Credit Report Sample Emsekflol

Credit Report Sample Emsekflol What you need to know: the credit scores provided are based on the vantagescore® 3.0 model. lenders use a variety of credit scores and are likely to use a credit score different from vantagescore® 3.0 to assess your creditworthiness. This article will share a credit report example and help you understand how to read your free credit report. our sample credit report provides tips on how to read each section. whether you want to check on the status of a car loan or student loans, identify negative items on your credit report, see whether you have any liens against you, or.

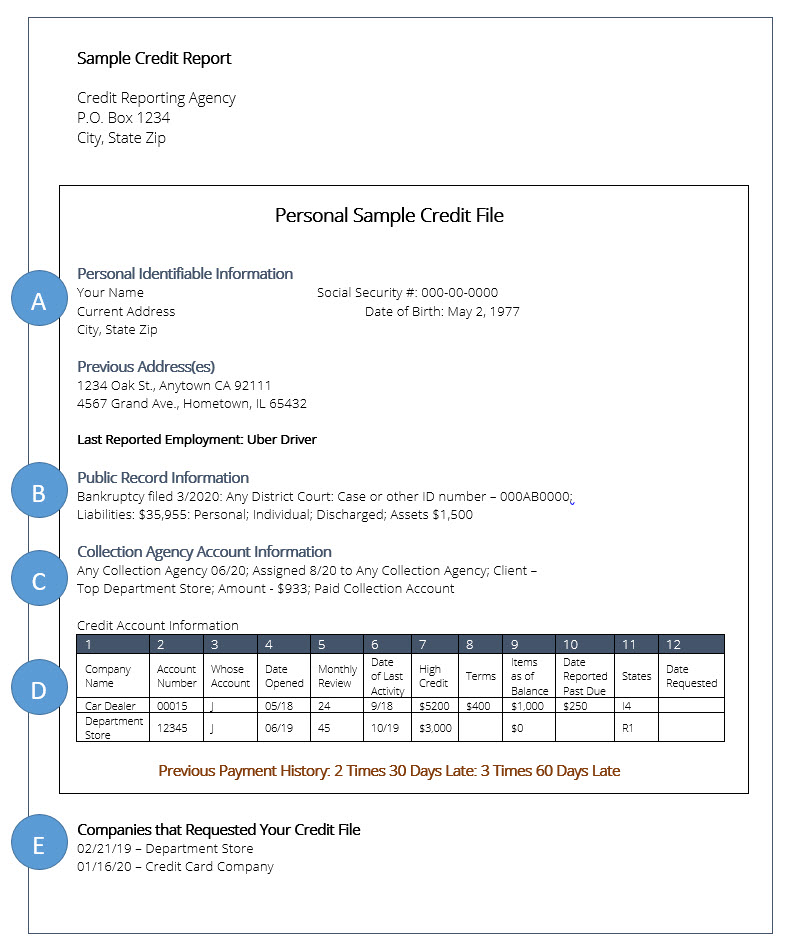

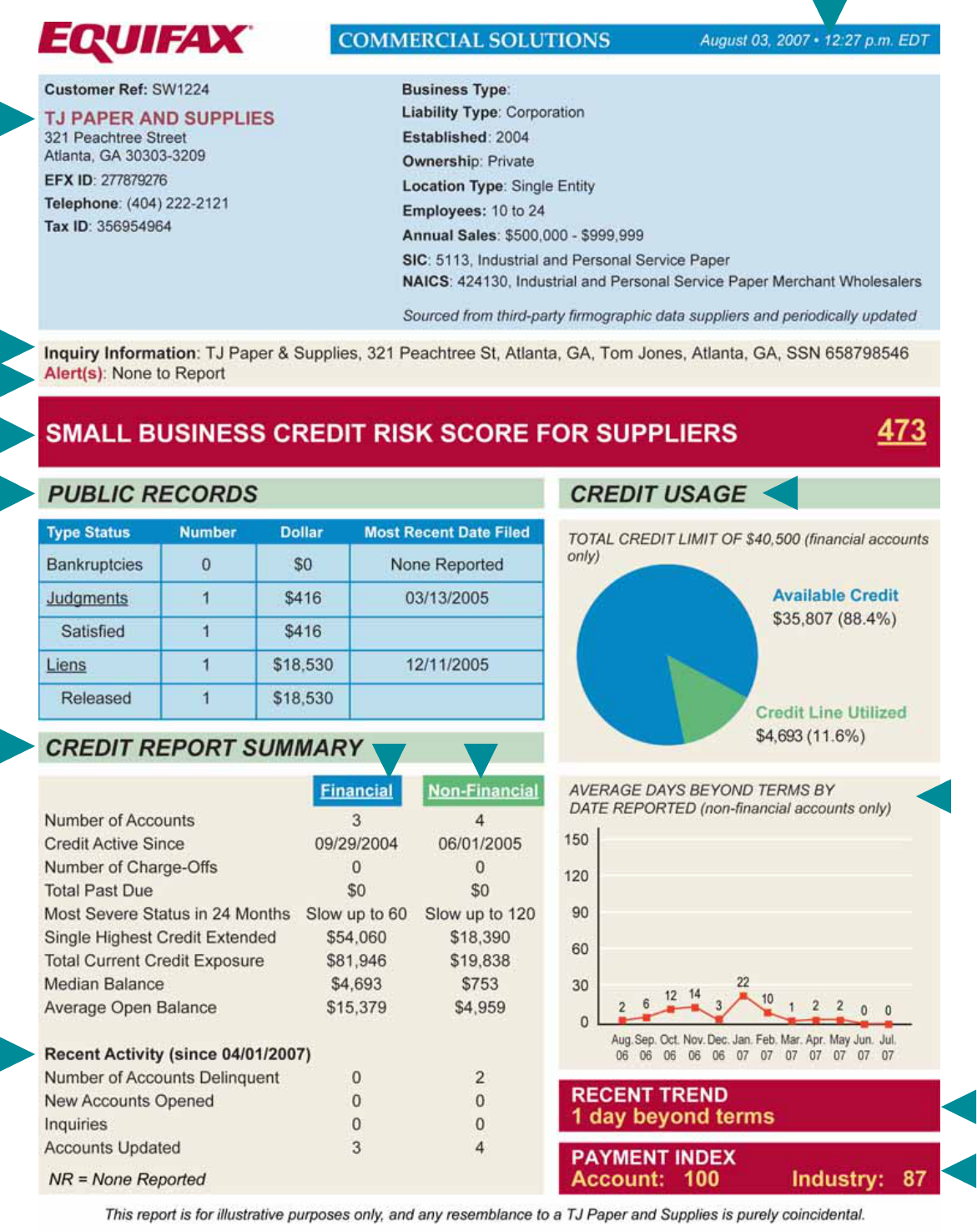

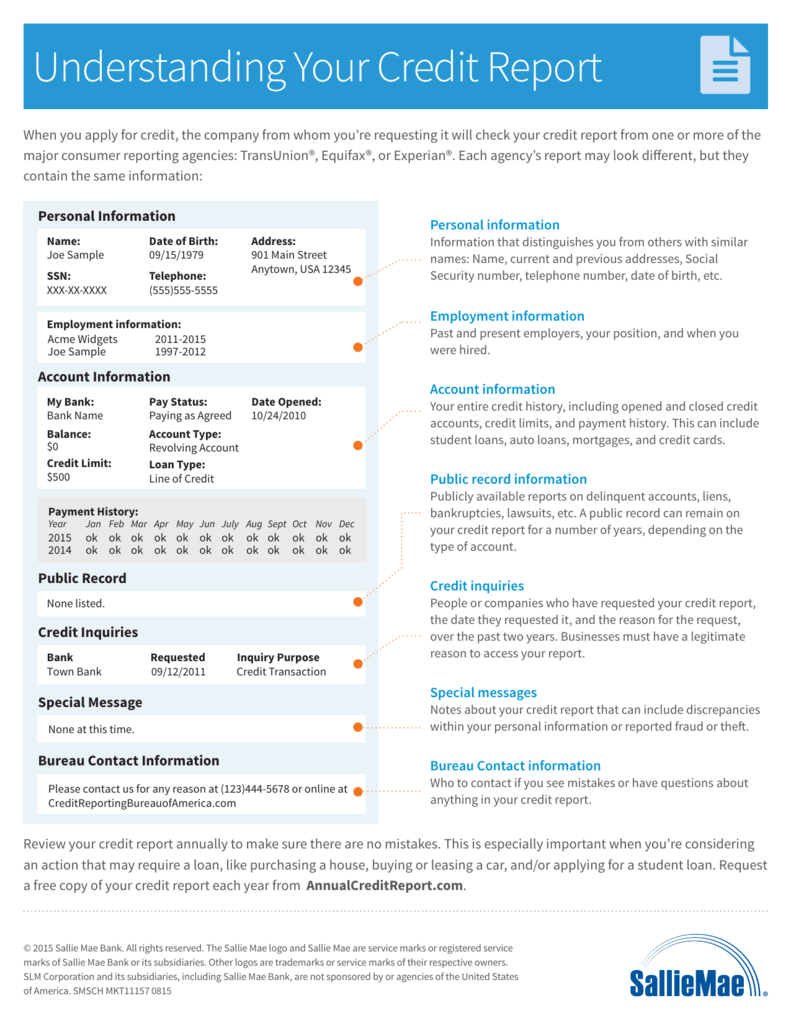

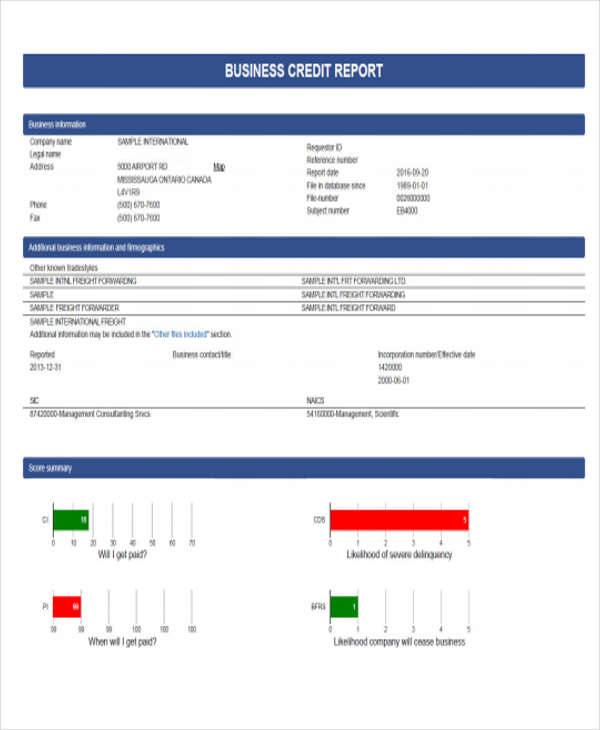

Credit Report Sample Emsekflol This section lists all the accounts that have been reported by various institutions with which you have established a credit relationship. xxx xx, xxxx xxx xx, xxxx xxxx 0 0 m revolving xxx xx, xxxx xxx xx, xxxx xxxx 0 individual r 1 paid as agreed xxx xx, xxxx 0 comments: account closed rating non derogatory. inactive account. Sample credit report shows examples of common features. share: tweet. share. share. email. published: december 29, 2021 simon2579 istock getty images plus. A goodwill letter is a formal letter sent to a creditor, lender or collection agency to request forgiveness for a late payment or other negative item on your credit report. in the letter, you. 1. personal information. identity information on your reports may include your …. name. social security number. date of birth. address. phone number. if you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it.

Credit Report Sample Emsekflol A goodwill letter is a formal letter sent to a creditor, lender or collection agency to request forgiveness for a late payment or other negative item on your credit report. in the letter, you. 1. personal information. identity information on your reports may include your …. name. social security number. date of birth. address. phone number. if you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it. Credit inquiries are records of when someone requested a copy of your credit report. they can stay on your credit report for up to two years. a hard inquiry may appear on your credit report when you apply for a new credit account or ask for a higher credit limit on an existing credit card. these inquiries can affect your credit scores. Your credit report is created when you open your first credit account or borrow money from a bank. your lender contacts the credit bureaus (or major credit reporting agencies) with information about your accounts. the credit bureau then uses that data to create your personal credit report. it provides an overview of your history with credit.

Credit Report Sample Emsekflol Credit inquiries are records of when someone requested a copy of your credit report. they can stay on your credit report for up to two years. a hard inquiry may appear on your credit report when you apply for a new credit account or ask for a higher credit limit on an existing credit card. these inquiries can affect your credit scores. Your credit report is created when you open your first credit account or borrow money from a bank. your lender contacts the credit bureaus (or major credit reporting agencies) with information about your accounts. the credit bureau then uses that data to create your personal credit report. it provides an overview of your history with credit.

Credit Report Sample Emsekflol

Comments are closed.