Filing 1099 Forms What You Need To Know

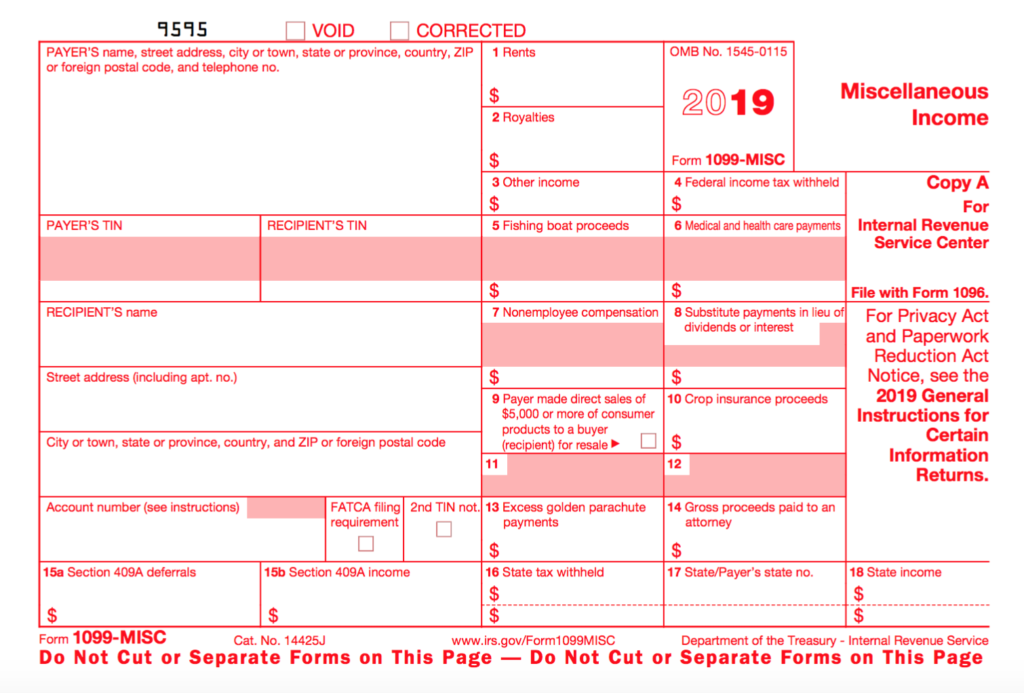

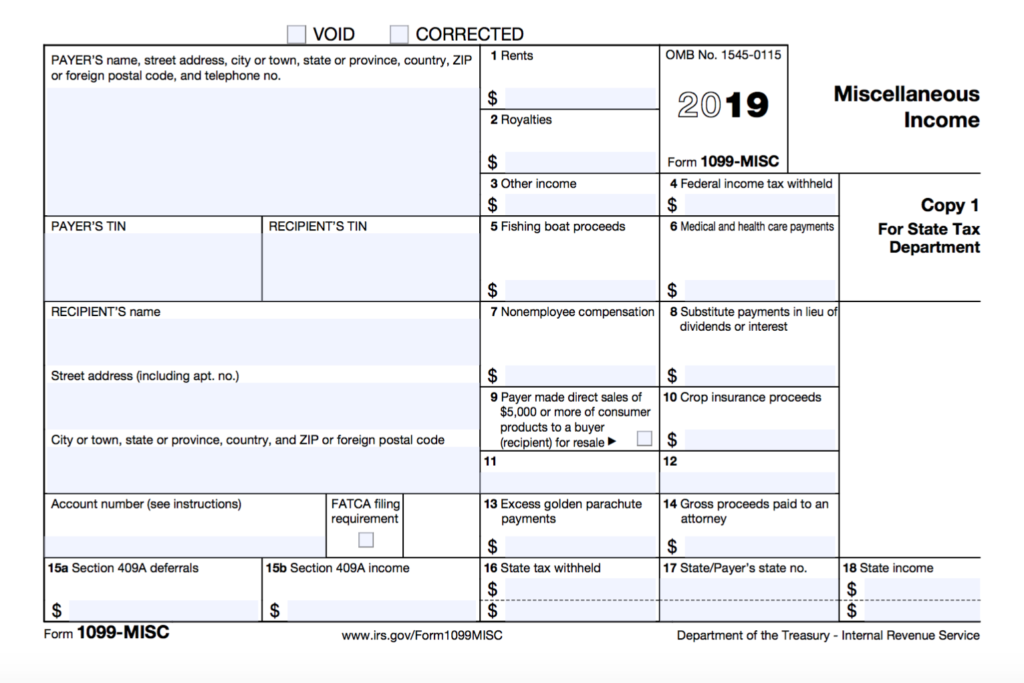

All That You Need To Know About Filing Form 1099 Misc Inman Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc). Form 1099 is used to report certain types of non employment income to the irs such as dividends from a stock or pay you received as an independent contractor. businesses must issue 1099s to any.

All That You Need To Know About Filing Form 1099 Misc Inman Form 1099 int: reports all interest income earned on bonds, cds, and cash in your brokerage account. form 1099 div: reports dividends received from stocks, mutual funds, and capital gains distributions. form 1099 b: reports the sale, redemption, or exchange of securities such as stocks, mutual funds, cds, or bonds. Nerdy takeaways. a 1099 is a type of form that shows income you received that wasn't from your employer. getting a 1099 form doesn't mean you necessarily owe taxes on that income, but you will. If you receive a 1099 form, find out everything you need to know to correctly file your self employment taxes. although anyone can file 1099 misc forms electronically with irs e filing, all. 1099 b reports income you received from the sale of stocks, mutual funds, etfs and other types of financial transactions, plus the sale date and other information.; 1099 c reports debt of $600 or.

.jpg)

Everything You Need To Know About Filing The 1099 Form If you receive a 1099 form, find out everything you need to know to correctly file your self employment taxes. although anyone can file 1099 misc forms electronically with irs e filing, all. 1099 b reports income you received from the sale of stocks, mutual funds, etfs and other types of financial transactions, plus the sale date and other information.; 1099 c reports debt of $600 or. 10 or more returns: e filing now required. starting tax year 2023, if you have 10 or more information returns, you must file them electronically. this includes forms w 2, e filed with the social security administration. find details on the final e file regulations and requirements for forms w 2. to e file, apply now for a transmitter control. About form 1099 misc, miscellaneous information. file form 1099 misc for each person to whom you have paid during the year: at least $10 in royalties or broker payments in lieu of dividends or tax exempt interest. at least $600 in: rents. prizes and awards.

Filing 1099 Forms What You Need To Know Youtube 10 or more returns: e filing now required. starting tax year 2023, if you have 10 or more information returns, you must file them electronically. this includes forms w 2, e filed with the social security administration. find details on the final e file regulations and requirements for forms w 2. to e file, apply now for a transmitter control. About form 1099 misc, miscellaneous information. file form 1099 misc for each person to whom you have paid during the year: at least $10 in royalties or broker payments in lieu of dividends or tax exempt interest. at least $600 in: rents. prizes and awards.

What Is A 1099 Types Details And Who Receives One Quickbooks

Comments are closed.