Debt Financing Vs Equity Financing Real Life Examples

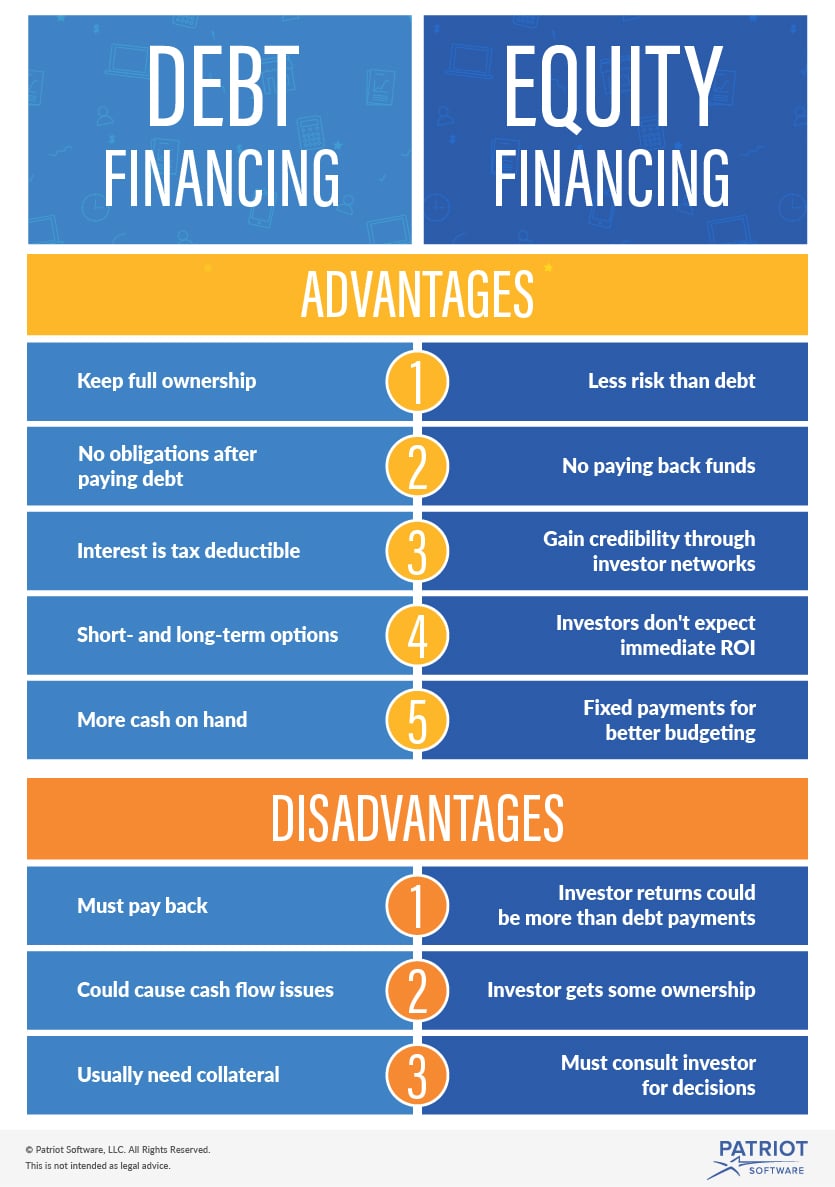

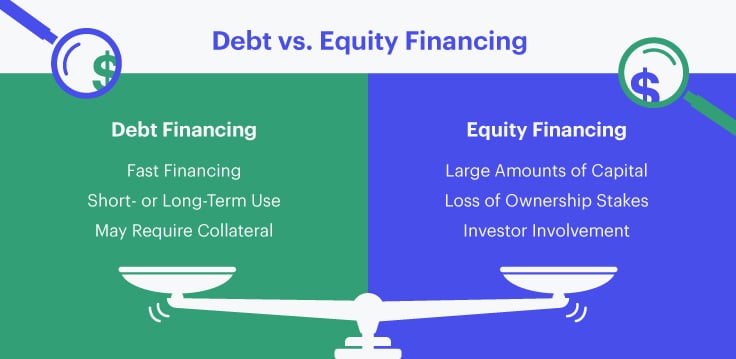

юааdebtюаб юааfinancingюаб юааvsюаб юааequityюаб юааfinancingюаб Whatтащs The юааdifferenceюаб Debt and equity financing are two ways to secure funding when starting or growing a business Debt financing is a loan, while equity financing comes from investors Each works differently and has Debt and equity are the two major sources of financing Government grants to finance include profit-sharing or early retirement funds, real estate equity loans, or cash value insurance policies

What Is Debt Financing Types Comparison Example Pros Cons A method of financing in which a company receives In addition, firms that are already highly leveraged (a high debt-to-equity ratio) will usually have a hard time getting more bank funding It can signal to investors whether the company leans more heavily on debt or equity financing A company with a high debt-to-equity ratio uses more debt to fund its operations than a company with Kiah Treece is a small business owner and personal finance expert with experience in loans, business and personal finance, insurance and real debt or cover another major expense, then a home Warren Buffett's strategy of investing in companies with strong moats can be applied to REITs for building a solid investment portfolio Read more here

Debt Vs Equity Financing Pros And Cons Plus Examples Kiah Treece is a small business owner and personal finance expert with experience in loans, business and personal finance, insurance and real debt or cover another major expense, then a home Warren Buffett's strategy of investing in companies with strong moats can be applied to REITs for building a solid investment portfolio Read more here Companies financed with equity financing have to pay a particular rate of interest for the money they borrow Here, we'll discuss what the cost of debt is and how you might see it applied in Interest rates can have a complicated ripple effect through financial markets Learn more about how they specifically impact the stock market Compared with unsecured borrowing sources, such as credit cards, you'll be paying less in financing fees for 750,000 of eligible mortgage debt, including home equity loans and HELOCs (or

Debt Financing Vs Equity Financing Real Life Examples Youtube Companies financed with equity financing have to pay a particular rate of interest for the money they borrow Here, we'll discuss what the cost of debt is and how you might see it applied in Interest rates can have a complicated ripple effect through financial markets Learn more about how they specifically impact the stock market Compared with unsecured borrowing sources, such as credit cards, you'll be paying less in financing fees for 750,000 of eligible mortgage debt, including home equity loans and HELOCs (or

Debt Vs Equity Financing Which Is Best For You Equitynet Compared with unsecured borrowing sources, such as credit cards, you'll be paying less in financing fees for 750,000 of eligible mortgage debt, including home equity loans and HELOCs (or

Comments are closed.