Fillable Edd Form De 1 Printable Forms Free Online

Edd Phone Number Fill Online Printable Fillable Blank De 1 Ed Employers and licensed health professionals: to avoid stocking outdated forms, order a six month supply or less. please allow two to four weeks for orders to arrive. claimants: orders of two or fewer forms can take up to 10 days. orders of more than two forms can take two to four weeks. to start a search, select an option from the dropdown menu. Register online from the edd’s e services for business at eddservices.edd.ca.gov. mail your completed registration form to the edd, account services group (asg) mic 28, p.o. box 826880, sacramento, ca 94280 0001. fax your completed registration form to the edd at 916 654 9211. call for telephone registration at 916 654 8706.

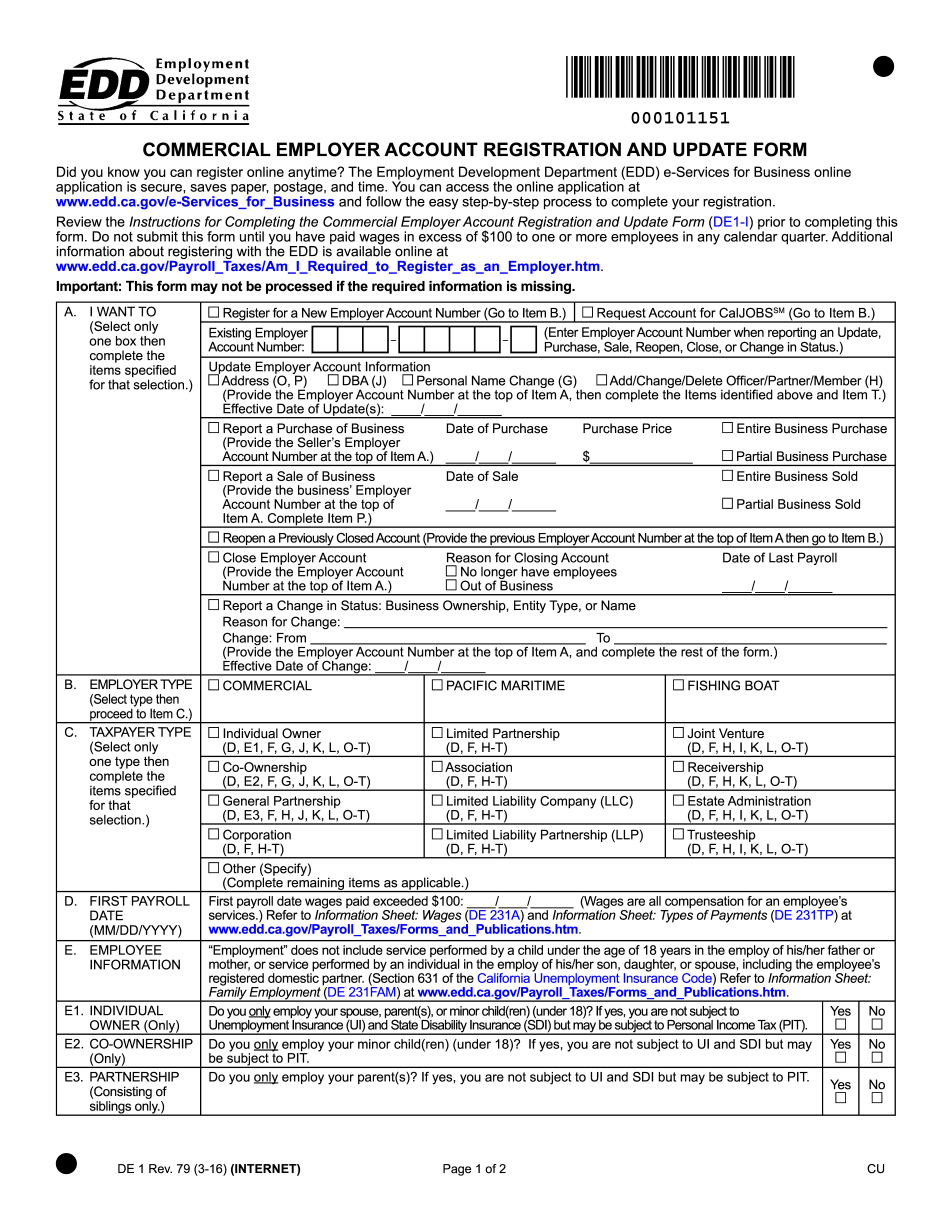

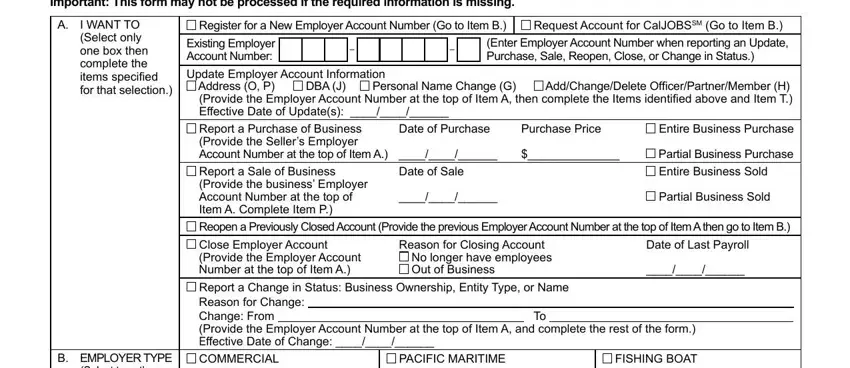

юааdeюаб юаа1юаб юааeddюаб юааformюаб тйб Fill Out юааprintableюаб Pdf юааformsюаб юааonlineюаб For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at edd.ca.gov contact the taxpayer assistance center at (888) 745 3886 (voice) or tty (800) 547 9565 (non verbal) for additional forms or inquiries regarding. De 9 rev. 3 (3 17) (internet) page 1 of 2. file online it’s fast, easy, and secure! visit . edd.ca.gov. m m d d y y y y. required. please type this form—do not alter preprinted information. reminder: file your de 9 and de 9c together. quarterly contribution. return and report of wages 00090112 (owner, accountant, preparer, etc.). Form de 1 commercial employer account registration and update form. download a blank fillable form de 1 commercial employer account registration and update form in pdf format just by clicking the "download pdf" button. open the file in any pdf viewing software. adobe reader or any alternative for windows or macos are required to access and. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. beginning january 1, 2020, employee’s withholding allowance certificate (form w 4) from the internal revenue service (irs) will be used for federal income tax withholding only.

Comments are closed.