Debt Consolidation Pros And Cons Review Counsel

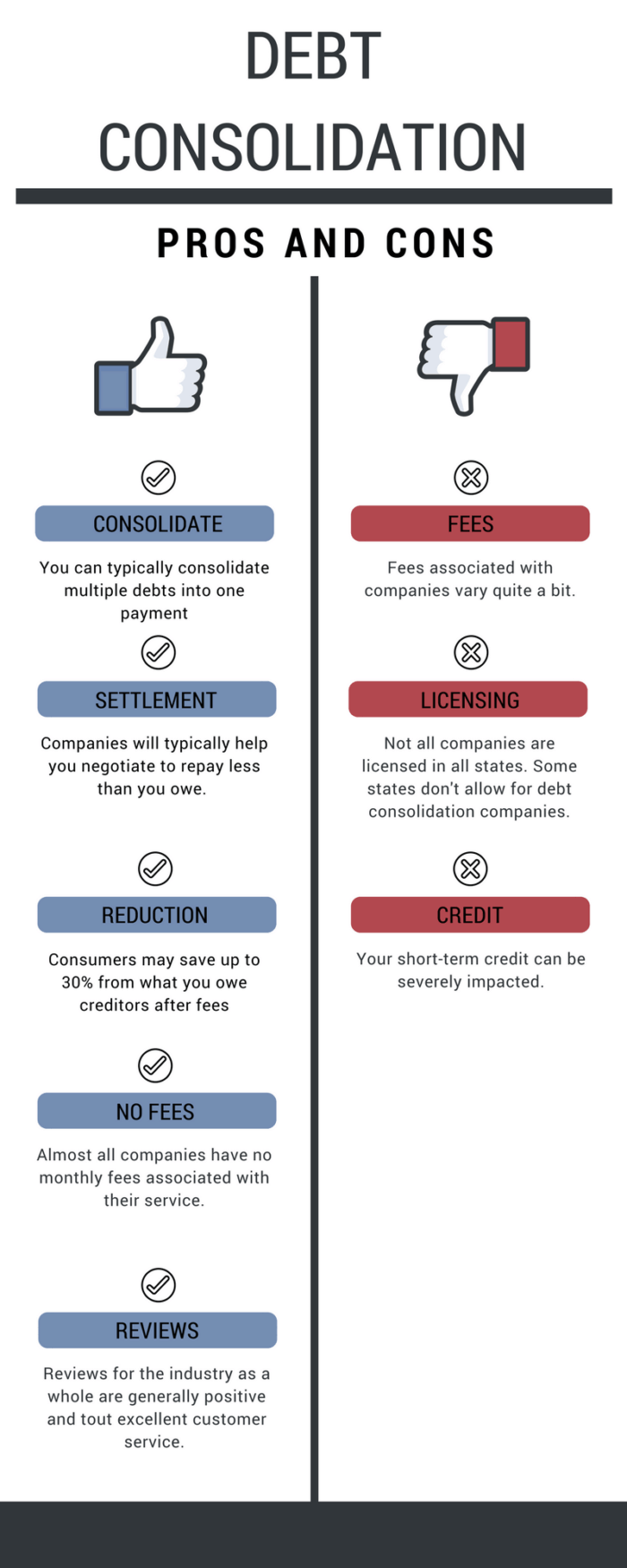

Debt Consolidation Pros And Cons Review Counsel Here at review counsel, we broke down the biggest pros and cons associated with debt consolidation. our intent is to present an objective set of guidance on how the product works and what you need to look out for. debt consolidation and debt settlement can be a tremendous asset for consumers with multiple high interest debts. for more. You could receive a lower rate. the biggest advantage of debt consolidation is paying off your debt at a lower interest rate, which saves money. for example, if you have $9,000 in total debt with.

Pros And Cons Of Debt Consolidation Pros of debt consolidation. debt consolidation has the potential to help consumers in numerous ways, from shortening their repayment terms to making the process more affordable. the following. Pros of debt consolidation. consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. streamlines finances. combining. A debt consolidation loan may temporarily lower your credit score by a few points due to the hard credit inquiry. but, over time, consolidation could improve your score. you may find that it’s. Not only can debt consolidation help you save money, it can also help you feel more financially organized. when you apply for a debt consolidation loan, the lender will send the funds to your.

Debt Consolidation Pros And Cons Review Counsel A debt consolidation loan may temporarily lower your credit score by a few points due to the hard credit inquiry. but, over time, consolidation could improve your score. you may find that it’s. Not only can debt consolidation help you save money, it can also help you feel more financially organized. when you apply for a debt consolidation loan, the lender will send the funds to your. Generally, debt consolidation is a good idea when: you have a good credit score: if it’s around 680 or higher, chances are you’ll qualify for a lower interest rate than you’ve been paying on your current debts. Pros of debt consolidation loans. simplified repayment: by consolidating your debts, you only have one monthly payment to manage, making it easier to stay organized and keep track of your repayment schedule. lower interest rates (if you qualify): if you have good credit, a debt consolidation loan could offer a lower interest rate than your.

Comments are closed.