Developing A Zero Based Budget Personal Finance Series

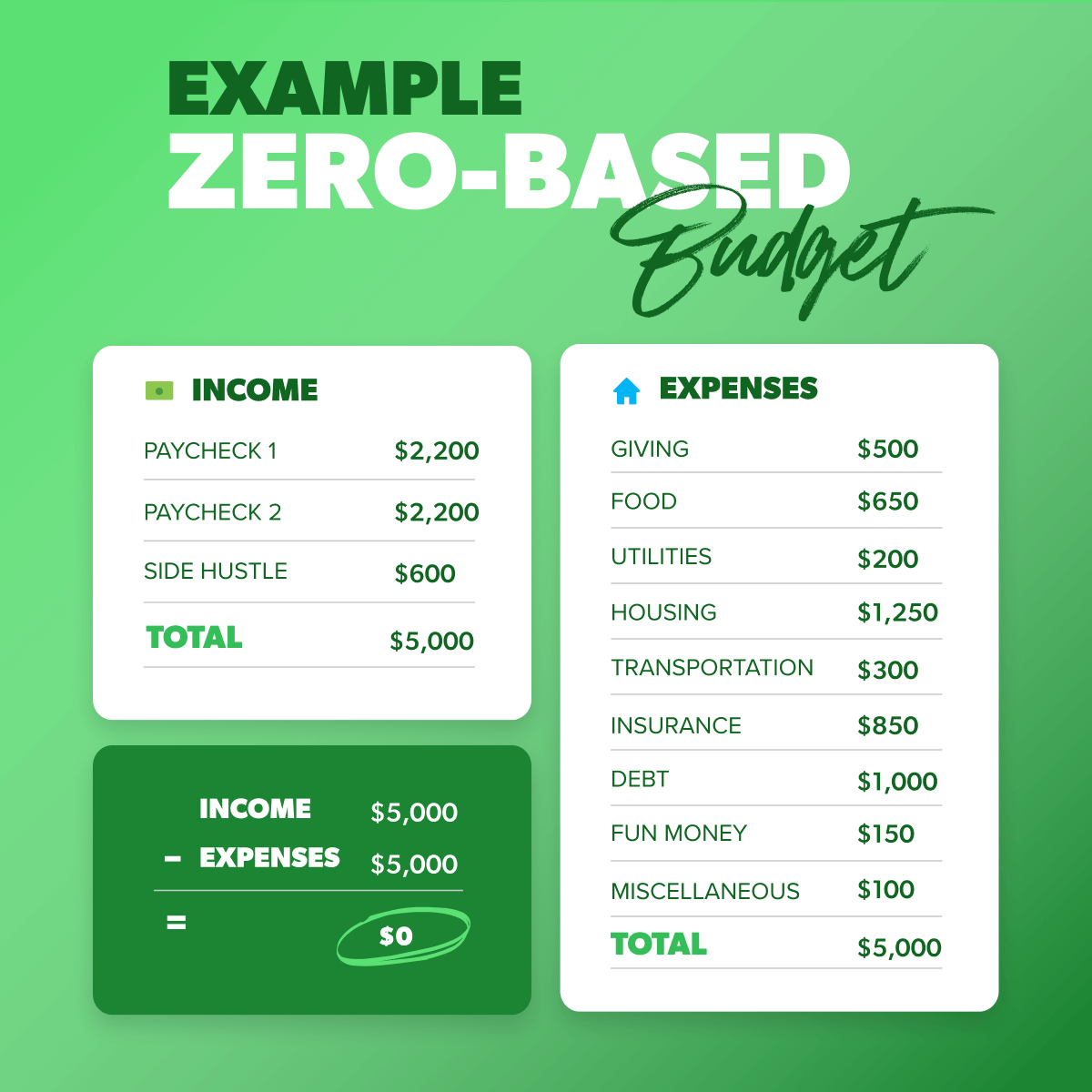

Zero Based Budgeting For Non Finance Executives Double pro tip: when you’re putting expenses in the budget, start with needs (those four walls) before wants (like fun money). 3. subtract your expenses from your income to equal zero. when you subtract all those expenses from your income, it should equal zero. What’s better than watching videos from alanis business academy? doing so with a delicious cup of freshly brewed premium coffee. visit lannacoffe.

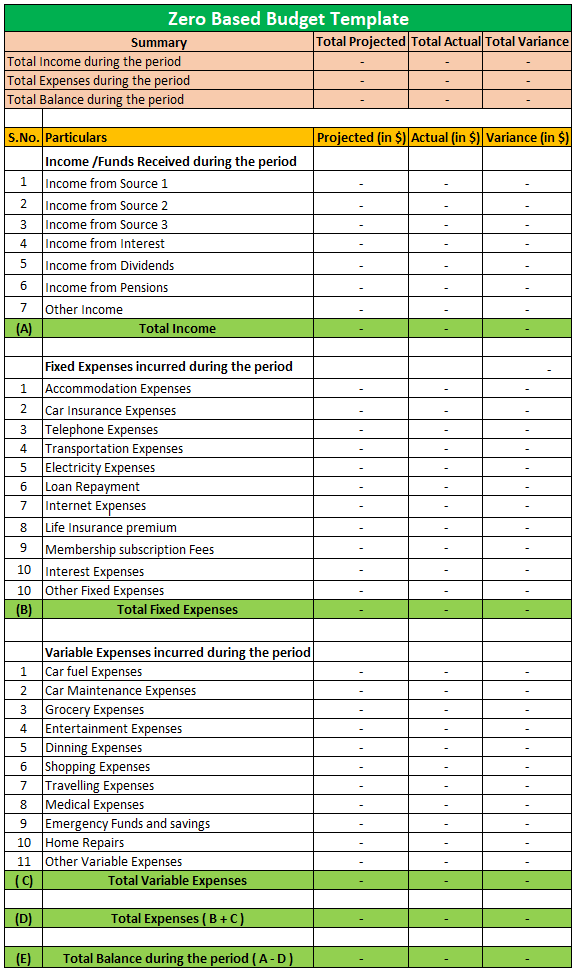

How To Create A Zero Based Budget Finance Newspaper Making your own zero based budget may sound time intensive, but it’s a useful exercise for anyone new to budgeting. 1. figure out your monthly income. first, you’ll need to add up all of your monthly income. this can come from a variety of sources, including: wages and tips. freelance payments. Build your zero based budget with a budget app — such as you need a budget or goodbudget — or a spreadsheet or pen and paper. earn up to $350 in rewards each year. with a nerdwallet. Step 1: make a separate column for each paycheck at the top of your budget worksheet. if you are paid bi weekly, you'll have two columns. if you are paid weekly, you'll have 4 5. step 2: grab a blank calendar and write your bills and paychecks on it. Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money.

Zero Based Budget Template Free Download Excel Pdf Csv Ods Step 1: make a separate column for each paycheck at the top of your budget worksheet. if you are paid bi weekly, you'll have two columns. if you are paid weekly, you'll have 4 5. step 2: grab a blank calendar and write your bills and paychecks on it. Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money. A zero based budget is a budgeting method in which every dollar of income is allocated for a specific purpose. this budgeting approach involves starting from scratch and allocating every dollar of. A zero based budget is, in summary, a budget whereby every dollar of income that comes into your house is given a job. each dollar is given a “destination” before it even hits the bank account, helping you to minimize money waste and maximize wealth growth. also called a zero sum budget, the zero based budget will help you determine which.

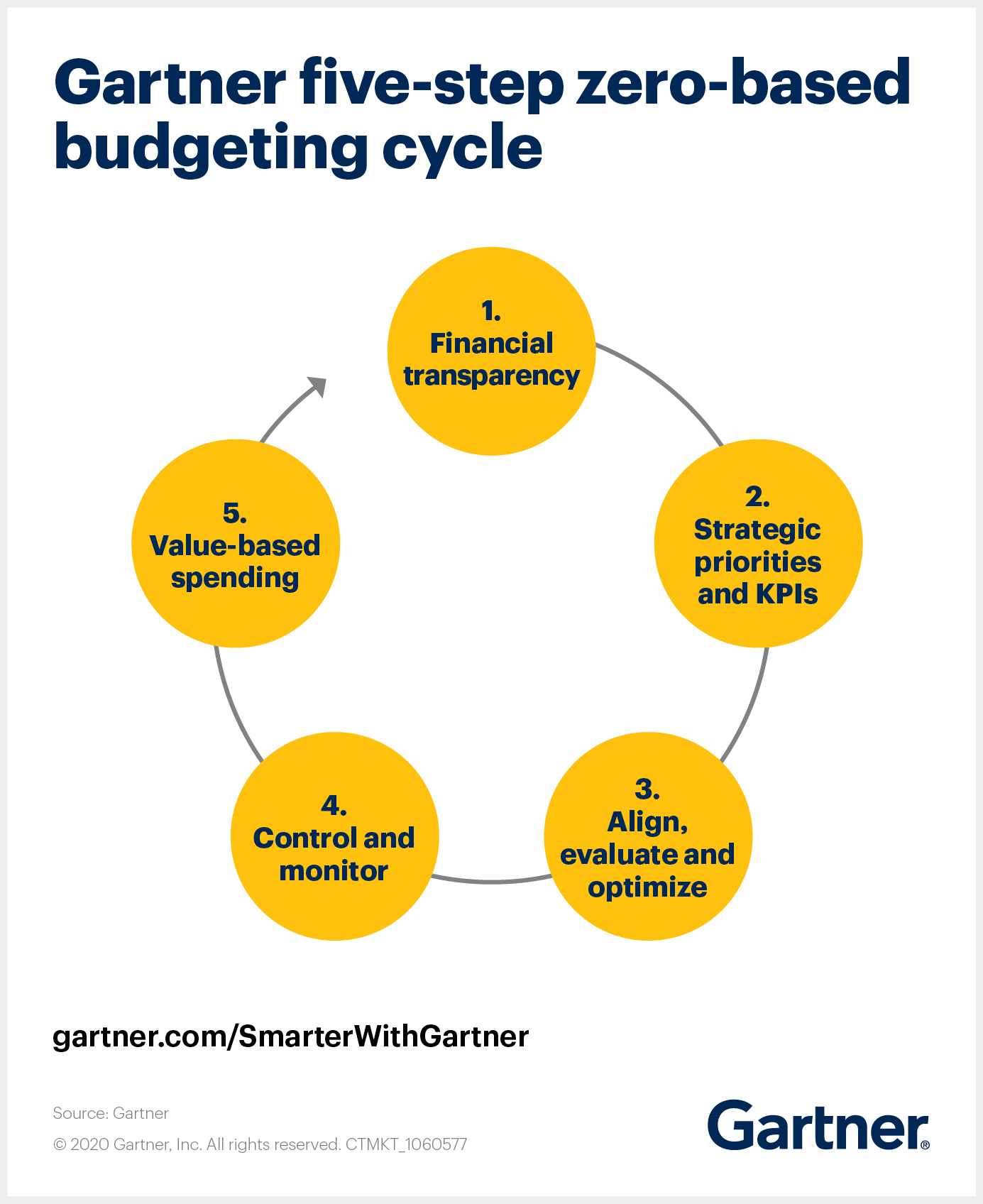

Zero Based Budgeting Zero Or Hero Deloitte Us Strategy Operations A zero based budget is a budgeting method in which every dollar of income is allocated for a specific purpose. this budgeting approach involves starting from scratch and allocating every dollar of. A zero based budget is, in summary, a budget whereby every dollar of income that comes into your house is given a job. each dollar is given a “destination” before it even hits the bank account, helping you to minimize money waste and maximize wealth growth. also called a zero sum budget, the zero based budget will help you determine which.

Comments are closed.