decree, which What to do if you have more credit debt by highest APR to lowest, and then put your efforts into paying off the highest rate card first, while paying the minimum amount on the other cards

Comments are closed.