Debt Financing Vs Equity Financing Difference And Comparison

юааdebtюаб юааfinancingюаб юааvsюаб юааequityюаб юааfinancingюаб Whatтащs The юааdifferenceюаб Equity financing vs. debt financing: an overview to raise capital for business needs, companies primarily have two types of financing as an option: equity financing and debt financing. With debt financing, you would still have the same $4,000 of interest to pay, so you would be left with only $1,000 of profit ($5,000 $4,000). with equity, you again have no interest expense.

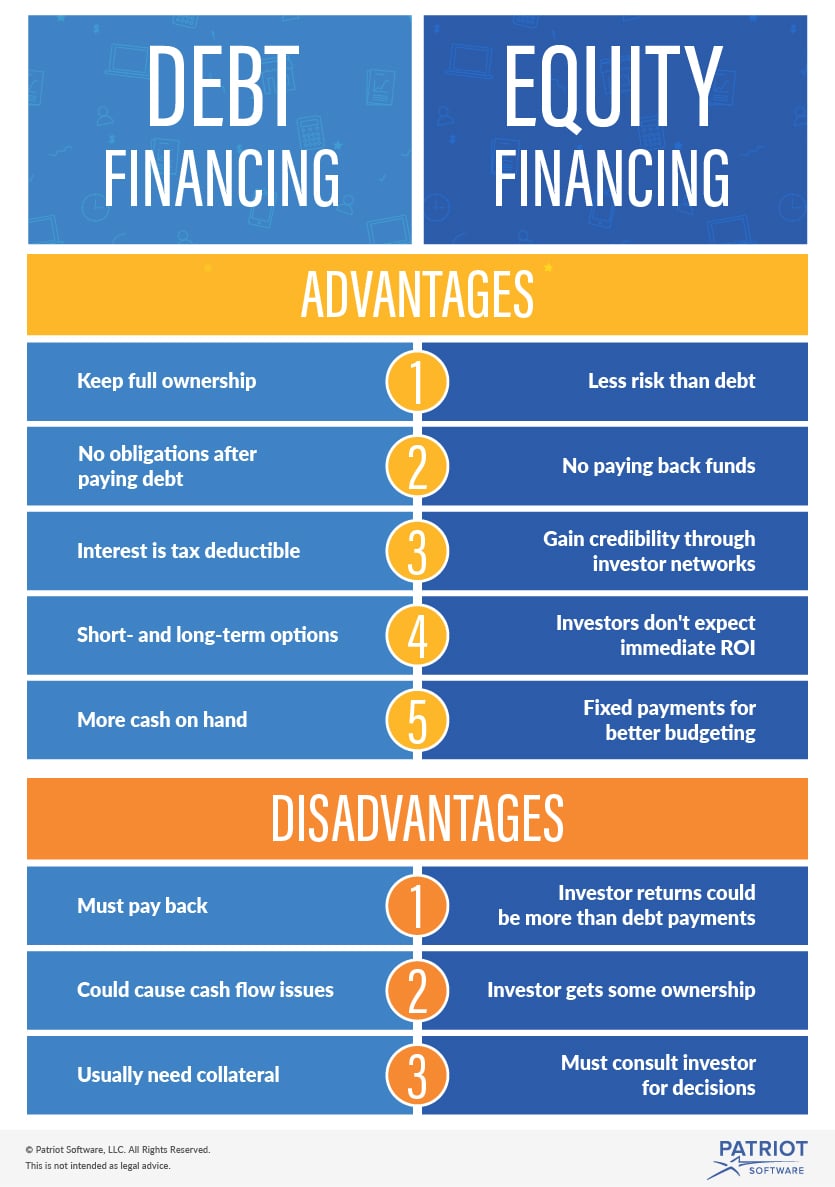

Comparison Between Debt And Equity Financing Presentation Graphics Debt financing is when a company is given a loan or issues bonds. some of these bonds can be commercial paper. however, they will have to pay back the money. equity financing is when a company sells equity to investors for a predetermined price. most companies have a strategy including debt and equity financing. It’s more than just the cost of financing. the balance is part of the dotdash meredith publishing family. debt and equity financing are two different ways businesses can raise capital. knowing the difference between the two can help you make smart financial decisions. Debt financing means a company takes on debt and borrows from a lender. equity financing means a company sells shares to investors in exchange for funding. for this type of funding, businesses don. Consider equity financing: if you want to avoid debt. equity financing may be less risky than debt financing because you don’t have a loan to repay or collateral at stake. debt also requires.

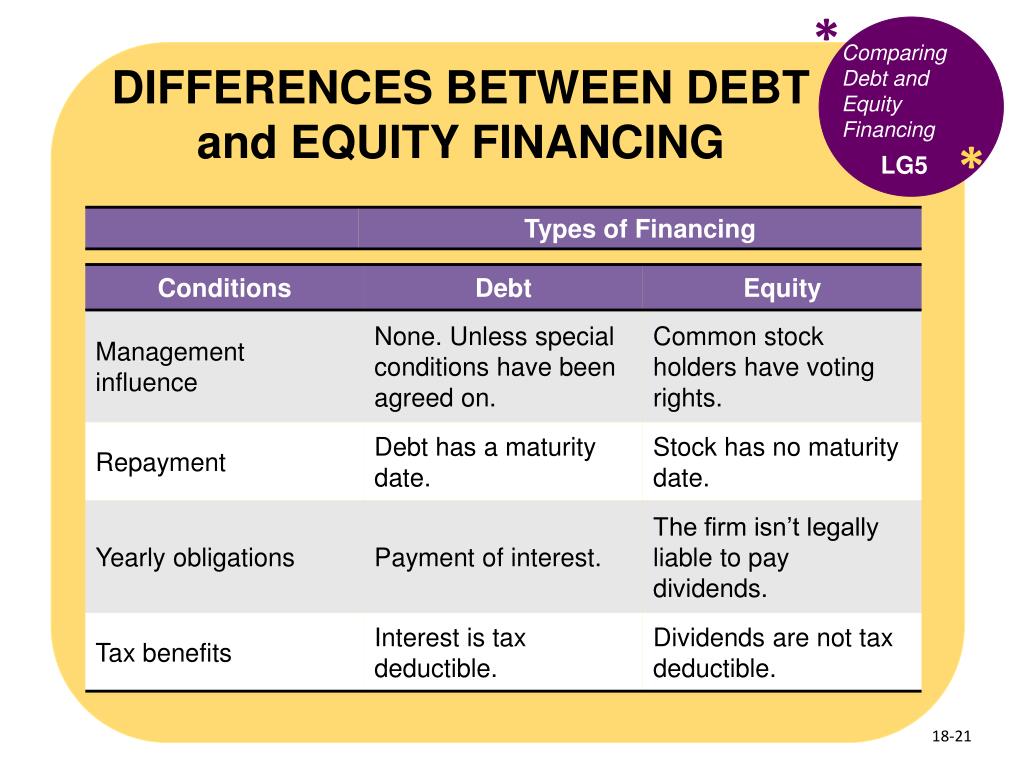

Ppt Whatтащs юааfinanceюаб Powerpoint Presentation Free Download Id 1658436 Debt financing means a company takes on debt and borrows from a lender. equity financing means a company sells shares to investors in exchange for funding. for this type of funding, businesses don. Consider equity financing: if you want to avoid debt. equity financing may be less risky than debt financing because you don’t have a loan to repay or collateral at stake. debt also requires. The primary difference between debt and equity financing is that debt financing is when the company raises the capital by selling the debt instruments to the investors. in contrast, equity financing is when the company raises capital by selling its shares to the public. both the concepts have their own pros and cons, due to which the selection. Debt vs. equity financing both are methods that can help you raise capital. but the distinction between debt and equity financing lies in the source and repayment of funds, as well as the repercussions each one brings. the key differences boil down to: repayment; control; risk; debt financing means borrowing funds to be repaid over time with.

Comments are closed.