Digital Onboarding In Corporate Banking Processmaker

Digital Onboarding In Corporate Banking Processmaker Onboarding in corporate banking can take 90–120 days for these clients—an unforgivable timeframe in the digital realm. corporate customers are consumers themselves, and they increasingly expect the same user friendly applications that they use in their personal lives to trickle down into their workday. fortunately, the gap between personal. Laying the foundation with new systems. 9 areas to focus on when revamping commercial banking onboarding. 1. expand your application access. 2. streamline your intake of applications and documents. 3. consolidate your applications. 4.

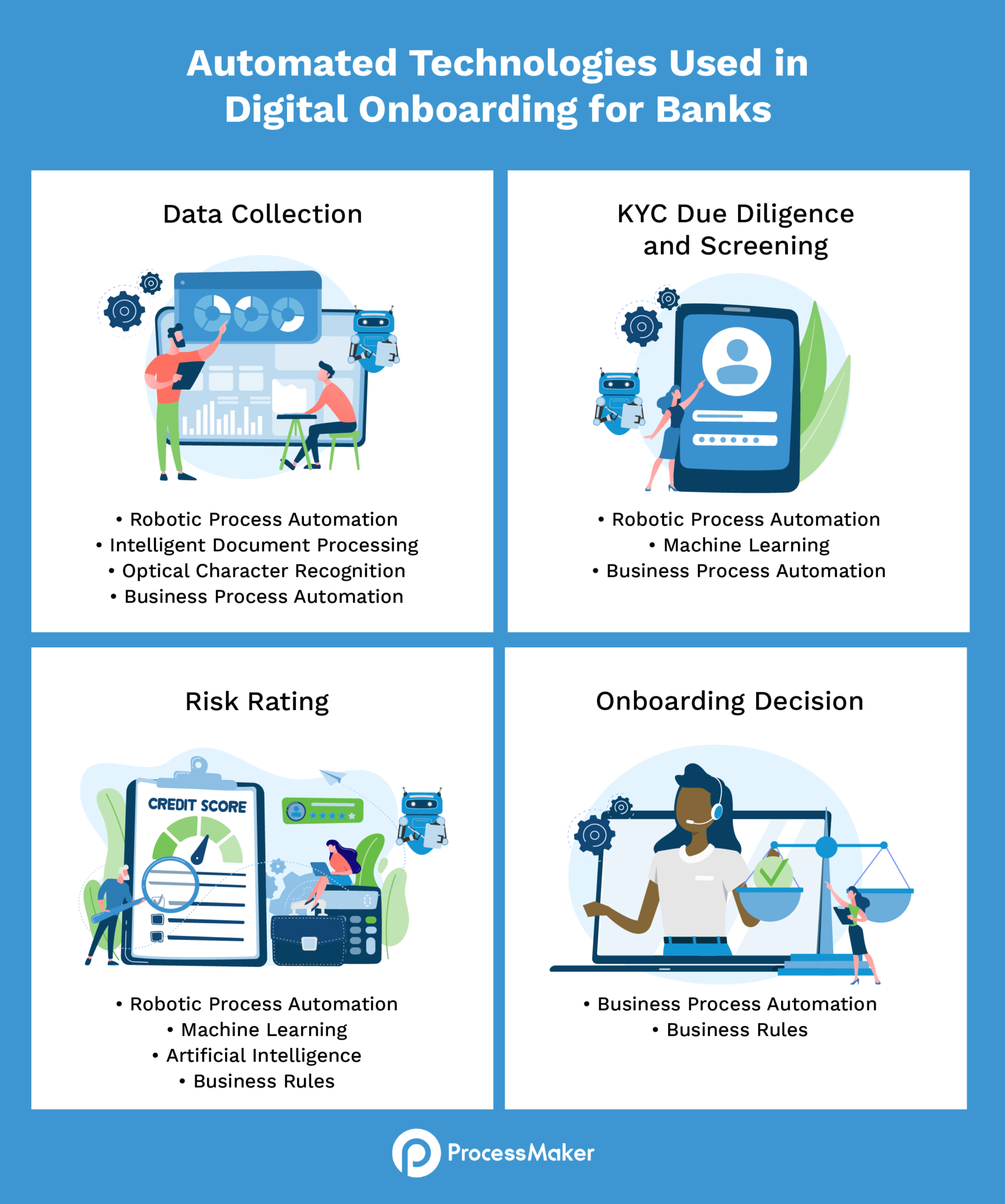

Digital Onboarding In Corporate Banking Processmaker From the client perspective, a one click account opening process would be a dream: almost 40% of consumer applicants abandon a journey that takes longer than ten minutes. corporate clientele mirrors the sentiment, with 13%reporting a experience so poor that they changed their banking partner because of the hassle. Onboarding is a data heavy procedure that poses an obvious stumbling block for banks trying to serve a fast and efficient experience. thanks to automation, you can engage software to do the heavy lifting, and reduce processing times from a meandering 90–120 days down to a swift few days. the post digital onboarding in corporate banking. 3. implementation. implemention tools and solutions that facilitate end to end digital requires you to realign teams internally and train them on the new online processes. while this requires you to invest time and money into digitizing onboarding, it also yields a high roi and positively impacts customer experience. Ally bank has a simple, user friendly digital onboarding process that allows customers to open an account in just a few minutes. the bank utilizes a mobile app that allows customers to scan their driver's license to verify their identity. it also provides customers with real time support through chat and email.

Digital Onboarding вђ Creating A Great First Impression 3. implementation. implemention tools and solutions that facilitate end to end digital requires you to realign teams internally and train them on the new online processes. while this requires you to invest time and money into digitizing onboarding, it also yields a high roi and positively impacts customer experience. Ally bank has a simple, user friendly digital onboarding process that allows customers to open an account in just a few minutes. the bank utilizes a mobile app that allows customers to scan their driver's license to verify their identity. it also provides customers with real time support through chat and email. Digital onboarding offers the opportunity to accelerate customer acquisition in corporate banking, save costs and increase customer satisfaction among their business clients. to do this, it is necessary to fundamentally reorient the corporate customer strategy – by closely aligning it with changing customer needs in the digital age. Whereas retail client acquisition in a physical, siloed world costs an average of $280, shifting to digital onboarding reduces the cost to $120 and in subsequent years for additional clients to $19. a similar story exists in corporate banking, where acquisition costs can be slashed from $4,000 to $1,200. better banking health.

A Guide To Improve Digital Onboarding For Corporate Banks Digital onboarding offers the opportunity to accelerate customer acquisition in corporate banking, save costs and increase customer satisfaction among their business clients. to do this, it is necessary to fundamentally reorient the corporate customer strategy – by closely aligning it with changing customer needs in the digital age. Whereas retail client acquisition in a physical, siloed world costs an average of $280, shifting to digital onboarding reduces the cost to $120 and in subsequent years for additional clients to $19. a similar story exists in corporate banking, where acquisition costs can be slashed from $4,000 to $1,200. better banking health.

Comments are closed.