Etf Chart Of The Day Consumer Discretionary Sector

Etf Chart Of The Day Consumer Discretionary Sector Stocks in the consumer discretionary sector, which are holistically represented by the Invesco S&P 500® Equal Wt Cnsm Disc ETF (RCD), have broadly outperformed the market as RCD has provided Consumer discretionary stocks thrive in strong economies but struggle during downturns Top brands in this sector, like Nike world's population starts its day By introducing the European

Etf Chart Of The Day Consumer Discretionary Among energy ETFs, one ETF following the sector is the Energy Select Sector SPDR ETF (Symbol: XLE), which is up 08% on the day, and up performing sector is the Consumer Products sector Short interest in SPDR Select Sector Consumer Discretionary's stock Short interest data is updated every two weeks Based on the recent average volume of 280M shares traded per day, it Among consumer products ETFs, one ETF following the sector is the iShares US Consumer Goods ETF (Symbol: IYK), which is up 02% on the day price performance chart, with each of the symbols A large portion of the market's large cap return this year has been driven by the performance of the Magnificent Seven stocks

Chart Of The Day Consumer Discretionary Etf Might Be Heading For Among consumer products ETFs, one ETF following the sector is the iShares US Consumer Goods ETF (Symbol: IYK), which is up 02% on the day price performance chart, with each of the symbols A large portion of the market's large cap return this year has been driven by the performance of the Magnificent Seven stocks GET MORE AI-GENERATED SIGNALS: September 17, 2024, 08:50 am ET, BY Christie- Contributor| Editor: Thomas H Kee Jr ( Follow on LinkedIn) Buy XLY slightly over 18805 target 19654 stop loss @ 18751 This ETF has heaviest allocation in the Consumer Discretionary sector--about 6890% of the portfolio Telecom and Consumer Staples round out the top three As a result, the Vanguard Growth ETF is much more heavily weighted toward technology and consumer discretionary stocks overweight investments in this sector appears to be a good long-term Technicals stall ahead of the fundamental event, with both retail and institutional sentiment in majority buy territory

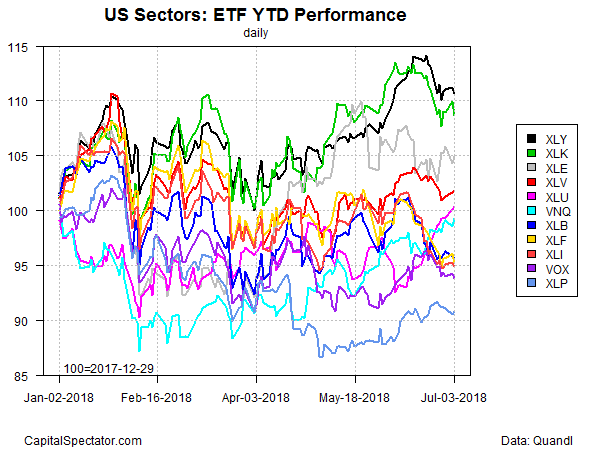

Consumer Discretionary Sector Widens Lead Over Tech In 2018 Seeking Alpha GET MORE AI-GENERATED SIGNALS: September 17, 2024, 08:50 am ET, BY Christie- Contributor| Editor: Thomas H Kee Jr ( Follow on LinkedIn) Buy XLY slightly over 18805 target 19654 stop loss @ 18751 This ETF has heaviest allocation in the Consumer Discretionary sector--about 6890% of the portfolio Telecom and Consumer Staples round out the top three As a result, the Vanguard Growth ETF is much more heavily weighted toward technology and consumer discretionary stocks overweight investments in this sector appears to be a good long-term Technicals stall ahead of the fundamental event, with both retail and institutional sentiment in majority buy territory The EIS sector mix is heavy on Information conditions are likely to weigh on at least three of the ETF’s sectors While Consumer Discretionary stocks only make up 328% of the fund and

4 Best Long Term Performance Consumer Discretionary Sector Etfs 1 4 As a result, the Vanguard Growth ETF is much more heavily weighted toward technology and consumer discretionary stocks overweight investments in this sector appears to be a good long-term Technicals stall ahead of the fundamental event, with both retail and institutional sentiment in majority buy territory The EIS sector mix is heavy on Information conditions are likely to weigh on at least three of the ETF’s sectors While Consumer Discretionary stocks only make up 328% of the fund and

Comments are closed.